Strategies for MSMEs to Achieve Growth and Maintain Resilience in an Economy with 4.8% Inflation

As MSMEs deal with rising costs and shrinking margins in an inflationary economy, actionable strategies and financial tools can ensure their resilience and sustained growth.

The Reserve Bank of India (RBI) revised its inflation forecast in December 2024, projecting it to hover around 4.8%. This announcement hints at inflationary pressures expected to have widespread implications, particularly for MSMEs who could grapple with rising input costs, shrinking margins, and fluctuating demand.

How Inflation Impacts MSMEs

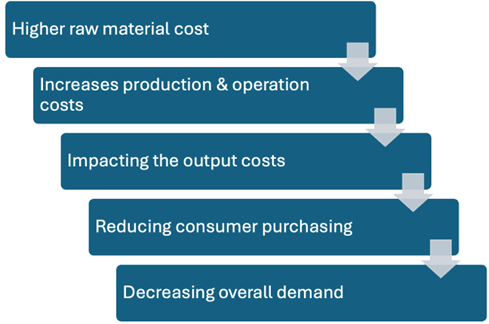

Inflation increases raw material and production expenses, driving operating costs up by 20%1. With intense market competition, small businesses struggle to transfer these costs to consumers, absorbing the burden and facing shrinking margins, as evident in 15% of MSMEs that reported reduced EBITDA margins2 owing to the above factors.

Besides, increased production and operation costs for MSMEs also hike the final output and commodity prices for the consumer, whose purchasing diminishes. The decreased consumer spending directly affects the overall demand, particularly in price-sensitive sectors like retail and services.

Along with higher costs and reduced demand, delayed payments and financial strain create a cash flow crunch. This trickle-down effect impacts all sectors except retail and services.

Overview Of Sectoral Impact of MSMEs:

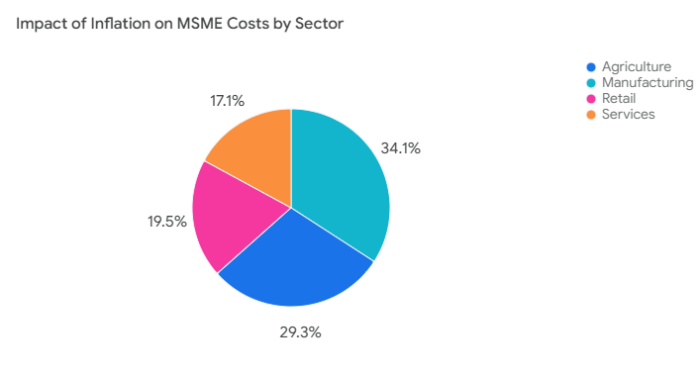

Inflation significantly impacts MSMEs across sectors, amplifying cost pressures and challenging profitability.

Source: World Trade Center Mumbai

- Manufacturing:

The manufacturing sector, which forms a significant part of MSMEs, is particularly affected by rising raw material costs. According to the WTC Mumbai report, material expenses increased by approximately 35% in FY21-22, with raw materials comprising over 50% of total costs. In 2024, India’s manufacturing activity slowed in November, recording a PMI score of 56.5, down from 57.5 in October, highlighting the strain on operational efficiency and expansion plans.

- Retail:

Retail MSMEs have grappled with an approximate 20% hike in procurement costs for consumer goods, creating inventory management challenges. Since most businesses in this sector cater to price-sensitive customers, passing on these costs to consumers has been difficult, resulting in shrinking profit margins. Tight cash flows and delayed supplier payments have further exacerbated financial stress in this sector.

- Services:

Service-oriented MSMEs have experienced a surge in fixed operational costs, including rent and utilities. For instance, utility bills rose by 15-20%, driven by fuel price increases, while housing inflation reached 2.78% in September 2024, adversely impacting businesses leasing office spaces. These factors have made it increasingly challenging for service providers to maintain competitive pricing and profitability.

- Agriculture:

Agriculture-based MSMEs have faced sharp increases in input costs, with fertilizer prices rising by an estimated 30% in FY21-22. Combined with higher fuel and logistics expenses, these costs have created ripple effects, significantly affecting production and distribution profitability. Such inflationary pressures have hindered growth in this sector, which is crucial to rural economies.

This demonstrates the widespread and diverse challenges inflation poses to MSMEs, underscoring the need for strategic interventions and adaptive measures across industries.

Key Indicators to Decode Inflation for MSMEs

Understanding and tracking inflation trends can empower MSMEs to plan effectively. Key indicators include:

- Consumer Price Index (CPI): Reflects changes in the average prices of goods and services consumers purchase. For MSMEs, particularly those in retail or services, CPI serves as a measure of consumer purchasing power. A rise in CPI often signals reduced spending capacity, helping businesses prepare for potential demand slowdowns.

- Wholesale Price Index (WPI): Monitors wholesale price changes, offering insights into input cost fluctuations. MSMEs relying heavily on these inputs can use WPI data to predict cost increases and plan budgets or procurements accordingly.

- Producer Price Index (PPI): PPI measures the prices producers receive for their goods, acting as an early warning system for cost changes across the supply chain. MSMEs can use PPI trends to foresee production cost escalations and adapt their pricing or sourcing strategies before these changes ripple through the market.

MSMEs can leverage tools and financial reports to monitor these indicators and anticipate economic shifts, enabling proactive decision-making.

Strategies MSMEs Can Adopt to Counter Inflation

- Advanced Cost Management

- Cost Audits: Regularly review operational expenses to identify inefficiencies and areas for cost reduction, such as renegotiating vendor contracts or streamlining logistics.

- Strategic Supplier Relationships: Establish long-term contracts with key suppliers to lock in prices and minimize the impact of market volatility.

- Inventory Optimization: Use predictive analytics to maintain optimal inventory levels, reducing storage costs while ensuring supply meets demand.

- Diversify Revenue Channels

- Expanding Distribution Channels: Focus on multi-channel distribution by collaborating with distributors and wholesalers to ensure seamless product flow and tapping into online platforms for direct-to-consumer reach.

- Developing Value-Added Services: Offer after-sales support, customization options, or bundled products to enhance revenue streams.

- Leveraging Export Markets: Target international markets with aligned demand and higher profit margins to diversify revenue streams and expand beyond domestic demand.

- Boosting Domestic Demand: Focus on strengthening local market presence by enhancing product offerings and implementing targeted marketing strategies to increase domestic sales.

- Leverage Technology

- AI-Driven Demand Forecasting: Use artificial intelligence to predict market trends and adjust production levels accordingly, minimizing overproduction or shortages.

- Process Automation: Invest in robotic process automation (RPA) to handle repetitive tasks, such as order processing or inventory management, freeing up resources for core operations.

- Enhanced Cybersecurity: Protect digital assets and sensitive customer data, ensuring business continuity amidst rising digital transactions.

- Maximize Digital Presence: Leverage social media tools, establish a strong presence on online marketplaces, and tap into e-commerce platforms to expand reach and connect with a broader audience.

- Workforce Resilience

- Upskilling Employees: Provide training in areas like digital literacy and advanced production techniques to enhance productivity.

- Flexible Work Models: Adopt hybrid or remote work setups to reduce operational costs associated with physical infrastructure.

- Employee Engagement: Foster a supportive workplace culture to retain talent and reduce turnover, minimizing recruitment expenses during inflationary periods.

- Accessing Credit and Financial Solutions

- Dynamic Financing Options: Inflation poses significant challenges for MSMEs, such as balancing rising costs with fluctuating demand. Regulated NBFCs like Protium provide dynamic credit lines tailored to business needs, ensuring liquidity while avoiding over-borrowing.

- Alternative Lending Models: Consider consumer lending or crowdfunding as supplementary financing methods.

- Credit Monitoring: Use digital tools to track credit scores and identify potential risks in obtaining future loans.

Inflation poses significant challenges for MSMEs, affecting costs, margins, and demand. However, by understanding inflation indicators and adopting detailed, proactive strategies, these businesses can mitigate its impact. Leveraging technology, diversifying revenue streams, and accessing tailored financial solutions are key to resilience. Preparedness and adaptability will ensure that MSMEs continue to thrive, even in challenging economic climates.