National Small Industries Day 2025: Building Future-Ready MSMEs

National Small Industries Day, observed on August 30, honors the role of small industries in employment, industrial growth, and grassroots development.

Small industries have deep roots in textiles, apparel, food processing, and agro-products, while also making strides in emerging areas like renewable energy, semiconductors, digital services, aerospace, and defense supplies.

Government support through initiatives like the Export Promotion Mission, Semiconductor Mission, National Manufacturing Mission, and ME-Card has been pivotal in enabling small industries to scale, modernize, and integrate into national and global value chains.

A variety of finance solutions, such as machinery loans, are helping small industries modernize, ensuring they not only remain competitive but also fulfill the nation’s self-reliance goals.

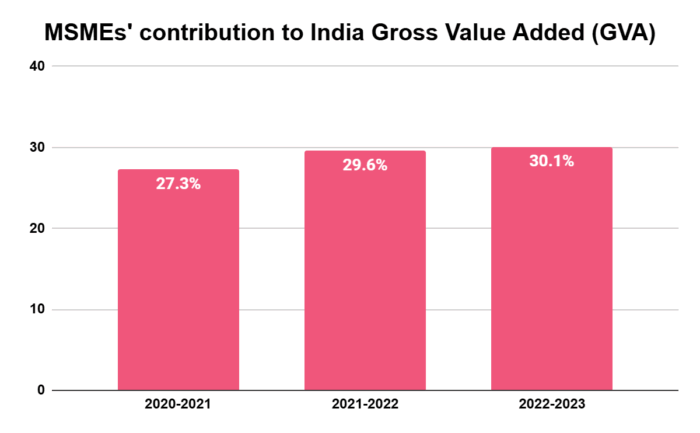

Every year, National Small Industries Day is observed on August 30 to recognize the immense contribution of small industries, also known as MSMEs. These enterprises are often referred to as the backbone and the “second engine” of India’s economy due to their wide reach, diverse sectoral presence, and role in driving industrial growth at the grassroots level. They play a vital role in generating employment, boosting production capacity, supporting exports, and promoting localized industrialization. In 2025, small industries provide livelihoods to more than 11 crore people, making them the second-largest employer after agriculture. With their strength, they contribute to the economy with over 30% of India’s gross domestic product (GDP), roughly 45% of exports, and nearly 62% of employment1. Furthermore, in recent years, the sector has demonstrated strong resilience, with its contribution to the country’s Gross Value Added (GVA) rising from 27.3% in 2020–21 to 29.6% in 2021–22 and further to 30.1% in 2022–23, underscoring its expanding role in India’s economic output.

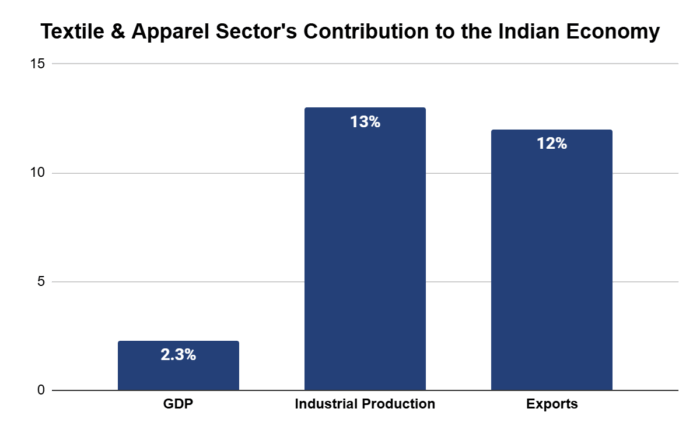

Small industries in India have always had strong roots in traditional sectors. Textiles, apparel, agro-processing, and food products remain the backbone of production in many regions. For instance, the textile and apparel sector accounts for 2.3% of India’s GDP, 13% of total industrial production, and 12% of the country’s exports. In 2023–24, textile exports were valued at USD 34.4 billion, with apparel forming the largest share at 42%, followed by raw and semi-finished materials at 34% and finished non-apparel goods at 30%. Beyond trade, the sector is also a major source of employment, directly providing jobs to more than 45 million people, making it the second-largest employer after agriculture2.

India’s food processing industry is also emerging as a cornerstone of the economy, contributing steadily to GDP, employment, and exports. Over the past seven years, the sector has experienced an annual average growth rate of 7.26%. In 2023, the industry was valued at approximately ₹28 lakh crore and is projected to nearly double to about ₹61 lakh crore by 2032, growing at a compound annual growth rate of 8.8%3.

In recent years, new opportunities have also emerged. Renewable energy has created demand for small manufacturers producing components for solar panels, wind turbines, and bio-energy systems. The semiconductor sector, supported by the India Semiconductor Mission, now offers opportunities for units specializing in precision tooling, clean-room systems, and testing services. Small, design-led enterprises are also beginning to participate in chip design innovations.

The rapid expansion of e-commerce and digital services has further allowed many small units to directly connect with buyers through platforms like ONDC (Open Network for Digital Commerce). Meanwhile, defense and aerospace programs, including Gaganyaan and the planned Bharatiya Antariksha Station Station, are opening doors for small suppliers of specialized assemblies, components, and precision parts.

This combination of traditional strengths and emerging opportunities positions small industries to not only sustain but also thrive in the new industrial landscape. A pivotal driving factor behind this resilience has been the consistent support of the government. The inaugural observance of National Small Industries Day in 2001 stemmed from a landmark decision taken the previous year, when a comprehensive policy package was introduced to strengthen the small-scale industry sector. That initiative marked the beginning of a tradition to recognize and reaffirm the contribution of small industries annually.

Another milestone came in 2007, when the Ministry of Small-Scale Industries and the Ministry of Agro and Rural Industries merged to form the Ministry of Micro, Small and Medium Enterprises (MSME). Since then, the MSME Ministry has used this observance to highlight the sector’s growing role in inclusive industrial growth and to align it with India’s broader economic transformation.

Government Support for Small Industries

Over the years, policy frameworks have created a more enabling environment for small industries. Access to working capital has improved, while reforms in classification and procurement policies have encouraged businesses to scale with confidence. Several initiatives stand out:

- Export Promotion Mission (EPM): With an outlay of ₹25,000 crore, this mission prepares small units for global trade by improving quality standards, infrastructure, and logistics.

- Revised small industry classification: This reform allows businesses to grow beyond earlier turnover limits without losing eligibility for benefits, encouraging long-term expansion.

- India Semiconductor Mission: Small industries are being integrated into the supply chain of fab projects through precision tools, clean-room facilities, and design-linked incentives.

- National Manufacturing Mission: Small industries working in clusters are contributing machining, tooling, and fabrication services to strengthen India’s goal of raising manufacturing’s share of GDP.

- Self-Reliant India and Vocal for Local initiatives: Procurement policies now reserve contracts for domestic suppliers, giving small industries a platform to replace imports with indigenous products.

- Aatmanirbhar Bharat in Space: Indian space projects actively involve small units as suppliers of components and precision equipment, expanding their presence in high-value industries.

- Micro Enterprise Card (ME-Card): Improves access to working capital by offering small businesses flexible credit to meet their day-to-day requirements.

Together, these measures show how the government has steadily built an ecosystem where small industries can innovate, modernize, and play a larger role in national missions.

However, despite these advancements, small industries continue to face several barriers that limit their competitiveness.

Challenges That Continue to Slow Growth

Access to capital remains the most significant challenge. Many small units struggle to secure formal financing for modernization because they lack collateral or sufficient credit history. While schemes exist, disbursement delays and eligibility restrictions reduce their impact.

Operational hurdles such as high freight costs, compliance burdens, and irregular power supply further strain daily functioning. The skill gap is another obstacle that slows down the adoption of modern machinery and advanced production techniques.

Together, these challenges highlight the importance of combining policy support with financial innovation to help small industries unlock their full potential.

Technology Adoption and Machinery Modernization to Improve Competitiveness

For small industries, modernization is no longer a choice but a necessity. Outdated machinery often reduces efficiency, raises costs, and makes it difficult to compete with both domestic peers and international players. Upgrading to energy-efficient, technology-driven equipment enhances product quality, reduces waste, and facilitates compliance with the latest safety and environmental standards introduced in 2024.

Yet, the biggest hurdle remains financing. Many small industries hesitate to invest in new machinery because it requires blocking substantial working capital. Instead of tying up their liquidity, enterprises today can opt for machinery loans from RBI-registered NBFCs such as Protium. These loans are designed with the realities of small industries in mind—where the machinery itself acts as collateral, easing the burden of arranging additional security.

Protium’s machinery loan is structured to ease the financial burden of modernization by covering up to 85% of the machinery cost, allowing small industries to upgrade without heavy upfront expenses. The loan amount ranges from ₹10 lakh to ₹3 crore, with flexible repayment tenures between 12 and 60 months to suit different business needs. Since the machinery itself serves as collateral, enterprises are not required to pledge additional assets. To further simplify access, loans of up to ₹50 lakh can be quickly disbursed with just 12 months of banking history and standard KYC documentation.

What makes this approach particularly relevant is the breadth of manufacturing subsectors that benefit from such machinery finance solutions.

- Textiles and apparel: Power looms, dyeing units, and garment machinery upgrades.

- Food processing and agro-based industries: Packaging, refrigeration, milling, and bottling equipment.

- Engineering and fabrication: CNC machines, tooling, welding, and heavy fabrication equipment.

- Electronics and electricals: Assembly lines, PCB manufacturing, and testing equipment.

- Pharma and chemicals: Mixers, dryers, packaging systems, and clean-room equipment.

- Renewable energy components: Equipment used in solar, wind, and bio-energy production chains.

The government’s large-scale support and customized financing solutions create an ecosystem that helps small industries meet both immediate and long-term needs. For instance, as the National Manufacturing Mission pushes India to increase its global manufacturing share, financing partnerships allow small suppliers in clusters to adopt advanced machinery without straining their balance sheets. Similarly, initiatives under the Export Promotion Mission gain greater impact when small units can modernize quickly and meet international standards.

With the right mix of policy support, financial innovation, and entrepreneurial drive, these enterprises can set the foundation for a sustainable and innovation-led future.