- India’s Economic Survey 2024-25 indicates that the nation is becoming a global economic powerhouse

- With a GDP growth of 6.4% for FY25, MSMEs have a stable macroeconomic environment in which they can plan and scale their operations.

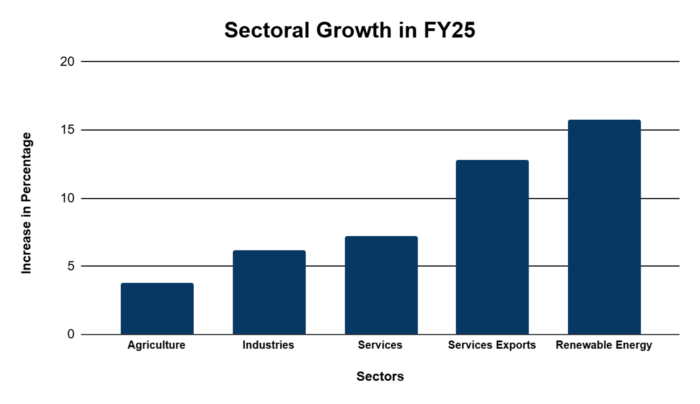

- Strong growth across agriculture (3.8%), industry (6.2%), and services (7.2%) opens up opportunities for MSMEs in IT, tourism, food processing, logistics, and manufacturing

- Initiatives like Ease of Doing Business 2.0 are simplifying compliance, improving cash flow, and reducing operational hurdles.

Presenting India’s Economic Survey 2024-25, the Ministry of Finance has highlighted robust GDP, controlled inflation, and sectoral growth, indicating that India is fast becoming an economic powerhouse worldwide despite global uncertainties. The upward trajectory can be attributed to the various economic indicators and is backed by structural reforms, which sets the tone for a year of strategic transformation for the economy.

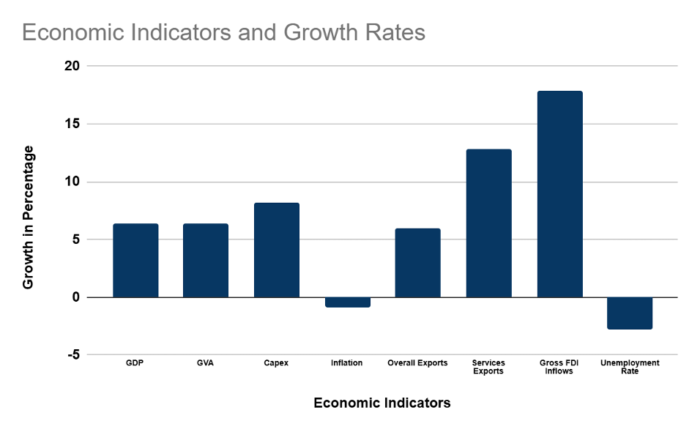

Here’s a glimpse of the growth across various economic indicators:

Source: Ministry of Finance

The growth rates seen in various economic indicators prove that India’s economy is on a stable growth path. The estimated GDP increase is 6.4% in the current financial year (FY25), and the projected growth is between 6.3% and 6.8% for the next year (FY26).

Reasons Behind the Growth & How it will Benefit MSMEs

This consistent increment, similar to our average over the past decade, provides a solid foundation for businesses, including small enterprises, to expand. Below is what the growth is underpinned by and how it will benefit MSMEs:

- Strong Private Consumption: Increased consumer spending has driven demand across sectors, creating opportunities for businesses to expand. It’s driven by rising disposable incomes, urbanization, and improved consumer sentiment. Sectors like retail, transport, travel, and food services are witnessing steady expansion.

As consumption rises across urban, semi-urban and rural India, MSMEs—especially in FMCG, retail, personal care, and food services—are poised to benefit from higher customer demand and increased footfall, both online and offline.

- Increasing Semi-Urban Demand: Driven by rising disposable incomes and evolving consumer preferences, smaller cities have emerged as key growth markets for sectors such as textiles, food processing, and e-commerce.

For MSMEs, this presents a valuable opportunity to tap into new, underserved markets with high growth potential. By catering to regional tastes and leveraging local distribution networks, small businesses can scale faster and build stronger brand loyalty in these emerging consumption hubs

- Rising Investments: The survey highlights a positive trend in investments and increased confidence among consumers. Notably, investments in infrastructure have picked up, showing an 8.2% increase year-on-year after the general elections (July-November 2024).

This focus on building infrastructure can open up new avenues for MSMEs in related industries like construction and manufacturing and create demand for materials, logistics support, electricals, fittings, engineering goods, and allied services—all strongholds for MSMEs. Subcontracting opportunities, ancillary supply, and public procurement avenues will grow substantially.

- Stable Inflation: While the survey notes that food prices remain a concern, overall inflation has softened to 4.9% in the current fiscal year (April-December 2024). This stability is generally good for businesses as it helps in better planning and cost management.

- Government Focus on Simplifying Regulations: The Economic Survey emphasizes the need for the government to continue simplifying rules and regulations under the Ease of Doing Business 2.0 initiative.

The push for deregulation entails lower regulatory burdens, quicker clearances, and better credit terms, which make it easier and more cost-effective for MSMEs to operate and grow. Together, these factors improve cash flow, planning, and long-term sustainability.

- Sturdy Foreign Direct Investment (FDI): FDI inflows increased from $47.2 billion in the first eight months of FY24 to $55.6 billion in the same period of FY25. The 17.9% growth has strengthened the industrial sector by leading to non-debt financing and capital formation, advanced technology, and job creation. With their expansion, industries also create increased demand for goods and services to support their growth and innovation.

As the industrial landscape transforms, MSMEs have the opportunities to serve international companies as suppliers, setting up local operations, and participate in global value chains through exports, technology transfer, and joint ventures.

Besides the above factors, sectoral growth has also contributed to the economic momentum and will shape the way MSMEs perform.

A look at how the different sectors performed and how MSMEs can scale with Protium’s financial solutions:

- Agriculture: Despite climate concerns, agriculture has shown resilience, supported by irrigation projects, digital agri-tech initiatives, and stable foodgrain production. The sector is expected to grow at a healthy rate of 3.8%. This positive growth is largely due to record production of Kharif crops and strong demand from rural areas.

MSMEs involved in supplying agricultural inputs and food processing are likely to benefit from this growth. There’s also a growing market for agri-tech solutions, cold storage, and logistics. Protium’s Machinery & Equipment Finance and Loan Against Property can support this momentum and help small businesses upgrade and scale their operations efficiently. MSMEs operating in or adjacent to the agricultural value chain can also innovate and collaborate with cooperatives to scale.

- Industrial Sector: The industry and manufacturing sector is also projected to grow significantly, with an estimated rate of 6.2%. While the survey points out a slight slowdown in manufacturing due to global factors, the overall industrial expansion still presents opportunities for MSMEs in various manufacturing and supporting industries.

The uptick opens doors for component suppliers, contract manufacturers, packaging providers, and raw material vendors. MSMEs can tap into large-scale production chains with Protium’s Machinery & Equipment Finance to emerge as trusted supply chain partners or develop niche products with export potential. - Services Sector: The services sector continues to be a major contributor to India’s economic growth, registering the highest estimated growth rate of 7.2%. Notably, exports of services have seen a strong increase of 12.8% during April to November in FY25.

This robust performance in services, including areas like IT, finance, and tourism, offers substantial opportunities for MSMEs operating in these sectors or providing related services. Small businesses in this field will see increased business as both consumers and enterprises scale their spending. Service-based MSMEs can also tap into B2B contracts in India’s expanding urban hubs. To scale and fulfil orders, MSMEs can turn to Protium’s business loan by leveraging property.

It’s not just the above facets; the Economic Survey also highlights several initiatives aimed at supporting MSMEs, including the simplification of processes through digital platforms like the Udyam Registration portal for easier business registration and access to government benefits, and the Trade Receivables Discounting System (TReDS) for improved cash flow through invoice discounting.

The government’s Micro and Small Enterprises-Cluster Development Programme (MSE-CDP) focuses on creating industrial clusters nationwide, often with Common Facility Centres (CFCs) that offer enhanced technology, skill development, and quality improvement measures. Additionally, the MSME Samadhan portal provides a mechanism for MSMEs to address delayed payment issues with buyers.

By capitalizing on these opportunities, MSMEs can drive innovation, create jobs, and contribute significantly to India’s economic progress.