7 Things To Keep In Mind For An MSME While Procuring Business Loans

- According to a recent report, 52 crore business owners have opted for Pradhan Mantri Mudra Yojana (PMMY).

- Out of this, 78% of business owners are first-time borrowers in the Shishu category, reflecting a shift toward new micro-entrepreneurship.

- The study also states that these first-time borrowers faced 6 key barriers: low credit history, lack of documents, no collateral, financial illiteracy, complex applications, and perceived high risk.

- This article reflects on the things that should be kept in mind by an MSME business owner, not only for the first time but also for future loans.

Of the 52 crore loans sanctioned under the Pradhan Mantri Mudra Yojana (PMMY), 78% belong to the Shishu category (loans up to ₹50,000), which is typically constituted of first-time entrepreneurs1. This rise highlights India’s expanding base of new micro-entrepreneurs and the informal economy steadily moving toward formalization. This means first-time borrowers represent the beginning of a transformative phase where informal businesses begin accessing institutional finance.

Formalization of MSMEs is crucial for India’s Viksit Bharat 2047 vision. And for this economic ambition to be truly inclusive, it is essential to support first-time borrowers who represent the next generation of job creators and grassroots entrepreneurs. Supporting them ensures that economic growth reaches the last mile and builds a self-reliant, inclusive India from the ground up. Despite this, the majority of micro enterprises remain financially excluded.

Understanding the Credit Gap

India’s MSME credit gap is currently estimated at ₹30 lakh crore2. Only ₹14.5 lakh crore of this demand is currently met by formal institutions, leaving a vast segment reliant on informal or exploitative lending practices.

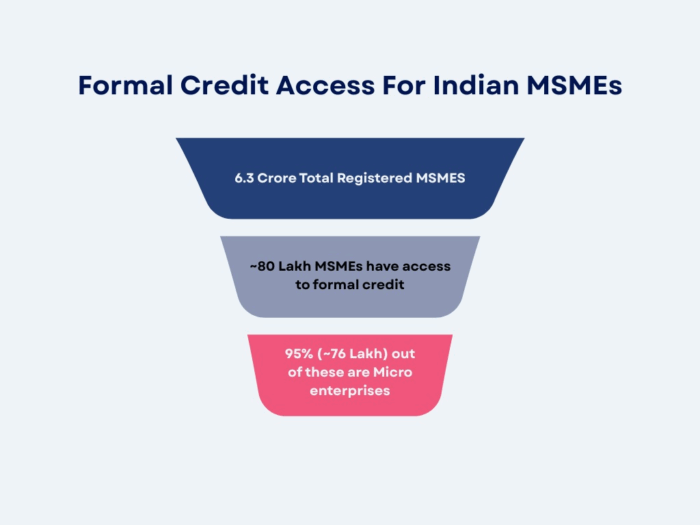

Approximately 80 lakh MSMEs out of 6.3 crore have access to formal credit. Of these, 95% are micro enterprises. This systemic exclusion often forces micro-units to resort to informal borrowing, typically at exorbitant interest rates and limited repayment flexibility.

One way of solving this persistent credit gap is financial literacy about various areas so first-time borrowers can navigate the loan ecosystem landscape confidently.

Here’s how first-time MSME borrowers can build a strong start:

1. Low or No Credit History A lack of formal credit history makes it challenging for lenders to assess a borrower’s reliability and repayment capacity.

- Solution: Begin with a modest loan and prioritize timely repayment. This disciplined approach builds a positive credit score over time. Leverage formal financing channels and digital payment platforms to establish a traceable financial footprint. Regularly request and monitor your credit report to track your progress.

2. Lack of Documentation Many informal businesses operate with limited paperwork, lacking essential financial records such as balance sheets, tax returns, or audited statements.

- Solution: Register the business under UDYAM, the official portal for MSME registration. To know how to register, refer to this article. If eligible, MSMEs can also consider GST registration And start maintaining basic financial records, including sales logs, expense sheets, and customer invoices. Having a dedicated current account for business and ensuring all transactions are routed through it is also a great first step.

3. Limited or No Collateral Many small businesses, particularly micro-enterprises seeking a loan for the first time, are asset-light and may not possess property or equipment to pledge as collateral.

- Solution: In this case, MSMEs can prepare a solid growth plan, explore government-backed subsidies and approach regulated NBFCs like Protium that offer tailored financing options.

4. Lack of Financial Literacy & Advisory A limited understanding of loan terms, interest rates, and repayment structures can lead to suboptimal financial decisions.

- Solution: MSMEs must invest time in learning the fundamentals of financial management, including budgeting, EMI planning, and interest calculations. Financial literacy workshops organized by banks, NGOs, or digital platforms also go a long way, besides utilizing simple tools or mobile applications to effectively track expenses, income, and business goals.

5. Perceived High Risk by Lenders First-time borrowers are often perceived as high-risk, which can lead to stricter loan terms or outright rejections.

- Solution: First-time borrowers must focus on strengthening their business plans by incorporating clear market insights, realistic revenue projections, and a detailed explanation of how the loan will be utilised. Even smaller businesses should aim to demonstrate consistent cash flow and customer demand. It is also advisable to begin building relationships with lenders early on.

6. Understanding Loan Applications

Many first-time borrowers are unsure about the types of loans available and which one suits their business needs.

- Solution: MSMEs should start by identifying whether they need a working capital loan, a term loan, or a credit line. It’s also important to explore collateral-free schemes like the Pradhan Mantri Mudra Yojana (PMMY) or CGTMSE. Revenue-based loans offered by NBFCs such as Protium provide flexible options with minimal documentation—making them well-suited for micro-entrepreneurs just entering the formal lending space.

7. Navigating the Application Process

Selecting the right lender—be it a bank, NBFC, or fintech platform—is crucial and should be based on the business’s specific financial needs.

- Solution: Where possible, opting for digital loan applications can save time and reduce paperwork. If guidance is needed, borrowers can consult local facilitation centres such as MSME Sambandh or District Industries Centres (DICs), or seek support from certified loan advisors.

Managing MSME Loan Effectively

For first-time borrowers, effective loan management is even more critical, as it sets the foundation for building long-term creditworthiness and future borrowing capacity. Mismanagement at this early stage can limit future access to funds or lead to financial distress, while disciplined handling can unlock larger credit opportunities and lower interest rates over time. To avoid this, first-time borrowers must:

- Pay on Time: Delay impacts your score and future eligibility.

- Track Every Rupee: Use budgeting apps or simple spreadsheets.

- Don’t Overborrow: Avoid taking multiple loans without repayment capability

- Keep Records: Even simple paper ledgers help when applying for renewals or top-ups.

If repayment becomes difficult, it is essential for first-time borrowers to act promptly. They should inform their lender of any cash flow issues before missing EMIs, as early communication can open up more options. In cases of genuine financial hardship, borrowers can explore one-time loan restructuring schemes permitted by the Reserve Bank of India (RBI). Additionally, many NBFCs offer flexible solutions such as temporary moratoriums or revised repayment schedules to help businesses navigate short-term challenges without damaging their credit profile.

The Role of NBFCs in Bridging this Gap

NBFCs play a pivotal role in addressing the credit shortfall faced by MSMEs, particularly first-time borrowers.

- Market Share: As of March 2024, NBFCs held a significant 36% market share of the secured MSME portfolio, demonstrating their growing influence in this segment, with MSME AUM for NBFCs to Cross ₹4.2 lakh crore by FY253.

- Flexibility and Customization: NBFCs are renowned for offering flexible, customized, and tech-driven financial products that are often tailored to the unique revenue cycles of MSMEs.

- Deep Geographical Reach: They possess the ability to reach deep into geographies, providing “doorstep credit” especially in rural and semi-urban areas where traditional banks may have limited presence.

- Tech-Led Credit Models: NBFCs are increasingly leveraging alternative data points—such as cash flows, GST filings, and digital payment records—for more robust credit assessments. They utilize artificial intelligence (AI) and digital platforms to significantly reduce loan turnaround times and minimize paperwork. For instance, Protium employs AI-driven underwriting systems, with tis engine using over 5,000 data points—including transaction history, digital payments, GST data, and proprietary risk scores—to evaluate borrower eligibility and intent with remarkable precision. This data-rich, AI-powered approach enables faster, more accurate decision-making, even for borrowers with little to no formal credit history.

- Collaborative Lending: NBFCs are actively partnering with banks and fintech companies through co-lending models. This collaborative approach expands credit access to a broader spectrum of MSMEs, including first-time borrowers.

- Fast Approval and Disbursal of Loans: NBFCs are known for short turnaround times in approving and disbursing loans. These institutions leverage digital onboarding, automated underwriting, and alternative data sources to fast-track loan approvals and disbursements.

First-time borrowers are not just new entrants to the credit system—they are catalysts of transformation for India’s informal economy.