Strengthening MSME Manufacturing Capacity to Reduce Festive Imports

- With 92% Indian consumers intending to maintain or increase their spending, the festive season creates one of the busiest retail cycles in India. However, import of goods like lights, toys, and packaging still captures a large share of demand.

- MSMEs can close the gap by scaling up production early, using cluster-based facilities, and accessing affordable finance to match import volumes.

- Digital platforms and ONDC expand reach, helping MSMEs directly access customers, benefit from Vocal for Local campaigns, and collaborate with retailers and exporters.

- Self-reliant festivities are possible if MSMEs focus on quality, innovation, and year-round supply, aligning with Make in India 2.0 and Atmanirbhar Bharat goals.

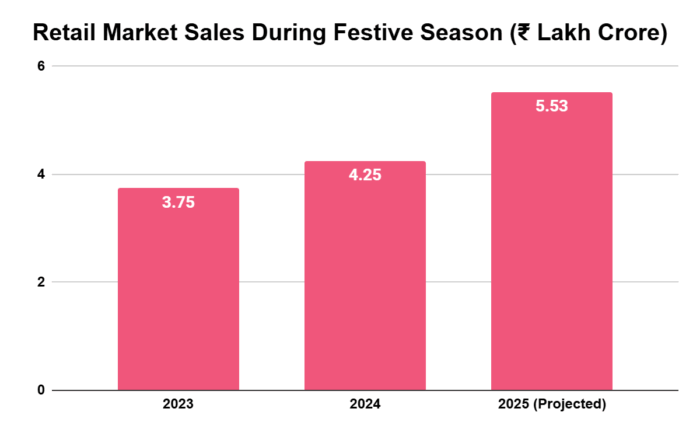

Festivals in India are as much about consumption as they are about celebration. The numbers tell the story—retail markets recorded ₹4.25 lakh crore in sales in 2024. This year, festive trade is projected to surge by another 20–30%, potentially touching ₹5.53 lakh crore. Few periods in the year generate such concentrated economic activity, bringing millions of buyers and sellers into motion at once.

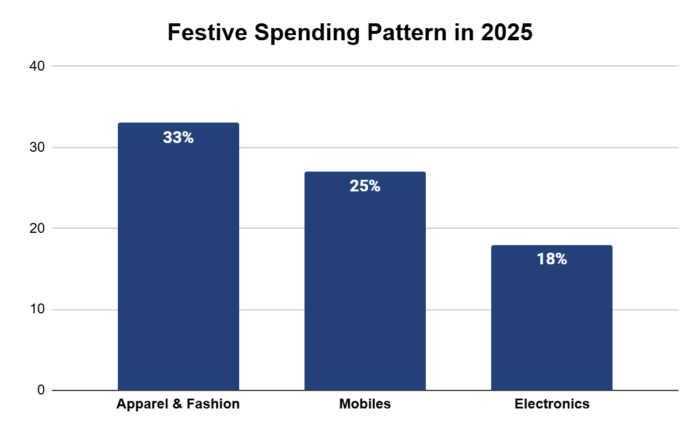

The momentum is further reflected in consumer spending in 2025. 92% of Indians plan to maintain or increase their festive spending, with an average budget of ₹16,500. Within this, apparel and fashion dominate at 33%, followed by mobiles (27%), electronics (18%), and significant allocations to jewelry and beauty products. Beyond these headline categories, the festive cart is diverse—stretching from decorative items, synthetic fabrics, lights, and packaging materials to gifts, sweets, and home décor.

The festive calendar, beginning with Raksha Bandhan and stretching through Ganeshotsav, Navratri, Durga Puja, Dusshera, and Diwali, creates one of the busiest retail cycles in India. It is also the period when low-cost goods that are manufactured in other countries flood the Indian market, particularly in categories like decorative lights, toys, and low-cost synthetic items. These inflows rise sharply in the run-up to Diwali, reducing the market space for domestic MSMEs that are well capable of supplying a large share of such products.

In recent years, however, the call for Vocal for Local and the government’s broader Atmanirbhar Bharat (Self-Reliant India) vision has gained momentum. By encouraging consumers to favor Indian-made products and supporting domestic manufacturing capacities, these initiatives aim to transform festive demand into an engine of self-reliance. The trend is beginning to show, as in 2023–24, imported goods lost an estimated ₹1.25 lakh crore worth of festive trade, a striking shift considering that in previous years such imports accounted for nearly 70% of Diwali market share1.

For MSMEs, this is more than a seasonal business opportunity—it is a chance to step into product segments once dominated by imports, strengthen India’s manufacturing resilience, and ultimately grow their own businesses.

Scaling Up Capacity Well in Advance

Seasonal demand requires manufacturers to scale up well in advance, something that imports often manage better because of bulk supply chains and cost advantages. For MSMEs, matching this requires early planning and boosting manufacturing capacity.

Cluster-based Common Facility Centers (CFCs) play an important role here. Access to shared machinery, testing labs, and modern production tools allows MSMEs to achieve higher volumes and consistent quality. Technology upgrades in packaging, finishing, and automated assembly can also help local products compete directly with imports in terms of look and reliability.

The financial side is equally important. Access to affordable credit allows MSMEs to stock raw materials, expand production lines, and meet festive timelines. This support is available through RBI-registered NBFCs like Protium, and if accessed in time, can ensure that MSMEs are not forced to cut corners.

Certifications and branding are another area that demands attention. Imported products often appear more attractive because they come with standardized packaging and consistent quality. MSMEs can bridge this gap by adopting quality certifications, improving packaging design, and building brand identity. A product that looks professional and carries certification gains better acceptance among both retailers and end consumers.

Material Sourcing: Building Local Alternatives to Imported Raw Materials

One of the key reasons for import dependence is not only the availability of low-cost finished products but also reliance on imported raw materials. LEDs, plastics, synthetic fabrics, and certain metals are still widely sourced from outside India. For MSMEs, this creates a double challenge—both the raw material and the finished product come from foreign markets.

To reduce this reliance, MSMEs can focus on developing and adopting local alternatives. Domestic suppliers and research institutes are working on solutions such as bamboo-based décor items, jute-based packaging, and organic textiles, which are increasingly replacing plastic and synthetic materials. These sustainable options are also gaining popularity among urban and semi-urban consumers, especially during festive purchases where eco-friendly choices add emotional value.

Government-backed programs such as the National Technical Textiles Mission aim to boost advanced fabric manufacturing in India, while the PLI (Production Linked Incentive) schemes for electronics and textiles are designed to strengthen domestic sourcing and reduce the inflow of imported raw materials. For MSMEs, aligning production with these initiatives can create long-term access to better-quality local materials, ensuring they are not left behind when demand peaks.

Digital Platforms and Distribution: Local Reach, Global Visibility

Even when MSMEs manufacture competitive products, access to markets becomes a bottleneck. Imports often dominate because they are distributed through large networks at scale. However, digital platforms are now helping to level this playing field.

E-commerce marketplaces and the Open Network for Digital Commerce (ONDC) are enabling small manufacturers to directly list their products, reaching customers across regions without relying entirely on middlemen. For festive-specific goods like decorative lights, home décor, apparel, or artisanal jewelry, this visibility can quickly translate into sales.

Government and corporate-led Vocal for Local campaigns during festivals further strengthen this push. With the right branding and digital presence, MSMEs can position themselves as reliable alternatives to imports. Additionally, collaborations with local kirana stores, organized retail chains, and exporters give MSMEs an extended distribution reach, ensuring their products are available where demand is the highest.

Toward Self-Reliant Festivities: Long-Term Role of MSMEs

Festive demand is not just about short-term sales. It offers a chance for MSMEs to transform their role in India’s manufacturing ecosystem. By gradually replacing imports, small businesses help reduce foreign exchange outflows, create jobs, and sustain traditional crafts while also meeting modern consumer preferences.

This aligns closely with Make in India 2.0 and Atmanirbhar Bharat, where self-reliance is seen as a key step toward economic resilience. While large industries focus on high-value manufacturing, MSMEs play an equally vital role in non-essential but high-volume goods that dominate the festive economy. Each locally manufactured decorative light, handcrafted diya, or jute-based gift packaging adds to India’s manufacturing strength. For MSMEs to sustain this momentum, three areas will remain critical—

- Quality consistency,

- Product innovation, and

- Production scale.

Seasonal demand can act as a launchpad, but businesses that innovate beyond festivals and establish themselves as year-round suppliers will be best placed to grow in the long run. By focusing on local material sourcing, scaling production capacity, leveraging digital platforms, and aligning with government initiatives, MSMEs can steadily reduce the inflow of imported festive goods. This shift not only protects small businesses but also supports the larger goal of a self-reliant India.