5 Ways MSMEs Can Build Resilient Business Models Amid Global Uncertainty

- US tariffs increment, rising freight costs due to Red Sea route disruptions, volatile crude prices, and currency fluctuations have further strained already limited cash flows for MSMEs. Enterprises that adapt quickly, embrace technology, and build strong industry networks can better withstand economic disruptions and recover faster from external shocks.

- Using digital tools to manage inventory, adopting energy-efficient machinery, and maintaining flexible production setups help MSMEs respond swiftly to market changes while keeping costs under control.

- Expanding into new regions and developing alternative products spreads risk and opens additional revenue streams, ensuring business continuity even when one segment slows down.

- With 67% of MSMEs already using digital tools and digitally mature firms growing nearly twice as fast as traditional ones, adopting technology is essential for improving competitiveness and operational resilience.

- Access to formal credit strengthens business stability. Financing options such as Protium’s Machinery Finance, Business Loans, Loan Against Property, and Top-up Loans provide flexible solutions for equipment upgrades, capacity expansion, and working-capital needs, helping MSMEs turn resilience into measurable growth.

Approximately 80% of Indian MSMEs still face credit constraints, despite marginal improvements in formal finance access. Between 2020 and 2024, the share of micro and small enterprises accessing finance through scheduled banks rose slightly—from 14% to 20%, while medium enterprises saw a modest increase from 4% to 9%. However, this access remains far below the sector’s actual requirements, with an estimated ₹30 lakh crore remaining unmet. The shortage continues to restrict investment, modernization, and operational resilience across the MSME landscape.

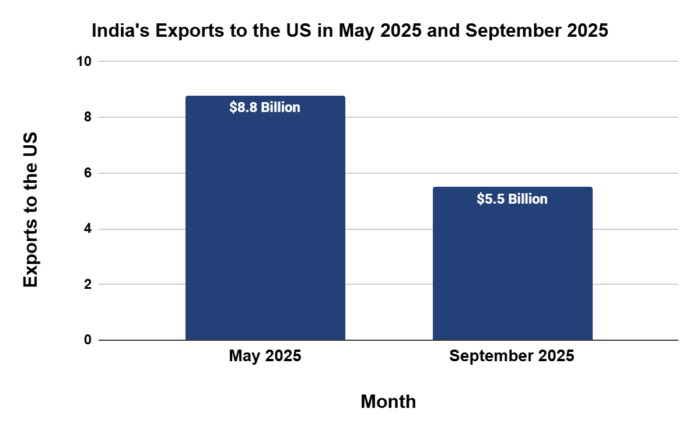

The effects of this gap are visible in how small enterprises respond to global disruptions. Following the 50% tariff imposition on most Indian goods, exports to the US fell by 37.5% between May and September—declining from $8.8 billion to $5.5 billion. Labor-intensive MSME sectors such as textiles, gems and jewellery, handicrafts, and leather goods have experienced severe pressure as order volumes fell and margins tightened. Meanwhile, rising freight costs due to Red Sea route disruptions, volatile crude prices, and currency fluctuations have further strained already limited cash flows.

This combination of financial constraints and global volatility underscores the urgent need for stronger entrepreneurial resilience—the ability of MSMEs to adapt, innovate, and create added value even under stress. Small enterprises can no longer rely solely on traditional resources or infrastructure to stay competitive. They must build the capacity to reconfigure assets, capabilities, and business networks as conditions change.

This blog explores how MSMEs can cultivate such resilience—developing business models that endure volatility, improve adaptability, and sustain long-term growth.

The Core of Entrepreneurial Resilience

Entrepreneurial resilience is one of the main factors determining MSME sustainability during periods of global stress. In practice, resilient enterprises often display three major strengths:

- Operational flexibility – the readiness to change or adjust production and services as demand shifts. For example, a manufacturer that can switch between product lines or reallocate resources during slow periods is better positioned to handle uncertainty. A garment unit, for instance, that moves from export orders to producing school uniforms or domestic workwear during a lean season can keep machines running and workers employed. This flexibility also helps businesses manage costs and maintain stability during downturns.

- Innovative capability – the willingness to try new ideas and adopt technology to stay competitive. MSMEs that experiment with new materials, automation, or digital tools often find ways to improve productivity and quality. Even small process changes, such as using digital invoicing or online marketing, can make operations more efficient and help reach wider markets.

- Network strength — the ability to work collaboratively within supply chains, local clusters, or trade associations. Partnerships with suppliers, buyers, and peers help small enterprises share information, access common facilities, and negotiate better terms. A strong network also provides collective strength during disruptions, allowing MSMEs to pool resources and recover faster.

For MSMEs in smaller towns and manufacturing clusters, developing these capabilities is essential. They form the base from which small enterprises can continue to grow, even when the market becomes uncertain.

- Reconfiguring Operations for Agility and Efficiency

MSMEs also need to keep their operations flexible and efficient in a constantly changing market, and competitiveness depends on how effectively a business can reconfigure its processes and resources to meet new demands.

To achieve operational agility, MSMEs must focus on improving efficiency across every stage of production. This begins with optimizing inventory and logistics through digital tools that help track materials, reduce delays, and minimize wastage. Adopting energy-efficient machinery and selective automation can further lower operating costs and enhance productivity without large-scale investments. Equally important is maintaining flexible production setups that can quickly adjust to changes in order size or customer requirements. Together, these measures enable small businesses to operate with greater control, respond faster to market shifts, and maintain steady output even during uncertain periods.

For instance, many small-scale manufacturers in the textile and engineering sectors are adopting lean manufacturing practices and participating in shared resource clusters. These approaches reduce expenses and help maintain steady output, even during periods of unstable demand.

- Diversification to reduce dependence and expand opportunity

One of the most practical ways to manage uncertainty is through diversification. Relying on one market, one buyer, or one product line exposes MSMEs to greater risk if conditions suddenly change.

Expanding into new regional or international markets, such as those in Southeast Asia, the Middle East, or Africa, can reduce this dependence. Similarly, developing new product lines—for example, transforming traditional handicrafts into sustainable lifestyle items—can open up fresh sources of revenue.

E-commerce platforms and digital B2B marketplaces have made it easier than ever for MSMEs to reach new buyers and expand their customer base. Diversification not only spreads risk but also builds resilience by creating multiple paths to growth.

- Digitalization as the New Resilience Driver

Digitalization has become one of the most effective tools for MSMEs to strengthen their resilience. Digital systems enable small businesses to operate with greater efficiency, visibility, and control across every function. Approximately 67% of Indian MSMEs now use tools such as ERP, CRM, and cloud platforms to streamline operations and improve decision-making.

Technologies such as cloud-based accounting, e-invoicing, digital payments, and AI-driven forecasting allow enterprises to manage cash flows better and plan more accurately for demand fluctuations. Digitally mature MSMEs have been found to grow nearly twice as fast as traditional MSMEs, showing that technology adoption directly supports competitiveness and long-term sustainability.

Government initiatives like Digital India, Udyam Registration, and the Open Network for Digital Commerce (ONDC) have further made digital transformation more accessible and affordable. Regions with better internet infrastructure and connectivity also record higher digital adoption among small enterprises, demonstrating how external conditions influence business growth. For MSMEs, going digital is no longer optional—it is now essential to remain competitive and future-ready.

- Building Collaborative Networks and Clusters

Collaboration and cluster-based development help small businesses share resources, reduce costs, and access new technologies that may be expensive individually. The Micro and Small Enterprises Cluster Development Programme (MSE-CDP) is one such initiative that has improved productivity and innovation across multiple sectors. Cluster-based manufacturing allows MSMEs to use common testing facilities, shared logistics, and collective marketing platforms, leading to higher efficiency. Working in clusters or associations also creates a support network that can help small enterprises recover faster during crises and adapt to new opportunities together.

- Accessing Government Programs and Access to Finance

The above-mentioned Internal strengths must be supported by external enablers. Access to government policies, financing, and institutional support by RBI-regulated NBFCs such as Protium helps MSMEs put their resilience into action.

Policy support and finance significantly strengthen the link between internal capabilities and long-term sustainability. MSMEs that benefit from dedicated government programs—such as the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Technology and Quality Upgradation Support Scheme, and the MSME Champions Portal—demonstrate greater ability to innovate and sustain growth.

Enterprises with better access to formal financing also report higher product innovation and process improvements, as capital availability directly supports business upgrades. Enterprises with better access to formal financing also report higher product innovation and process improvements, as capital availability directly supports business upgrades. Thus, tailored financing solutions such as Protium’s Machinery Finance, Business Loans, Loan Against Property, and Top-up Loans can meet the unique and evolving needs of MSMEs—whether it is for upgrading equipment, expanding capacity, or strengthening working capital. These flexible options help business owners respond quickly to new opportunities and manage slow periods without disrupting operations.

Resilience is not built in a single step. It develops through continuous learning and adaptation. MSMEs that regularly assess their risks, update supplier partnerships, and invest in skills and technology are better prepared to sustain growth.

As India becomes more integrated with global value chains, the resilience of its MSMEs will play a key role in ensuring long-term economic stability and competitiveness. In this evolving environment, three pillars define MSME sustainability: strong internal capabilities, access to finance and policy support, and commitment to digital transformation.