The Role of Business Loans in MSME Growth

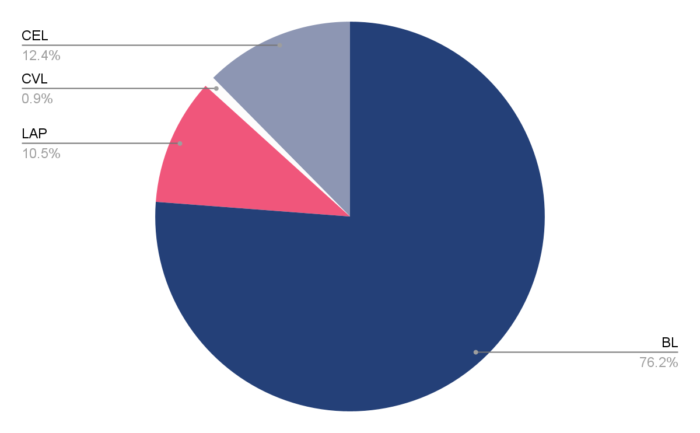

- Nearly 76.2% of the total active loans in India in FY2024 toward MSMEs are business loans.

- The trend in the amount of active loans indicates that business loans are preferred by MSMEs to fund working capital, expansion plans, tech adoption, debt restructuring, innovation, R&D and supply chain management, and growth financing.

- When used strategically, business loans drive sustainable growth, as seen in Saravanan Power Looms’ 700% sales increase in FY2024.

- Beyond funding, business loans create a financial footprint, building credibility with lenders and investors for future growth.

Traditionally, many small business owners across India would consider taking any kind of loans to grow or start their business either due to lack of collateral or immediate access to funds. But over the years, business owners have realized the benefits of taking business loans as compared to other loan products available.

This shift is reflected in the numbers – MSME lending grew by approximately 12.6% from FY2023 to FY2024. However, what makes the shift to business loans evident is the trend seen in the amount of active loans in FY2024.

(Share of Business Loan, Loan Against Property, Commercial Vehicle Loan, and Construction Equipment Loan in the total active loans in FY2024)1

Nearly 76.2% of the total active loans disbursed to MSMEs in FY2024 were business loans. One of the reasons why business loans are preferred is the perspective shift that business loans are more than just reactionary measures. But what factors are driving this change, and how do business loans truly empower MSMEs? Let’s delve more into this:

Business Loan as a Comprehensive Financial Solution:

A business loan today is more than just emergency funding—it’s a comprehensive financial solution designed to support MSMEs through every phase of growth.

- Startup & Early Growth: The initial stages of business require a significant capital infusion for setting up machinery, procuring raw materials, or hiring the first batch of employees. Though bootstrapping is an option, many businesses still need an external source of finance. This is where business loans help in fulfilling the initial capital requirement.

- Sustaining Operations: For businesses that are up and running, business loans can help address cash flow gaps, maintain inventory, and cover ongoing operational costs. At this stage, business loans help ensure business continuity, even when there are unexpected market demand fluctuations.

- Scaling & Expansion: When a business is ready to explore new opportunities and markets, the need for larger capital infusions becomes paramount for scaling operations, investing in technological upgrades, and venturing into new markets. Business loans, with their usage flexibility, allow MSMEs to invest in every upgrade needed to take their business to the next level.

- Technology Adoption: With the advancements in payment processes, manufacturing techniques, and operational structure, investing in technology is no longer optional; it’s necessary. Whether it’s automating processes, upgrading systems, or implementing digital tools for customer data management, business loans help MSMEs finance their tech adoption to improve efficiency.

- Debt Consolidation: For businesses with existing loans, consolidating multiple loans into a single, more manageable one can help simplify finances. Business loans offer opportunities for debt consolidation, resulting in a lower interest rate, extended repayment period, or more favorable terms. This improves monthly repayments, simplifies management, and provides financial flexibility.

- Innovation and R&D (Research & Development): With the increased emphasis on innovation and R&D in Budget 2025-26, businesses are encouraged to innovate to match the global competitiveness and support the ‘Make In India’ vision. Business loans take care of the financial support needed for this shift and fund R&D projects, allowing businesses to improve or introduce new products or services. This helps businesses better meet the changing needs of the market.

- Strengthening Supply Chain and Inventory Management: Business loans can be used to bulk purchase inventory, invest in warehouse expansion, or finance vendor relationships. This improves supply chain resilience and helps businesses manage their stock more efficiently.

- Employee Training and Upskilling: Investing in employee development is one of the most effective ways to improve productivity and help them adapt to new technologies. Business loans can help fund training programs that upskill employees, ensuring that the workforce remains competitive in a rapidly changing business environment.

- Access to Additional Funding: Businesses need more funds as they scale to sustain growing operations. With business loans, MSMEs can secure top-up loans, which offer infusions of additional capital without too much paperwork for loan application. This helps businesses seize opportunities promptly.

- Addressing Temporary & Seasonal Needs:

For many businesses, there are times of the year when demand surges (such as during festivals or peak seasons). For instance, the festive business during Diwali in FY2024 rose to around Rs.4.25 lakh crore2 or for this summer, the expected y-o-y growth in consumer durables is 30%. During such surges, MSMEs need to:

- Cater to the increase in demand for specific products

- Seize the opportunity to register higher profits by leveraging the positive market trend

- Improve or continue to serve quick customer experience

- Maintain product quality due to any operational or financial pressure

- Manage and maintain inventory such as bulk purchases

- Cope with unforeseen operational costs quickly

Business loans help cover these temporary needs, allowing businesses to be better prepared for these fluctuations and maintain steady operations.

- Providing Structured Financing:

Business loans from regulated NBFCs (Non-banking Financial Companies) like Protium provide clear repayment terms and transparent pricing. Structured financing thus allows businesses to plan their repayments around their cash flow cycles, making it easier to stay on track.

There are numerous instances of small businesses benefiting from business loans. One such MSME is Saravanan Power Looms, who started with two handlooms 24 years ago. The business was started by the father, and the son had ambitions of expanding the business for which they procured a secured business loan from Protium. This loan helped them grow their business from 2 handlooms to 38 power looms.

The loan taken catalyzed growth in the following aspects:

- The business fulfilled the increasing market needs by adding more power looms

- The sales grew by 700% in 2023-24

- The annual turnover grew to Rs.2.4 crore in 2023-24

The Financial Implication of Business Loans

Securing a business loan can have a profound effect on a company’s financial health and strategic planning. The aspects that change for the business are:

- Budgeting Shifts:

A business loan compels an entrepreneur to assess their financial needs carefully. This process helps them create a clear financial plan, set budgets, and allocate resources effectively. Loans also encourage better cash flow management, as business owners need to plan for regular repayments within their cash flow cycles.

- Impact on Financial Statements:

Business loans reflect on a company’s balance sheet as liabilities. The borrowing aspect of the loan changes the company’s financial ratios, such as

- Debt Service Coverage Ratio (DSCR): The ratio measures a company’s ability to repay its debts by comparing its net operating income to its total debt service. It helps investors and lenders assess financial health and determine the company’s creditworthiness for future funding.

- Profitability Ratios: The improved output due to the upgrades is reflected in profitability ratios like Return on Equity (ROE) and Return on Asset (ROA), which indicate efficient use of borrowed capital.

Business loans thus change the financial picture of the business.

- Long-Term Financial Strategy:

In the long run, taking a business loan can create a strong foundation for strategic financial planning. With timely repayments and efficient loan utilization, borrowers can build a history of successful debt management, get better terms for future loans or top-up loans, and increase their financial credibility.

Over the years, business loans have become more than just a quick yet burdensome fix for financial struggles. They have evolved as a strategic tool businesses, especially MSMEs, use to scale, innovate, and enhance operational efficiency. Moreover, with the emphasis on taking business loans from trusted NBFCs like Protium, financing growth has become more transparent, convenient, and empowering. It is easier than ever for MSMEs to reach their full potential while ensuring long-term financial stability and success.