- India’s financial inclusion shows progress, yet a significant credit gap persists for MSMEs in underserved regions.

- Formal credit addresses challenges like streamlining working capital and fuels growth plans.

- Practical steps like thorough documentation and financial planning help MSMEs get credit.

- One such example is of a business owner from Rajasthan

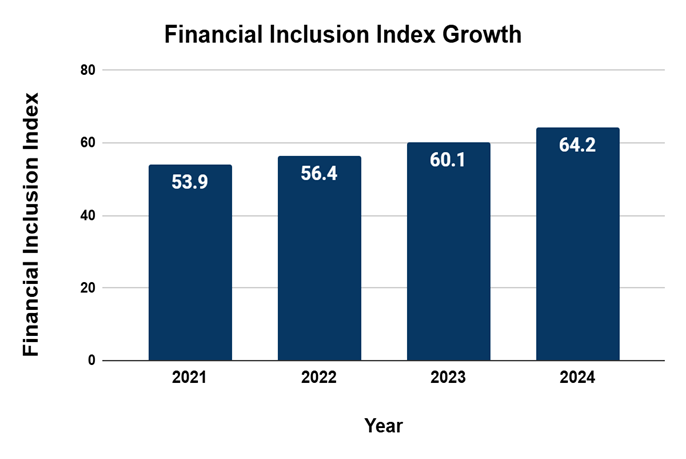

India recorded a score of 64.2 on the Reserve Bank of India’s (RBI) Financial Inclusion Index at the end of March 2024. This composite index, developed by the RBI, measures the extent of financial inclusion across the country on a scale of 0 to 100—where 0 represents complete exclusion and 100 signifies full inclusion. It captures key aspects such as access to financial services, their usage, and the overall quality of service. The score of 64.2 places India in the “middle to moderate” range of financial inclusion. It reflects steady progress, but not universal access or usage—especially when looking at disparities across different states or sectors (like MSMEs in remote areas).

Source: Ministry of Finance

This year-on-year improvement reflects steady strides in expanding financial services compounded with an increased credit supply to MSMEs. However, the sector still faces an addressable credit gap of approximately 24%, nearly ₹30 lakh crore1. This financial disparity in formal credit access is enhanced for MSMEs in financially underserved areas.

State-wise MSME Registrations and Credit Outstanding (FY 2023–24)

The table below shows the number of MSMEs registered and how much credit was given in each state during FY 2023–24. This helps us understand which regions have better access to formal credit and where the gaps still exist.

| State/Union Territory | Micro Enterprises Registered (as of Mar 15, 2025) | Small Enterprises Registered (as of Mar 15, 2025) | Medium Enterprises Registered (as of Mar 15, 2025) | Total MSMEs Registered (as of Mar 15, 2025) | Accounts with Credit Outstanding (as of Mar 31, 2024) (lakhs) | Amount Outstanding (as of Mar 31, 2024) (₹ crore) |

| Andaman and Nicobar Is. | 17,855 | 275 | 14 | 18,144 | 0.08 | 989.97 |

| Andhra Pradesh | 3,113,513 | 25,337 | 2,000 | 3,140,850 | 12.06 | 1,01,085.90 |

| Arunachal Pradesh | 34,540 | 416 | 35 | 34,991 | 0.12 | 1,514.76 |

| Assam | 1,071,011 | 10,102 | 887 | 1,082,000 | 3.57 | 28,729.48 |

| Bihar | 3,334,405 | 19,619 | 1,042 | 3,355,066 | 12.35 | 51,766.42 |

| Chandigarh | 62,152 | 2,005 | 210 | 64,367 | 0.47 | 14,634.23 |

| Chhattisgarh | 1,050,295 | 12,193 | 1,298 | 1,063,786 | 3.94 | 43,694.34 |

| Dadra and Nagar Haveli & Daman and Diu | 27,411 | 1,295 | 237 | 28,943 | 0.10 | 2,345.29 |

| Delhi | 1,078,412 | 41,566 | 5,034 | 1,125,012 | 6.95 | 1,79,638.00 |

| Goa | 104,985 | 1,744 | 160 | 106,889 | 0.56 | 7,350.41 |

| Gujarat | 3,403,129 | 84,195 | 8,592 | 3,495,916 | 11.90 | 2,51,504.11 |

| Haryana | 1,520,364 | 34,810 | 3,329 | 1,558,503 | 6.75 | 1,22,258.78 |

| Himachal Pradesh | 267,653 | 3,986 | 449 | 272,088 | 1.52 | 16,147.28 |

| Jammu & Kashmir | 705,479 | 5,283 | 361 | 711,123 | 3.86 | 24,036.19 |

| Jharkhand | 1,235,850 | 9,078 | 667 | 1,245,595 | 6.16 | 34,398.89 |

| Karnataka | 4,045,487 | 47,254 | 4,432 | 4,097,173 | 16.07 | 1,65,082.73 |

| Kerala | 1,459,795 | 19,354 | 1,479 | 1,480,628 | 11.32 | 85,221.33 |

| Ladakh | 17,314 | 145 | 4 | 17,463 | 0.09 | 745.13 |

| Lakshadweep | 2,087 | 1 | – | 2,088 | 0.01 | 625.99 |

| Madhya Pradesh | 3,875,413 | 30,398 | 2,310 | 3,908,121 | 15.14 | 1,01,220.23 |

| Maharashtra | 7,904,060 | 108,112 | 12,472 | 8,024,644 | 29.81 | 4,25,437.84 |

| Manipur | 135,461 | 691 | 39 | 136,191 | 0.37 | 1,534.83 |

| Meghalaya | 44,552 | 507 | 63 | 45,122 | 0.21 | 1,834.20 |

| Mizoram | 42,534 | 211 | 11 | 42,756 | 0.12 | 851.34 |

| Nagaland | 54,601 | 252 | 19 | 54,872 | 0.22 | 1,268.83 |

| Odisha | 1,918,887 | 15,116 | 1,113 | 1,935,116 | 8.82 | 53,516.04 |

| Puducherry | 88,390 | 974 | 128 | 89,492 | 0.49 | 4,082.11 |

| Punjab | 1,677,425 | 27,505 | 2,471 | 1,707,401 | 6.48 | 96,611.66 |

| Rajasthan | 3,437,035 | 43,199 | 3,452 | 3,483,686 | 11.03 | 1,51,219.10 |

| Sikkim | 25,859 | 204 | 19 | 26,082 | 0.14 | 1,997.76 |

| Tamil Nadu | 4,898,748 | 60,443 | 5,358 | 4,964,549 | 23.50 | 2,81,696.93 |

| Telangana | 2,339,575 | 28,506 | 3,167 | 2,371,248 | 7.52 | 1,16,962.81 |

| Tripura | 258,561 | 1,014 | 74 | 259,649 | 1.02 | 2,978.15 |

| Uttarakhand | 496,891 | 6,427 | 544 | 503,862 | 2.69 | 26,006.06 |

| Uttar Pradesh | 6,477,132 | 63,554 | 4,910 | 6,545,596 | 27.45 | 1,95,413.75 |

| West Bengal | 4,298,224 | 37,009 | 3,331 | 4,338,564 | 24.55 | 1,31,256.60 |

| Total | 60,525,085 | 742,780 | 69,711 | 61,337,576 | 257.45 | 27,25,657.46 |

Source: Udyam Registration Portal (July 1, 2020 – March 15, 2025) and RBI (March 31, 2024)

The above table offers a clear view of which states may have insufficient formal credit access for MSMEs. RBI has identified Bihar, Uttar Pradesh, Jharkhand, Chhattisgarh, Odisha, Assam, Madhya Pradesh, and Rajasthan as the states with a high number of registered micro-enterprises but a relatively low number of credit accounts or lower average outstanding amounts per account. This indicates areas where formal credit systems are not adequately penetrating the MSME ecosystem and require targeted financial inclusion interventions.

Bridging this credit gap is essential—not just to improve financial inclusion, but to ensure fair economic opportunity for MSMEs across all regions of India. mall enterprises in financially underserved regions continue to face compounded challenges, such as:

- Cash Flow Issues: Without access to credit, MSMEs struggle to manage day-to-day operations, especially during lean periods.

- Limited Growth Opportunities: Lack of funds restricts the ability to invest in new equipment, hire additional staff, or expand to new markets.

- Increased Vulnerability: Without financial buffers, businesses are more susceptible to market fluctuations and unforeseen expenses.

- Missed Opportunities to Scale or Fulfill Large Orders: Inability to access timely funds often forces MSMEs to decline sizable orders or expansion opportunities, limiting their growth potential.

- Dependence on Informal Lenders with High Interest Rates: Many MSMEs resort to informal credit sources, which often come with exorbitant interest rates, leading to increased financial strain and longer debt traps.

- Digital illiteracy: Many entrepreneurs in these regions are unfamiliar with online banking or digital lending platforms, making it hard for them to benefit from modern financial tools.

- Inadequate infrastructure: Limited internet connectivity and access to physical bank branches further complicate matters. Even if digital services are available, without the necessary infrastructure and knowledge, MSMEs struggle to utilize them effectively.

Financing Solutions to Overcome These Challenges

As the financial landscape continuously evolves, concentrated efforts from government and other BFSI entities can continue to improve accessibility. This can further be clubbed with offering and providing good quality financial services, which extends beyond just credit such as financial literacy savings, insurance, and efficient payment solutions.

Government Initiatives and Policy Measures to Boost Financial Inclusion

The Indian government has been striving towards formalization of the MSMEs through multiple initiatives, especially in regions with lower financial inclusion, such as:

- Schemes & Initiatives: These include the Pradhan Mantri Mudra Yojana (PMMY), Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), Stand-Up India Scheme, and PM Vishwakarma Scheme.

- Digital Interventions: Digital platforms are streamlining processes and expanding the reach of financial services:

1– Udyam Registration Portal & Udyam Assist Platform (UAP): Simple, paperless online registration for MSMEs and informal micro-enterprises, formalizing them for scheme access, including Priority Sector Lending (PSL).

2– Trade Receivables Discounting System (TReDS) & GST Sahay App: Helps MSMEs get early payments by discounting invoices, improving liquidity and providing cash flow-based credit. (Source: RBI, SIDBI).

3- Jansamarth Portal & PSB Loans: Online platforms for quick, digital loan approvals, significantly reducing processing time and paperwork for MSMEs.

- Regulatory Reforms: The RBI has implemented regulations to ensure fair and increased lending to MSMEs:

1– Priority Sector Lending (PSL) Targets

2– External benchmark for interest rates, ensuring transparency and fair pricing of interest rates for MSME loans by linking them to external benchmarks.

3– RBI frameworks for innovation, with initiatives like Account Aggregator (AA) and Regulatory Sandbox promote data-driven and automated lending, making credit more accessible to underserved MSMEs.

Role of BFSI Players: A Phygital Strategy for Deeper Reach

While government reforms lay the groundwork, financial institutions must play a proactive role in executing inclusion on the ground. A “phygital” (physical + digital) approach is emerging as the most effective solution to bridge the financial inclusion divide.

Key Steps BFSI Entities Can Undertake:

- Expand Physical Presence in Tier 3 & 4 Markets:

Establishing more branches or micro-offices in remote locations builds trust and accessibility for MSMEs that may not be digitally savvy.

- In-person BTL Activations for Financial Literacy:

Roadshows, workshops, and local community events can help demystify formal credit processes, documentation needs, and loan products for small business owners.

- Form Strategic Partnerships with Government & Industry Bodies:

Collaborations can amplify reach and ensure consistent messaging across sectors. This includes working with state agencies, MSME development councils, and industry chambers.

- Leverage Digital Tools to Enable Efficiency and Scale:

Use of mobile-based loan applications, vernacular interfaces, AI-driven underwriting, and secure document collection ensures scalability while keeping MSME onboarding simple and fast.

Together, these integrated efforts are not just improving the availability of capital, but also ensuring that MSMEs across all geographies can access, understand, and utilize financial services meaningfully.

Furthermore, MSMEs themselves can take concrete steps to improve their chances of accessing formal credit:

- Meticulous Documentation: Keep all business registration, GST, PAN, financial statements (P&L, Balance Sheet), bank statements, and KYC documents organized.

- Strategic Financial Planning: Maintain accurate books, manage cash flow diligently, and prepare realistic business plans and financial projections.

- Improving Creditworthiness: Build a strong credit history by ensuring timely loan repayments, minimizing excessive debt, and consistently filing all tax and regulatory compliances.

By taking these practical steps, MSMEs can navigate the loan application process more smoothly and position themselves as reliable borrowers, unlocking the formal credit they need to thrive.

Protium’s Role in Supporting MSMEs in Financially Underserved Regions

Protium focuses on facilitating access to formal credit for MSMEs across India, including in regions identified with lower financial inclusion. The company’s operational model emphasizes reaching businesses in diverse markets where traditional financial services may be less accessible.

Protium maintains a geographical presence comprising 104 branches across 74 cities in 15 states and 3 Union Territories. This network is supported by a workforce of over 3,000 individuals.

With its presence, Protium demonstrates a strategic focus on these areas.

Specific regional presence includes:

- Uttar Pradesh & NCR: 17 branches are located in this region.

- Rajasthan: 5 branches operate within the state.

- Madhya Pradesh: 12 branches are situated in Madhya Pradesh.

- Eastern States: 6 branches cover areas within the East, which include states such as Odisha.

To address lack of credit in these regions, Protium’s products like Loan Against Property, Business Loan, and Machinery & Equipment Finance are designed to meet the operational and growth capital requirements of MSMEs.

Fuelling Ambition for the Printers Club of India in Rajasthan

An example of Protium’s engagement in a state with lower financial inclusion is the case of the Printers Club of India, an enterprise located in Rajasthan. This business sought funding for machinery acquisition to support its expansion goals. Securing substantial capital from traditional lenders had presented challenges, a common experience for MSMEs in such regions.

Protium provided a Machinery Finance solution that included a ₹1.5 crore funding facility at competitive interest rates. This enabled the Printers Club of India to acquire essential advanced machinery. Following this investment, the business reported a 20-25% increase in production capacity and experienced a 15-20% rise in their monthly revenue. This transaction facilitated the expansion of their operational capabilities and enhanced their financial performance.

This example from Rajasthan illustrates Protium’s function in providing targeted financial support that enables tangible business growth for MSMEs in regions with significant credit gaps.

Disclaimer:

*Protium Finance Ltd (Protium) may use the services of various agents on its behalf for the purpose of sales and marketing for Protium’s products and services

*Terms and conditions apply, based on applicant eligibility and financial profile.