Micro, Small or Medium — How Can a Business Identify Itself?

A Guide to MSME Categories, Criteria, and Benefits

- Correct MSME classification is essential for tailored financial and policy support.

- Businesses are categorized based on both investment and annual turnover thresholds.

- Micro enterprises make up over 99% of India’s MSME base, especially in smaller cities.

- Each category—micro, small, or medium—offers distinct government-backed benefits.

- Accurate registration on the Udyam portal is the first step toward accessing these advantages.

As the business ecosystem rapidly evolves, the Union Budget 2025 has laid greater emphasis on the classification of businesses as micro, small, or medium. It isn’t just a technical formality but a strategic decision. Classifying a business under the MSME framework offers broad benefits, such as access to finance, lower interest rates, subsidies, tax exemptions, and international trade support. However, further bifurcating them into micro, small, or medium brings additional, category-specific advantages. Each classification offers a tailored set of government schemes, compliance norms, and institutional support designed to match the unique operational scale and needs of that enterprise.

This blog post will provide MSMEs the clarity, which will translate into an enhanced growth journey. Here’s a breakdown of the nuances.

What Is an MSME?

The term MSME stands for Micro, Small, and Medium Enterprises. These are defined under the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, which was enacted to promote and facilitate the growth of small businesses across India. Over time, the definitions have evolved to better match economic realities.

MSME classification is now based on a composite of investment in plant and machinery or equipment and annual turnover. This two-fold approach ensures that classification reflects both the scale of operations and the financial footprint of a business. It also means that two businesses in the same sector with different turnover and investment levels may fall into different MSME categories.

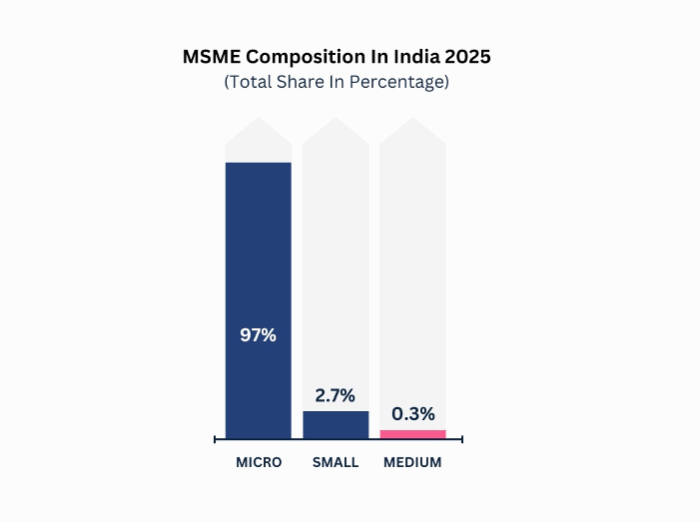

MSME Composition in India

To understand the importance of proper classification, one must look at the composition of India’s MSME sector. As per data from the Udyam Registration portal and corroborated by the Ministry of MSME:

Source: NITI Aayog

These figures highlight the sheer dominance of micro businesses in India’s entrepreneurial ecosystem, especially in Tier-2 and Tier-3 cities. The business needs, financial risk appetite, and market behavior of micro enterprises are vastly different from those of a medium enterprise operating out of a different region. This makes classification not only relevant but essential for tailored support.

Micro, Small or Medium — How Can a Business Identify Its Category?

With the definition now based on both investment and turnover, it’s important for a business to fulfill both criteria to qualify for a particular MSME category. Here are the thresholds defined by the Government of India, which were revised from 2020 in the Union Budget 2025–26:

| Enterprise Type | Investment (₹ in Crores) | Turnover ₹ in Crores |

| Micro Enterprises | 2.5 | 10 |

| Small Enterprises | 25 | 100 |

| Medium Enterprises | 125 | 500 |

The most reliable way to determine one’s category is through the Udyam Registration portal. The process is digital and self-declared, requiring only basic documentation on investment and turnover. Upon registration, the enterprise receives a Udyam certificate that explicitly states the MSME classification, which can then be used for scheme eligibility, loan applications, and tender participation.

Correct identification on Udyam is the gateway to unlocking MSME-specific incentives, which differ greatly across the three categories.

Decoding Requirements for Micro Enterprises

Micro enterprises are often the first step in formal entrepreneurship, particularly in non-metro cities and rural belts. Typically family-owned or partnership-run, they operate with minimal fixed capital and serve local or niche markets.

The eligibility criteria for a micro enterprise are: investment in plant and machinery or equipment must not exceed ₹2.5 crore, and annual turnover must stay within ₹10 crore.

Many micro enterprises are found in retail, repair services, tailoring, local manufacturing, food processing, and small-scale trading. These businesses generally have fewer than 20 employees. Due to their lean structure, they are agile but often lack formal access to finance, technology, and skilled labor—challenges that government policies aim to address.

Benefits Available for Micro Enterprises

Micro enterprises, because of their size and limitations, are often prioritized in several government schemes. One of the most significant enablers is the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE). Additionally, micro units can avail benefits under the Zero Defect Zero Effect (ZED) Certification, which not only helps improve product quality but also opens doors to green and sustainable manufacturing.

For those seeking to scale operations, Skill India and digital literacy programs provide a ready pipeline of training opportunities to upskill. Registration on the GeM (Government e-Marketplace) portal enables micro businesses to participate in government tenders, enhancing their revenue base.

State-level incentives further ease the burden for micro units, often offering lower compliance requirements, reduced utility tariffs, and subsidies for infrastructure. However, all these benefits hinge on one thing: a business must first identify and register as a micro enterprise to access them.

Micro enterprises also have the financial advantage of accessing elevated loan limits, equity financing, and structured credit facilities, including those offered by SIDBI.

Decoding Requirements for Small Enterprises

As businesses grow beyond the micro level, they may scale into the small enterprise category. These are generally more structured, with clearer divisions of labor and moderate investment in plant and machinery. The eligibility criteria are investment up to ₹25 crore and annual turnover not exceeding ₹100 crore.

Small enterprises often span industries like specialized manufacturing, regional logistics, IT services, and mid-level wholesale operations. While they are more capital intensive than micro enterprises, they still face limitations in terms of market penetration and technology adoption.

Benefits Available for Small Enterprises

Small enterprises are often supported through schemes that emphasize technology upgradation and market expansion. The Credit Linked Capital Subsidy Scheme (CLCSS), for example, provides capital subsidies for upgrading production equipment.

SME clusters, which are encouraged by the Ministry of MSME, enable small enterprises to share infrastructure, reduce costs, and access collective marketing channels. Government-supported MSME parks offer plug-and-play infrastructure to streamline expansion.

Small enterprises also enjoy better access to institutional credit, more substantial loans, equity-based funding, structured credit, and longer repayment cycles, especially through NBFCs and SIDBI-linked partners.

These benefits are designed to help small businesses compete not only in domestic markets but also prepare for cross-border trade and e-commerce integration.

Decoding Requirements for Medium Enterprises

At the top of the MSME classification sits the medium enterprise—a business with investment up to ₹125 crore and annual turnover up to ₹500 crore. These are often organized as private limited companies or LLPs and may have branches, structured HR and finance functions, and multiple lines of business.

Medium enterprises are generally export-oriented or form part of a larger supply chain. Their operations may include manufacturing for the automotive, textile, chemicals, or electronics sectors. With greater scale comes a higher compliance burden, but also access to a wider range of financial instruments and global opportunities.

Benefits Available for Medium Enterprises

To support medium enterprises, the government has introduced several schemes aimed at export promotion and global competitiveness. The MSME Export Promotion Council facilitates international trade fairs, buyer-seller meets, and capacity-building for export compliance.

These businesses are also eligible for schemes promoting Industry 4.0 adoption, lean manufacturing, and productivity-linked incentives. Moreover, they are often integrated into global value chains, supplying parts or services to MNCs or large domestic corporations.

Financially, medium enterprises can access higher loan limits, equity-based financing, and structured credit from institutions like SIDBI. While the scope of benefits is vast, it remains critically dependent on correct classification and registration.

Government Policies to Support Each Category

Recognizing that no one-size-fits-all solution exists, the Indian government has launched category-specific support programs. For micro enterprises, schemes like MUDRA (Shishu, Kishor, Tarun) and Udyam Registration simplification aim to boost formalization and financial inclusion.

For small enterprises, the focus lies on capacity-building and infrastructure, such as technology parks, SME clusters, and access to working capital.

For medium enterprises, the government is nudging players toward internationalization, digitization, and ESG compliance. These distinctions underline the importance of classification—each rung of the MSME ladder offers a unique blend of support.

Recent Government Focus: NITI Aayog’s Roadmap for MSMEs

In its 2025 strategic roadmap, NITI Aayog outlined six key priorities for MSME transformation. These include:

- Developing differentiated policy measures for micro, small, and medium enterprises

- Expanding access to finance

- Driving digital transformation

- Supporting green, sustainable MSMEs

- Improving domestic and global market access

- Upgrading workforce skills and managerial capabilities

The roadmap emphasizes the critical need for data-driven, category-specific interventions. But for that to succeed, the first step must come from the MSME itself: identify, register, and declare the correct classification. Only then can India’s vast network of small businesses fully benefit from the ecosystem being built around them.