Declining credit growth is preventing small businesses from leveraging the opportunity, but a fresh line of credit can enable them to repurpose stock, meet demand, and maximize profits during the high-demand season.

The festive season in India brings high sales and increased demand, proving to be a boon for MSMEs. However, it often leaves businesses with unsold inventory, tying up working capital and causing cash flow issues. Waiting until the next festive season may not be practical, but the Indian wedding season that soon follows offers MSMEs a chance to offload the piled up stocks. According to the Confederation of All India Traders (CAIT), 2024 will witness an estimated 48 lakh weddings and approximately Rs 6 lakh crore business in 2024. This boom means a heavy demand for products and services, with the wedding market’s massive scale offering a golden opportunity for MSMEs to liquidate surplus stock and reinvigorate their operations.

A solution may be at hand, but it’s not without its own set of challenges: the current decline in credit growth for MSMEs is preventing businesses from reallocating resources or repurposing the stock to target these new opportunities.

The answer to the above is a fresh line of credit. This article delves into how the wedding season can help small enterprises deal with surplus inventory and how financing can help them achieve this goal.

The Indian Wedding Market: A Golden Opportunity for MSMEs

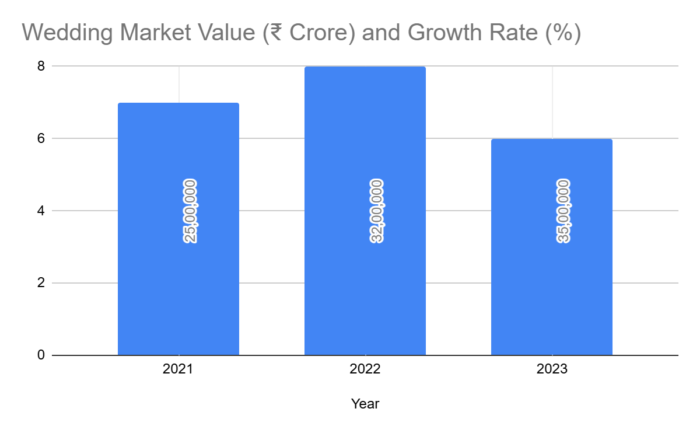

India hosts nearly 1 crore weddings annually, making its wedding industry the second largest globally. According to a report by The Economist, it is also the fourth-largest industry in the country, with annual spending of approximately ₹10.7 lakh crore. The industry has grown consistently over the years, fuelled by rising disposable incomes and cultural traditions. It is one of the fastest-growing sectors in India, showing an annual growth rate of 7-8%.

Source: IBEF

Besides being astoundingly large, the market also brings together numerous large and small sectors, each playing a vital role in its overall dynamics. The extensive scope also makes it ideal for MSMEs, since it’s a largely unorganized sector as most vendors have small-scale operations and limited online presence.

| Category | Sub-Category |

| Retail | Apparel Jewellery, Decorations Invitations and Gifts |

| Service-Based | Wedding Planning Photography and Videography Catering and Decor Makeup and Hair Styling Music and Entertainment Artisanship and Crafts |

| Allied Sectors | Hospitality Tourism Technology Logistics |

Of the above, MSME retailers of apparel, jewelry, and decor and gift items are typically left with surplus stock from the festival season, and can tap into the wedding market to repurpose their goods. Still, it’s worth noting that seizing the wedding market’s potential requires agility and financial flexibility – an aspect MSMEs may struggle with, due to a lack of credit line.

Decline in Credit Growth is Impacting MSMEs

While MSMEs face piled-up inventory and lack of working capital, the situation has further been aggravated due to a drop in credit growth, as a recent RBI report suggests. According to the data, credit growth to MSMEs under the priority sector lending category has declined, with loans increasing by less than 3% between March and August 2024, a significant drop compared to the 8.7% growth recorded during the same period in the previous financial year.

The need of the hour for MSMEs is to scale up this season by accessing finance solutions. This is because the flexibility of a credit line will enable them to respond to market demands dynamically, maximizing their earnings during this crucial period.

How a Fresh Line of Credit can Help

A fresh line of credit is crucial to MSMEs to adapt to seasonal opportunities and leverage the post-festival wedding market. This is how it helps:

1. Overcoming Cash Flow Challenges

Post-festival inventory often locks up a significant portion of working capital, leaving businesses unable to reinvest or operate smoothly. A credit line solves this problem by providing immediate liquidity.

With access to credit, MSMEs can:

- Repackage or repurpose existing inventory to cater to wedding demands.

- Invest in high-demand items such as ethnic wear or customised gifting solutions.

- Cover operational costs like logistics and temporary staffing.

2. Funding Marketing and Sales Strategies

Visibility and standing out is critical in the wedding market. MSMEs must reach their target audience effectively, and that requires investment in targeted marketing efforts. A credit line enables businesses to:

- Launch digital campaigns on platforms like Instagram and Facebook.

- Offer attractive discounts or bundles to draw bulk buyers.

- Collaborate with wedding planners or vendors to showcase their offerings.

3. Seizing Time-Sensitive Opportunities

The wedding season comes with a short, intense sales window. MSMEs must act quickly to adapt their operations, secure bulk orders, and meet tight deadlines. A credit line helps businesses:

- Scale up operations by hiring seasonal staff or upgrading equipment.

- Purchase raw materials in bulk to fulfil large orders.

- Maintain service excellence, ensuring long-term relationships with wedding vendors and clients.

4. Financial Cushion During Seasonal Peaks

Declining credit growth leaves MSMEs with little to no financial buffer. This impacts their ability to negotiate bulk deals with suppliers, handle sudden surges in demand, or manage operational costs during busy seasons like weddings. Without financial flexibility, MSMEs may turn down large orders or compromise on service quality, damaging their reputation and long-term growth prospects.

Here’s how a line of credit can help:

- Enable bulk purchases and negotiate better deals with suppliers

- Ensure MSMEs can meet sudden increases in demand without delays or shortages, maintaining customer satisfaction

- Support day-to-day expenses like salaries, utilities, and logistics during high-demand periods, ensuring seamless operations

- Offer financial flexibility to accept large orders and deliver quality service on time, safeguarding reputation and driving long-term growth.

As credit allows MSMEs to act decisively, deliver exceptional service, and build lasting relationships, small businesses further have enhanced opportunities with the Government of India launching the wedding tourism campaign and initiatives like ‘Wed in India.’ Finance solutions can empower them to ride the wave of an increased focus on MSMEs in the wedding industry.

Customized Finance Solutions

NBFCs can provide credit solutions designed to help businesses during high-demand seasons like weddings with flexible credit options to maintain cash flow, seamless access to funds for urgent needs like restocking or marketing, customized repayment plans aligning with seasonal sales cycles.

By bridging the financial gap, finance solutions by Protium can enable MSMEs struggling with post-festive inventory challenges to turn surplus stock into profit. By leveraging the wedding market, MSMEs can harness the power of credit, and make this season a profitable one.