Protium’s LAP and MFL Can Help MSMEs In Strengthen Infrastructure in India’s Smaller Cities

- Over 51% of registered MSMEs in Tier 2 and Tier 3 cities form a major share of India’s enterprise base, yet their productivity remains low due to weak transportation networks, unorganized warehousing, unreliable power supply, and uneven digital connectivity.

- This slows their export readiness, weakens supply-chain integration, and reduces product quality consistency.

- long-term competitiveness requires sustained investment in modern infrastructure, stronger utilities, and facility-level upgrades that support higher productivity.

- Infrastructure-focused financing becomes critical at this stage, as MSMEs need structured capital support to modernise operations and expand capacity.

- Protium’s Loan Against Property strengthens productivity by financing modern machinery, internal facility upgrades, and specialized production environments that support automation and higher-quality output. Machinery and Equipment Loan strengthens productivity by financing modern machinery, internal facility upgrades, and specialized production environments that support automation and higher-quality output.

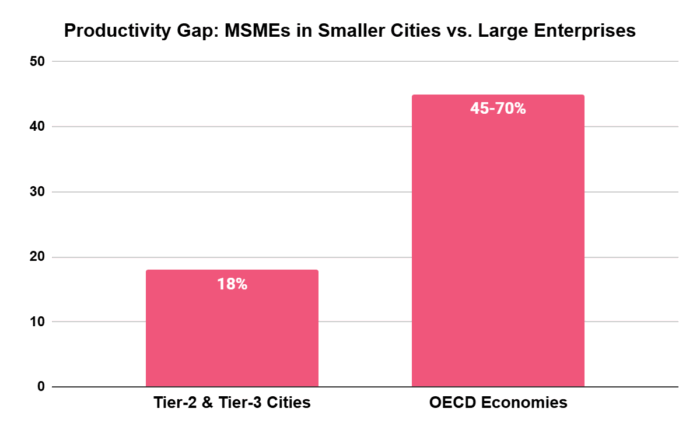

Tier-2 and Tier-3 cities account for more than 51% of India’s registered MSMEs1. However, the growth potential of these enterprises remains constrained. MSMEs in smaller cities operate at only around 18% of the productivity of large enterprises, far below the 45–70% range seen in the OECD (Organization for Economic Co-operation and Development) economies2. This productivity gap is shaped by three major challenges: credit deficit of ₹30 lakh crore, only 18% adoption of digital lending platforms, which limits MSMEs’ ability to access faster, data-driven financing,3 and infrastructure gap, without which MSMEs in Tier 2 and Tier 3 regions remain unable to build the scale required for sustained competitiveness.

While smaller cities are evolving into economic hubs, here’s where the country lags behind when it comes to infrastructure:

- Transportation Bottlenecks: Transportation remains a major challenge in smaller cities. Even with progress through the Eastern and Western Dedicated Freight Corridors, new expressways, and multimodal logistics parks strengthening national routes, many MSME clusters continue to face delays and higher transport costs due to poor local roads and weak last-mile connectivity.

- Unorganized Warehousing and Inefficient Cold Chains: Warehousing and cold-storage infrastructure also show significant gaps. A large share of warehouses remains unorganized, operating without standardized safety norms, compliance systems, or digital management tools. Limited adoption of automation, IoT, and AI—driven by high investments, fragmented demand, and low skill availability—continues to cause cold-chain losses, slow inventory turnover, and uneven handling across MSME-linked supply chains.

- Power Reliability Issues Disrupt Production Cycles: Power supply remains inconsistent in many Tier 2 and Tier 3 districts, with outages more frequent in MSME-intensive regions than in metropolitan areas, interrupting production cycles and making technology adoption or automation difficult to sustain.

- Uneven Digital Connectivity: Digital infrastructure varies widely across smaller cities. High-speed, reliable connectivity does not reach several non-metro industrial clusters, limiting the use of digital invoicing, ERP platforms, remote monitoring systems, and other efficiency-enhancing tools.

How Infrastructure Constraints Limit Scalability and Global Integration

Infrastructure gaps in smaller cities shape the way in which MSMEs participate in both domestic and global markets. These limitations influence everything from delivery timelines to product quality, and they create persistent barriers that prevent enterprises from meeting the expectations of larger buyers.

- Export Readiness

Export-linked MSMEs depend on predictable movement of goods. When shipments are delayed because of weak local logistics, long turnaround times, or inconsistent connectivity to ports and dry docks, their competitiveness falls. Many district-based enterprises lose out on long-term export relationships simply because their environment cannot support the precision global markets require.

- Supply Chain Integration

Successful participation in modern supply chains depends on speed and reliability. MSMEs in Tier 2 and Tier 3 cities often struggle to integrate into structured supplier networks when transportation delays, loading inefficiencies, or fragmented logistics make it difficult to meet production and delivery commitments. These gaps strain relationships with large manufacturers and distributors, weakening the ability of smaller enterprises to form steady, long-term partnerships.

- Quality Control Challenges

Production quality is also influenced by the physical conditions in which goods are made and stored. Ageing buildings, limited storage space, and inadequate safety systems lead to inconsistencies that affect customer trust. International buyers, in particular, expect uniformity across batches. When facilities cannot maintain controlled environments, MSMEs find it harder to meet the standards required for export contracts or high-value supply chains.

- Technology Adoption Barriers

Digital tools and automation lead to higher productivity, but they require stable power and reliable connectivity—both of which are uneven across smaller cities. MSMEs operating in such environments face disruptions when electrical loads dip, networks fail, or machinery cannot run at full capacity. These limitations slow the adoption of ERP systems, automated lines, and digital quality control tools, reinforcing the productivity gap between smaller enterprises and larger firms.

As MSMEs aim to modernize, the need for long-term, flexible financing becomes more urgent. This is where Loan Against Property (LAP) from RBI-regulated NBFCs like Protium emerges as a practical and accessible option.

The Role of Loan Against Property (LAP) in Infrastructure Upgrades

Infrastructure improvements require significant, long-term investment, and many MSMEs lack access to financing to support such upgrades. LAP offers a practical solution by unlocking the financial value of owned assets and redirecting it toward facility modernization. Here’s how it helps:

- Supporting High-Value Projects: LAP enables enterprises to undertake substantial improvements such as expanding factory floors, constructing additional units, strengthening structures, or upgrading electrical systems to support heavy machinery. The higher ticket sizes provide room for comprehensive repairs or new construction, enabling MSMEs to build facilities that can meet the expectations of larger buyers and regulators.

- Flexible End Use for Modernization: The flexibility of LAP allows MSMEs to address a wide spectrum of infrastructure needs. Funds can be directed toward reorganising production layouts, setting up dedicated loading bays, improving ventilation systems, or creating separate storage zones for sensitive goods. These improvements support smoother operations and stronger compliance during vendor audits.

- Faster Access to Capital: Because LAP is secured against property, approval processes tend to be faster and more predictable. For MSMEs, this makes it easier to plan long-term upgrades without compromising day-to-day working capital. By investing in better facilities, enterprises strengthen their ability to meet customer expectations and handle larger order volumes.

Infrastructure upgrades form only one part of the transformation MSMEs in smaller cities require. Once the physical foundation is strengthened, the next step is modernizing the processes and equipment that operate within that facility. Buildings and utilities determine how efficiently a workspace can function, but machinery and internal systems decide the pace, quality, and consistency of production.

This is where MSMEs need to invest in modern equipment and facility-level improvements that go beyond structural expansion. Machinery and Equipment Loans address this requirement by supporting upgrades that directly influence productivity and operational strength.

Importance of Machinery and Equipment Loans (MFL) In Strengthening Productivity

Modern machinery and upgraded facilities are essential for MSMEs aiming to improve accuracy, reduce manual work, and shorten production cycles. MFL provide a structured way to support these transitions by:

- Enabling Modern Machinery Purchases: MFL helps MSMEs acquire machines that offer faster operations, greater precision, and higher consistency. These upgrades lift overall productivity and enable enterprises to handle more complex orders. For units moving from manual processes to semi-automated or fully automated systems, MFL often becomes the catalyst for transformation.

- Ancillary Equipment: MFL supports the purchase of essential ancillary equipment that complements core machinery, such as material-handling units, calibration tools, conveyors, and safety systems. These additions streamline workflow, reduce downtime, and strengthen overall production efficiency, enabling MSMEs to operate with greater consistency and meet higher performance standards.

- Building Specialized Capabilities: Some sectors require controlled or specialized facilities—such as clean rooms, temperature-regulated storage, or precision assembly zones. MFL allows MSMEs to build or upgrade such spaces, opening access to higher-value segments and more demanding supply chains. These improvements also make digital adoption and automation more effective, as the underlying facility can now support advanced tools.

Automation requires stronger internal infrastructure. It’s crucial for MSMEs to improve electrical systems, ventilation, safety mechanisms, and workstations to support advanced machines. These upgrades reduce downtime, create safer working conditions, and support a more organized production environment. Small businesses can achieve these through finance solutions such as Protium’s LAP.

Infrastructure Financing Is Now a Critical Growth Enabler

MSMEs in smaller cities have traditionally relied on incremental improvements. However, rising customer expectations and stricter quality standards now require stronger facilities, modern machinery, and better utilities. Infrastructure financing helps enterprises move beyond quick fixes and invest in lasting solutions by:

- Strengthening Competitiveness

When MSMEs invest in modern infrastructure, they gain the ability to deliver consistent quality, reduce wastage, and meet compliance requirements with greater ease. These improvements strengthen their credibility with buyers and prepare them for integration into national and global supply chains.

- Improving Operational Efficiency

Better facilities reduce interruptions, speed up order processing, and lower the burden of rework or defects. Over time, these efficiencies translate into higher margins and greater working-capital stability.

- Supporting Long-Term Growth

LAP and MFL together provide the financial foundation for MSMEs to build durable assets. These assets improve borrowing capacity, support future expansion, and increase the enterprise’s ability to take on more complex or time-sensitive orders.

Infrastructure upgrades also generate wider economic benefits by strengthening local industrial clusters and helping smaller cities evolve into credible export hubs. Modern facilities attract ancillary suppliers, improve logistics efficiency, and create new employment opportunities. As MSMEs become more reliable producers, they integrate more effectively into national and global value chains, supporting long-term regional growth through the following:

Strengthening Local Networks

When MSMEs modernise, they generate demand for supporting services such as logistics, maintenance, packaging, and processing. These linkages, in turn, strengthen local economies and encourage more enterprises to formalise operations.

Enabling Export-Oriented Growth

Improved facilities help smaller cities build credibility as export hubs. Faster production cycles, better storage, and higher compliance standards enable enterprises to serve global markets with greater consistency.

Building the Infrastructure Backbone for India’s Next Growth Wave

Infrastructure remains one of the most decisive factors shaping the growth of MSMEs in smaller cities. By investing in better facilities and modern machinery—supported through financing options such as LAP and MFL—enterprises can improve productivity, expand capacity, and participate more confidently in competitive markets. Strengthening the infrastructure foundations of Tier 2 and Tier 3 cities is essential for unlocking the next stage of MSME-led growth across India.

Disclaimer:

*Protium Finance Ltd (Protium) may use the services of various agents on its behalf for the purpose of sales and marketing for Protium’s products and services

*Terms and conditions apply, based on applicant eligibility and financial profile.