Income Tax Slab FY 2025-26 – New & Old Tax Regime Rates in India

Complete guide to Income Tax Slabs for Financial Year 2025-26 with latest Budget 2025 changes, tax rate comparisons, and savings calculator. Choose the best tax regime for maximum savings.

New Income Tax Slab FY 2025-26 (AY 2026-27)

Budget 2025 introduced significant changes to income tax slabs under the new regime, making income up to ₹12 lakh completely tax-free with enhanced rebates and higher exemption limits.

| Income Slab | Tax Rate | Tax Amount | Effective from |

|---|---|---|---|

| Up to ₹4,00,000 | NIL | ₹0 | April 1, 2025 |

| ₹4,00,001 to ₹8,00,000 | 5% | ₹20,000 | April 1, 2025 |

| ₹8,00,001 to ₹12,00,000 | 10% | ₹40,000 | April 1, 2025 |

| ₹12,00,001 to ₹16,00,000 | 15% | ₹60,000 | April 1, 2025 |

| ₹16,00,001 to ₹20,00,000 | 20% | ₹80,000 | April 1, 2025 |

| ₹20,00,001 to ₹24,00,000 | 25% | ₹1,00,000 | April 1, 2025 |

| Above ₹24,00,000 | 30% | Variable | April 1, 2025 |

💡 Key Highlights of New Tax Regime FY 2025-26:

- Enhanced rebate under Section 87A increased from ₹25,000 to ₹60,000

- Income up to ₹12 lakh is completely tax-free due to increased rebate

- For salaried employees: Tax-free limit extends to ₹12.75 lakh (including ₹75,000 standard deduction)

- Basic exemption limit raised from ₹3 lakh to ₹4 lakh

Old Income Tax Slab FY 2025-26 – Age-wise Rates

Individuals Below 60 Years

| Income Slab | Tax Rate | Tax Calculation |

|---|---|---|

| Up to ₹2,50,000 | NIL | ₹0 |

| ₹2,50,001 to ₹5,00,000 | 5% | 5% of amount exceeding ₹2,50,000 |

| ₹5,00,001 to ₹10,00,000 | 20% | ₹12,500 + 20% of amount exceeding ₹5,00,000 |

| Above ₹10,00,000 | 30% | ₹1,12,500 + 30% of amount exceeding ₹10,00,000 |

Senior Citizens (60-80 Years)

| Income Slab | Tax Rate | Tax Calculation |

|---|---|---|

| Up to ₹3,00,000 | NIL | ₹0 |

| ₹3,00,001 to ₹5,00,000 | 5% | 5% of amount exceeding ₹3,00,000 |

| ₹5,00,001 to ₹10,00,000 | 20% | ₹10,000 + 20% of amount exceeding ₹5,00,000 |

| Above ₹10,00,000 | 30% | ₹1,10,000 + 30% of amount exceeding ₹10,00,000 |

Super Senior Citizens (Above 80 Years)

| Income Slab | Tax Rate | Tax Calculation |

|---|---|---|

| Up to ₹5,00,000 | NIL | ₹0 |

| ₹5,00,001 to ₹10,00,000 | 20% | 20% of amount exceeding ₹5,00,000 |

| Above ₹10,00,000 | 30% | ₹1,00,000 + 30% of amount exceeding ₹10,00,000 |

Tax Savings Calculator – New vs Old Regime

Example 1: Annual Income ₹8 Lakh

- Old Regime Tax₹30,000

- New Regime Tax₹0 (Due to rebate)

- Tax Savings with New Regime₹30,000

Example 2: Annual Income ₹15 Lakh

- Old Regime Tax₹1,40,000

- New Regime Tax₹1,05,000

- Tax Savings with New Regime₹35,000

Example 3: Annual Income ₹25 Lakh

- Old Regime Tax₹4,40,000

- New Regime Tax₹3,30,000

- Tax Savings with New Regime₹1,10,000

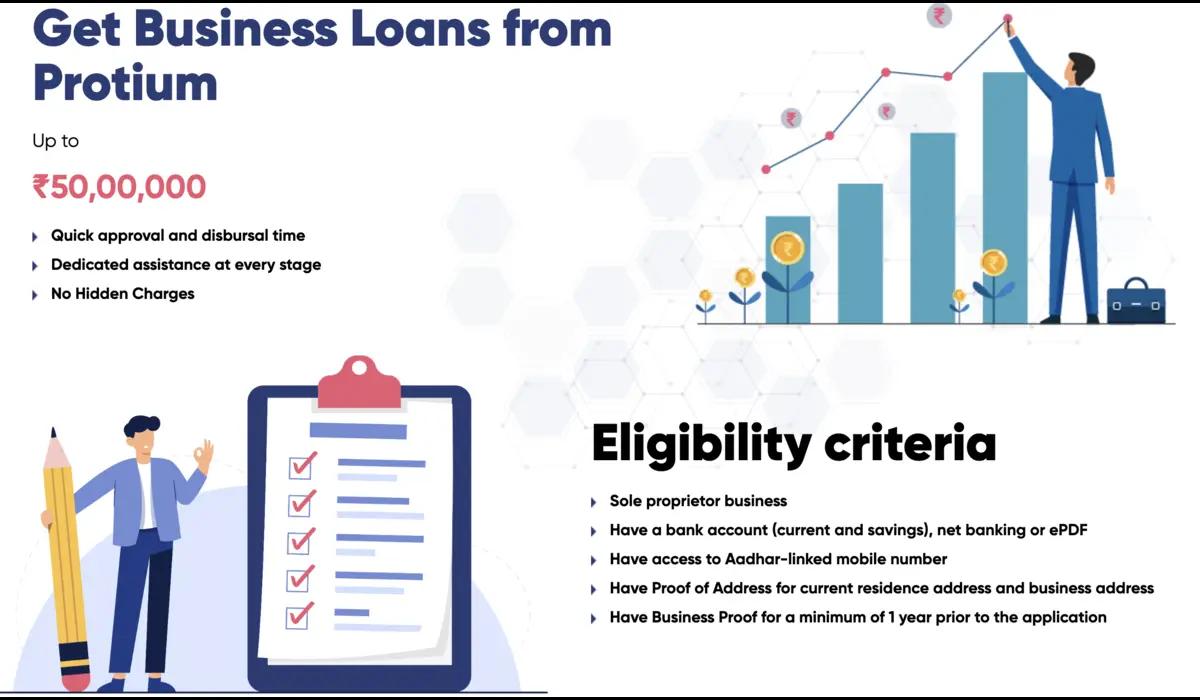

Need Business Loan? Get a Call Back

Optimize your tax planning while securing business funding with competitive rates and expert guidance

Complete Income Tax Slab Guide – Choose the best tax regime for maximum savings

New vs Old Tax Regime – Detailed Comparison

Benefits & Features

- ✅ ₹12 lakh tax-free income

- ✅ No complex deduction calculations

- ✅ Enhanced ₹75,000 standard deduction

- ✅ Default regime (automatically selected)

- ✅ Lower tax rates for most income brackets

- ❌ Limited investment deductions

Benefits & Features

- ✅ Multiple investment deductions (80C, 80D)

- ✅ HRA, LTA exemptions

- ✅ Home loan interest deduction

- ✅ Senior citizen benefits

- ❌ Complex calculation process

- ❌ Higher effective tax rates

📊 Which Regime Should You Choose?

Choose New Regime if: Your income is up to ₹15 lakh and you don’t have significant deductions.

Choose Old Regime if: You have substantial investments in 80C, claim HRA, or have home loan interest deductions exceeding ₹2 lakh annually.

Budget 2025 Key Changes in Income Tax

Enhanced Rebate

Section 87A rebate increased from ₹25,000 to ₹60,000, making income up to ₹12 lakh completely tax-free under new regime.

Higher Basic Exemption

Basic exemption limit raised from ₹3 lakh to ₹4 lakh from April 1, 2025, benefiting all taxpayers.

Standard Deduction Increase

Standard deduction for salaried individuals increased to ₹75,000, extending tax-free limit to ₹12.75 lakh.

Senior Citizens Relief

Tax deduction limit for senior citizens doubled from ₹50,000 to ₹1 lakh, providing additional relief.

Frequently Asked Questions – Income Tax Slab

The new income tax slabs for FY 2025-26 under the new regime are: 0% up to ₹4 lakh, 5% from ₹4-8 lakh, 10% from ₹8-12 lakh, 15% from ₹12-16 lakh, 20% from ₹16-20 lakh, 25% from ₹20-24 lakh, and 30% above ₹24 lakh. With enhanced rebate, income up to ₹12 lakh is completely tax-free.

Under the new tax regime for FY 2025-26, income up to ₹12 lakh is completely tax-free due to the enhanced Section 87A rebate of ₹60,000. For salaried employees with ₹75,000 standard deduction, the tax-free limit extends to ₹12.75 lakh annually.

Choose the new regime if your income is up to ₹15 lakh and you don’t have significant deductions. Choose the old regime if you have substantial 80C investments, claim HRA, or have home loan interest. Calculate tax under both regimes to determine which offers lower liability for your specific situation.

Senior citizens (60-80 years) have a higher basic exemption of ₹3 lakh under the old regime. Super senior citizens (80+ years) get ₹5 lakh exemption. Under the new regime, age-based exemptions don’t apply, but the enhanced rebate makes income up to ₹12 lakh tax-free for all ages.

Yes, individuals without business income can switch between old and new tax regimes annually while filing ITR. However, if you have business or professional income, you can switch only once from the new regime (default) to the old regime, and this decision cannot be reversed.

Marginal relief ensures that if your income slightly exceeds ₹12 lakh under the new regime, your additional tax doesn’t exceed the excess income over ₹12 lakh. For example, if your income is ₹12.1 lakh, you’ll pay only ₹10,000 tax instead of the slab-calculated amount, preventing sudden tax jumps.

Financial Products & Loan Services

Business Loans

Get instant business funding up to ₹50 lakhs with competitive rates

Apply for Business Loan →Education Finance

Institutional education financing solutions for higher studies

Explore Education Loans →

Disclaimer:

This income tax information is for educational purposes only and based on Budget 2025 proposals and current tax laws. Tax rates and slabs may change as per government notifications. For personalized tax advice and planning, consult qualified tax professionals or visit the official Income Tax portal.

*Terms and conditions apply for all financial products and services offered by Protium Finance Ltd.