India’s Festive Economy 2025: GST 2.0 Fuels Demand Surge Across High-Growth Sectors

Retailers are expecting double-digit growth during 2025 festive season, with overall sales already rising from 3–4% in Q1 to 7% in Q2, showing higher customer spending across categories.

GST 2.0 and tax reduction across 375 items have brought down prices for big-ticket products, including automobiles, consumer durables, building materials, and fashion & jewelry.

The new 5% and 18% GST structure has made compliance easier for small businesses and improved cash flow through faster input-tax refunds.

Retail and manufacturing sectors are witnessing renewed momentum during India’s festive season in 2025. This is primarily due to the early impact of GST 2.0 reforms, which reduced rates across 375 items. There’s been a steady growth in sales, with many retailers expecting double-digit expansion by the end of the quarter. The first quarter recorded around 3–4% growth, while the second quarter rose to about 7%, showing an uptick in customer spending1. While the updated GST structure has made prices lower for everyday products, it’s the big-ticket goods that are also seeing a spike in their sales, especially in automobiles and consumer durables segments.

Let’s take a look at what it means for small businesses and how they can benefit from the busiest shopping period of the year.

Simpler Taxes, Stronger Demand Under GST 2.0

Most goods and services now fall under two slabs — 5 and 18 % in the new GST regime, while only luxury or sin goods attract higher rates. This simplification has removed the earlier confusion around multiple tax brackets and made compliance easier for small traders.

When taxes fall by just a few percentage points, customers often notice the difference at checkout. Lower rates on common services and daily goods have increased purchasing power, while easier filing and faster refunds have improved business cash flow. As a result, demand for products such as appliances, electronics, and personal-care items has grown by nearly 10 % this season, with total household spending estimated between ₹35,000 and ₹40,000 crore2.

The increased sales is positively affecting the following high-growth sectors:

- Automobiles

The automobile industry is among the biggest winners from GST 2.0. The rate on vehicles has been brought down from 28% to 18%, and the 1–3% compensation cess on smaller models has been removed. This has cut vehicle prices by ₹40,000 to ₹1.5 lakh, making new cars and two-wheelers far more attractive to buyers.

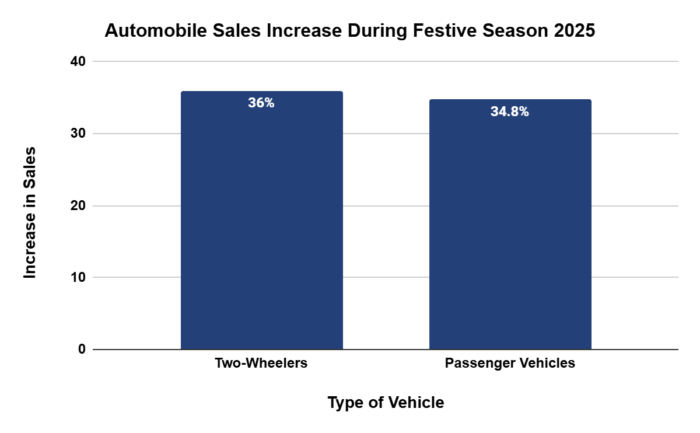

Auto sales are expected to touch ₹1.5–2 lakh crore this festive quarter. Dealers have restocked heavily, and early figures show a 34% year-on-year rise in festive-season sales. Two-wheeler volumes rose 36 %, and passenger vehicles 34.8 % during the festive season3.

For MSMEs, this surge creates opportunities in auto-component and spare-part production, battery, tire, and lubricant distribution, vehicle servicing and detailing, local logistics and transport, accessories and car-care retail. Each of these segments benefits directly as new buyers enter the market and existing owners invest in maintenance and upgrades.

- Home Appliances and Electronics

The home-appliance and electronics sector is also seeing one of its best festive seasons in recent years. Families are upgrading air-conditioners, washing machines, refrigerators, televisions, and kitchen appliances. A 10 % rise in spending has pushed overall sales to an estimated ₹35,000–40,000 crore4.

For MSMEs, opportunities are growing across the value chain, including local appliance retailers and repair centers, spare-part and component suppliers, packaging, warehousing, and transport partners.

- Building Materials and Home Décor

The festive period is also driving home-improvement and construction activity. Paints, tiles, lighting, furniture, and sanitaryware are all seeing higher demand as people renovate homes ahead of Diwali. In Mumbai alone, 10,630 properties were registered during Navratri and Ganesh Chaturthi 2025 — a 23% increase over the same time last year. The festive period also boosted state revenue by 17%, reaching ₹587 crore5.

Simpler GST compliance and faster input-tax credits now allow these businesses to offer competitive prices while keeping working capital free. For MSMEs, this translates into business for interior contractors, paint suppliers, lighting, electrical, and hardware dealers, décor artisans, furniture makers, and modular-kitchen units.

- Fashion, Retail, and Lifestyle

The fashion and lifestyle market is thriving this year. Spending on apparel, footwear, and jewelry is expected to cross ₹2.8–3 lakh crore, as buyers move from need-based to lifestyle-based purchases.

Even though garments now attract 18% GST, the simpler system has reduced compliance costs and improved price clarity. Demand for ethnic wear, designer accessories, and handcrafted jewelry has grown sharply during the festive and wedding season.

For MSMEs, the biggest opportunities lie in apparel manufacturing and tailoring units, boutique labels and small accessory brands, local footwear and jewelry makers expanding online. E-commerce and digital payments are helping these businesses reach new customers quickly and securely.

How MSMEs Can Make the Most of the Uptick this Season

- Plan Inventory Early – Keep enough stock to handle higher demand, using short-term loans if needed.

- Go Digital – Use GST-compliant billing, e-invoicing, and online-payment systems.

- Partner Wisely – Work with e-commerce sites, suppliers, and logistics companies for wider reach.

- Market Actively – Offer festive discounts and advertise online or through local channels.

- Claim Credits Promptly – File returns on time to get input-tax refunds quickly and keep cash flowing.

The ongoing festive rush is also supported by easy financing and digital tools. Many buyers are choosing EMI and cashback offers, while small businesses are accessing short-term credit to manage higher inventory and staff needs. GST 2.0’s digital records give lenders clear visibility into a business’s financial health. This allows for faster loan approvals and easier access to credit without heavy collateral.

Non-banking lenders and fintech firms are offering MSMEs flexible top-up and working-capital loans to help them stock up for the season. Digital invoicing and UPI payments have also reduced paperwork and improved cash collection cycles — vital for small traders operating on tight timelines.