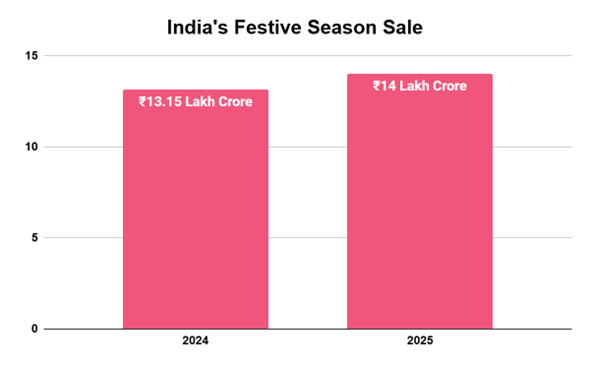

India’s festive season in 2025 is projected to drive record consumer spending between ₹12 lakh crore and ₹14 lakh crore, marking the strongest demand surge in three years.

Retail, textiles, FMCG, food processing, logistics, and quick commerce are expected to benefit the most due to a surge in demand, GST rate rationalisation, and rising consumer spending.

As working capital needs rise sharply during the festive rush, top-up loans serve as the most practical festive financing option, offering MSMEs quick liquidity, minimal documentation, no new collateral requirements, and faster disbursal through existing lender relationships.

India’s festive season 2025 is the strongest one in three years, with consumer spending projected to range between ₹12 lakh crore and ₹14 lakh crore1, which rose from ₹11.25 lakh crore and ₹13.15 lakh crore in 2024. Sales during Navratri 2025 have been described as India’s best in a decade. The year is also shaping up to be the most active festive e-commerce season since 2021, with expected gross merchandise value (GMV) of over ₹1.15 lakh crore, marking a 20–25% year-on-year increase — nearly double last year’s growth rate.

Dusshera, on September 22, alone witnessed 23–26% year-on-year growth in GMV, led by smartphones and televisions, while large appliances and groceries emerged as major contributors this year. Two new segments are driving this transformation: quick commerce, which is growing at approximately 150% year-over-year, and value commerce, which is expanding by 40–50% year-over-year. To manage the surge, many have increased gig worker hiring by 40–60%. Q-commerce now accounts for nearly two-thirds of all e-grocery orders and about 10% of total e-retail GMV, powering an estimated 80–90% lift in grocery sales2. Together, these channels are broadening the festive funnel beyond traditional big-ticket categories.

Beyond retail and digital trade, the festive and wedding season, combined with GST rate rationalisation, is driving up demand in automobiles, electronics, FMCG, and quick-service restaurants.

At the same time, logistics — a key enabler of MSME operations — is witnessing notable shifts. Railways is particularly emerging as a cost-efficient transport mode for MSMEs, with an average cost of ₹1.96 per tonne per km3. This affordability allows smaller manufacturers, traders, and suppliers to move raw materials and finished goods across regions more efficiently, reducing their input costs and improving competitiveness during the high-demand festive period.

In the travel sector, — particularly aviation and railways — is also experiencing a sharp increase in passenger traffic.

For MSMEs, this vibrant festive landscape offers immense opportunities and a way to address the challenges they face.

What the Festive Season Business Spike Means for MSMEs

Every festive period (beginning with Raksha Bandhan and including Navratri, Dusshera, Diwali, the wedding season, and leading up to Christmas and New Year) brings a surge in demand across sectors. For MSMEs, this period can determine a large share of their annual revenue. However, higher demand also means increased expenses.

Without adequate financing, even well-performing businesses risk missing out on sales opportunities, supply contracts, or bulk orders. Managing this seasonal spike efficiently, therefore, becomes crucial for sustaining growth and profitability. This is when The need for working capital rises sharply to meet the following operational demands:

- Inventory Build-up: MSMEs must stock up on raw materials or finished goods in advance which requires upfront payments to suppliers, often weeks before sales revenue arrives.

- Higher Labor and Logistics Costs: Seasonal workers are hired, shifts extended, and distribution networks expanded — all of which increase wage and transport expenses.

- Marketing and Promotions: Small enterprises often invest in packaging, advertising, or discounts to stay competitive, especially as large players increase their festive marketing budgets.

- Delayed Receivables: With bulk credit sales common during this season, MSMEs may receive payments only after the festive rush has ended, creating a temporary liquidity crunch.

This tests a business’s financial agility and To manage the heightened financial needs, MSMEs can explore loan products that provide financial support during high-demand periods. Loan options such as top up loans, machinery loans for manufacturing units, Loan Against Property (LAP) can cover operational expenses, purchase raw materials, restock inventory, or even install new machinery ahead of the festive rush.

RBI-regulated NBFCs like Protium offer quick disbursal and flexible repayment tenures that allow small enterprises to repay once post-festive sales stabilize. Such loans ensure that supply chains remain uninterrupted and that MSMEs can meet customer expectations without operational strain.

Top-Up Loans: A Practical Solution for Festive Expansion

Businesses with existing loans that require additional funds during the season can benefit from Top-Up Loans, which allow enterprises to scale operations just when demand peaks. Because the lender already holds the borrower’s financial history, repayment records, and KYC documents, the process is faster, simpler, and requires minimal new documentation. Disbursal timelines are typically much shorter, often allowing MSMEs to receive funds within days — a crucial advantage during the fast-moving festive cycle.

Here’s how top-up loans help MSMEs not only handle the festive rush but also expand their business:

- Quick Access to Working Capital Credit

During high-demand months, lenders often experience heavy loan application traffic. For MSMEs, applying for a completely new loan means longer evaluation periods and scrutiny. In contrast, a top-up loan leverages an existing relationship and considerably cuts down approval time. MSMEs cannot afford to wait weeks for loan approvals when customer orders are increasing daily. A Top-Up Loan offers instant access to funds so that business owners can buy extra raw materials, expand production, or add delivery capacity. This quick infusion keeps operations agile and responsive to real-time market demand.

- Lower Processing Time and Cost

Since the borrower is already a customer with an existing loan, lenders skip many verification steps. This reduces paperwork, appraisal time, and associated processing fees. MSMEs can thus save both time and cost while securing the funds they need.

- Competitive Interest Rates

Lenders often offer preferential or lower interest rates on top-ups because they are extending credit to an existing, proven borrower. For MSMEs, this means cheaper access to working capital compared to taking a new standalone loan.

- No Fresh Collateral Requirements

A major benefit of top-up loans is that borrowers do not need to pledge new collateral. The same security used for the initial loan is typically extended to cover the top-up amount, easing the borrowing process and ensuring convenience for small enterprises that may lack additional assets.

- Customizable Tenure and Repayment Flexibility

Depending on the MSME’s seasonal cash flow, lenders can tailor the top-up repayment period — often allowing shorter tenures that align with post-festive inflows. This ensures that the added debt does not strain future operations.

- Use-Case Versatility

Top-up loans offer exceptional use-case versatility, allowing MSMEs to address nearly any short-term business requirement during the festive season. A textile enterprise, for instance, can utilize the additional funds to procure new festive fabrics and expand its tailoring units to meet increased demand. Similarly, a sweet manufacturer can use the capital to purchase sugar and ghee in bulk or upgrade packaging for gifting orders, enhancing both scale and presentation. Retailers, on the other hand, can invest in point-of-sale systems, improve store displays, or introduce festive-themed sections to attract more walk-in customers. This flexibility makes top-up loans a practical and timely tool for MSMEs seeking to capitalize on seasonal opportunities.

- Business Continuity and Growth

Beyond meeting temporary needs, top-up loans also contribute to long-term creditworthiness. Timely repayment of these loans builds a strong credit profile, increasing future borrowing limits and positioning MSMEs for sustained growth beyond the festive season.

Repayment Strategies for Seasonal Borrowing

While festive financing can accelerate business growth, repayment discipline remains key to long-term stability. MSMEs can follow these practical strategies:

- Plan for Post-Festive Cash Flow: Anticipate when revenue from recent festive sales will materialize and align repayment schedules accordingly.

- Opt for Structured EMIs: Choose repayment plans that factor in potential off-season dips in income. This ensures consistent cash flow management.

- Maintain Credit Discipline: Timely repayments not only reduce interest burden but also improve credit scores, enhancing eligibility for future loans or top-ups.

- Reinvest Wisely: Using a portion of festive profits to close short-term debts early can strengthen financial health and free up capacity for future borrowing.

A disciplined repayment approach transforms festive financing into a sustainable growth cycle rather than a temporary cash flow patch.

Beyond access to credit, strategic financial planning determines how effectively MSMEs leverage the festive season. Some key practices include forecasting demand realistically and setting achievable targets, maintaining optimal stock levels to avoid overstocking that ties up capital or understocking that limits sales, allocating funds for marketing, adopting digital tools to track expenses, monitor cash flow, and simplify tax compliance, and applying for loan well before the festive rush to ensure smooth approvals.

These proactive measures ensure that borrowed funds translate into measurable returns during and after the festive season.