- India ranks second in the world in cotton production, supporting over 60 million livelihoods across various stages of cultivation, processing, and trade. Various MSMEs involved in these processes form the backbone of this crop, ensuring a smooth flow of cotton from farm to market.

India is the second-largest producer of cotton in the world, accounting for nearly 24% of global production1. The Indian cotton industry directly or indirectly supports an estimated 60 million people, making it one of the largest employment-generating sectors after agriculture2. The country’s total cotton production for the 2024–25 season is estimated at 302.25 lakh bales of 170 kg each, and the total cotton supply up to the end of the 2024–25 season (30 September 2025) stood at 357.44 lakh bales of 170 kg each. Exports, meanwhile, are expected to reach 18 lakh bales for the current crop year.3

This scale highlights the strategic importance of cotton in India’s economy. It sustains a vast value chain, and at the core of this ecosystem are MSMEs, which transform cotton from a raw commodity into products that represent Indian craftsmanship and enterprise worldwide.

On World Cotton Day, we are highlighting MSMEs’ contributions and how they keep the industry resilient while adapting to changing markets and global demands.

MSMEs Across the Cotton Supply Chain

MSMEs are present at every stage, ensuring the chain runs smoothly and bringing cotton from farms to the domestic and foreign markets. Here’s how:

- Farmers and Input Suppliers: Cotton cultivation is dominated by small and marginal farmers. They depend heavily on MSMEs that provide seeds, fertilizers, pesticides, irrigation tools, and small-scale farm equipment.

- Ginning and Processing Units: Once harvested, raw cotton is cleaned and separated in ginning units before being pressed into bales. These ginning units and small spinning mills perform the essential task of preparing cotton for downstream industries.

- Textile and Artisan Units: India’s cotton heritage is sustained by handloom clusters, weavers, dyers, and block printers, many of whom operate as MSMEs. Clusters such as Shantipur in West Bengal, for example, depend on cotton yarn supplies from Gujarat to produce distinctive handwoven fabrics.

- Traders, Retail, and Logistics: The cotton economy also relies on a large number of small traders, transporters, warehouse operators, and retail outlets. These MSMEs bridge the gap between production centers and consumer markets.

All these MSMEs continue to push the cotton industry forward with agility and innovation. For example, many weaving and fabric units introduce new blends, finishes, and designs to cater to evolving trends across domestic and global markets. They also embrace digital tools—such as e-catalogs, e-commerce storefronts, firming their B2B trading platforms that help them expand their reach beyond local buyers.

The concept of Cluster-based development has also gained momentum, and its success is evident in towns like Tirupur, where exports have increased by 20%, reaching ₹45,000 crore in FY2024-25. The city has shared facilities for dyeing, printing, embroidery, finishing, etc, allowing small enterprises to conserve on resources and scale collectively.

Another significant shift is toward transparency and traceability. With buyers increasingly demanding information on origin and sustainability, MSMEs are adopting technologies such as QR codes and blockchain-enabled supply tracking.Several weaving units are able to target premium international buyers by aligning with sustainability trends, thereby improving long-term competitiveness.

Rising Prices, Global Competition, and Production Trends

While MSMEs continue to drive innovation across India’s cotton sector, they also face increasing pressure from shifting production trends and global competition.

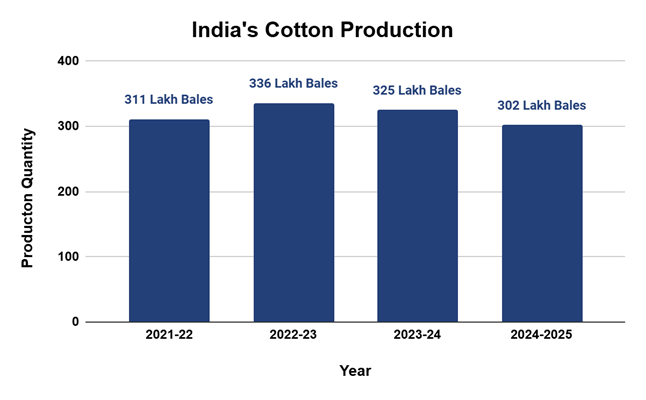

India’s cotton output has seen a slight decline over the past three years. Production stood at 311 lakh bales of 170 kg each in 2021–22, rose slightly to 336 lakh bales in 2022–23, and then eased to 325 lakh bales in 2023–24.

Exports have followed a similar downward trend, from 30 lakh bales in 2022–23 to 28 lakh bales in 2023–24, and 18 lakh bales in 2024–25.

This fall reflects reduced competitiveness in global markets, where India faces strong pricing pressure from major exporters such as the United States and Brazil.

Several factors are adding to cost and price pressures. A smaller area under cotton cultivation, higher Minimum Support Prices (MSP) announced by the government, increased input costs for fertilizers and energy, and fluctuating weather conditions have all affected yields. Domestically, consumption by spinning and textile units continues to exceed production, further tightening availability for small processors and traders.

Government Efforts to Strengthen India’s Cotton Industry

In response to the production and trade challenges, the Government of India has intensified its focus on strengthening the cotton sector through targeted interventions in productivity, exports, and farmer support through:

- Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme: The scheme offers exporters relief by refunding taxes and levies that are not otherwise rebated. This measure helps improve cost competitiveness and ensures that Indian cotton products remain viable in international markets, even amid global price fluctuations.

- Collaboration with the Export Promotion Council for Handicrafts (EPCH): Together, the bodies have outlined a broader vision of achieving ₹8.3 lakh crore (US $100 billion) in textile exports by 2025–264. Meeting this target will depend on enhancing productivity, strengthening domestic processing capabilities, and expanding value-added exports.

- Enhance Productivity: At present, India’s average cotton productivity stands at around 450 kilograms of lint per hectare, which is lower than the global average. The government’s target is to raise this to 800–900 kilograms per hectare through widespread adoption of high-yielding cotton varieties, efficient irrigation systems, and modern farm practices.

- Farmer Outreach: Regular awareness drives, training sessions, and field demonstrations are being conducted to help farmers adopt integrated pest management, balanced fertilisation, and sustainable cultivation techniques. Efforts are also being made to transfer research-based technologies “from lab to land” to improve both yields and fibre quality.

- Procuring cotton at the Minimum Support Price (MSP): Cotton Corporation of India (CCI) continues to play a stabilising role in the domestic market by procuring cotton at the MSP whenever market prices fall below government benchmarks. This safeguards farmer incomes and prevents distress sales during volatile market conditions.

Together, these measures highlight a coordinated national approach—one that aims to raise productivity at the farm level, promote sustainable cultivation, and enhance the competitiveness of Indian MSMEs across the cotton value chain. However, policy reforms and productivity gains can only deliver their full impact when MSMEs have the financial strength to participate in this transformation.

Financing MSMEs in Cotton with Manufacturing Loan and Hypothecation

In a sector where prices fluctuate and operations are seasonal, access to timely working capital is critical. Cotton-based enterprises, whether ginners, spinners, or fabric processors, often experience cash flow mismatches during procurement or high-demand cycles.

Manufacturing Loans from an RBI-registered NBFC such as Protium, designed specifically for enterprises engaged in manufacturing, fabrication, and logistics, address these needs. They provide working capital support for raw material purchase, daily operations, and transportation of goods across the supply chain.

One of the most practical tools under such loans is hypothecation financing. Simply put, hypothecation allows MSMEs to pledge assets such as cotton bales, yarn stock, or machinery as security without giving up their use. The enterprise retains operational control, while the lender holds a legal charge on the pledged asset.

This model is especially effective for cotton-sector MSMEs. Given that cotton is bulky, seasonal, and high in value, hypothecation enables small enterprises to release funds tied up in inventory, maintain liquidity, and manage working capital through peak procurement months.

Additional instruments such as business loans, Loan Against Property, and cluster-based lending frameworks further expand financial options for MSMEs. These allow enterprises to bridge short-term capital gaps, take on larger orders, and integrate more deeply within formal supply chains.

Strategic Recommendations for MSMEs

To remain competitive and resilient, MSMEs in the cotton value chain can adopt several strategies:

- Selective integration: Moving upstream or downstream, such as a weaving unit investing in finishing facilities, helps capture more value.

- Cluster participation: Joining or forming clusters increases bargaining power, reduces costs, and improves access to shared infrastructure.

- Digital adoption: Using online platforms, traceability tools, and lean process management can improve efficiency and market access.

- Sustainability focus: Building organic cotton or eco-friendly product lines allows entry into premium export markets.

- Efficient management: Accurate stock valuation, periodic audits, and disciplined repayments ensure credit sustainability and prevent asset quality risks.