The Role of Financial Planning – A Guide for MSMEs to Scale & Grow With Their Annual Budget for FY2025-26

- Strategic financial planning follows a staged approach that includes budgeting and forecasting, investment planning, cash flow management, and digital transformation. Here is how each of these help:

- Budgeting allows MSMEs to allocate funds wisely for operations, expansion, or emergencies

- A well-structured investment plan focuses on technology upgrades, infrastructure, equipment, workforce expansion, skill development, market penetration & expansion, thereby driving business growth and long-term sustainability

- MSMEs that leverage digital transformation for smarter decision-making, optimize cash flow, and reduce financial risks

- Read more on how a well-planned financial strategy helps MSMEs not only survive through turbulent times but also grow tremendously during high seasons.

The Stages of Financial Planning for MSMEs

Financial planning is a step-by-step process that helps MSMEs maintain stability while scaling their business. It begins with forecasting and budgeting, followed by strategic investment planning and cash flow management, ensuring that financial resources are allocated efficiently for growth and sustainability. Here’s a detailed look at what MSMEs must consider:

- Forecasting & Budgeting: Laying the Foundation

Financial stability is paramount for MSMEs, especially in an unpredictable market. Whether it’s fluctuating demand, rising operational costs, or unexpected financial setbacks, having a well-structured financial plan ensures businesses can navigate challenges and sustain growth. This is where budgeting becomes crucial so that MSMEs can allocate funds wisely for operations, expansion, or emergencies. Meanwhile, forecasting allows businesses to anticipate future financial needs by analyzing past trends and current market conditions.

With accurate forecasting, businesses can:

- Prepare for slow seasons by adjusting expenses accordingly

- Plan stock purchases and inventory management based on projected demand

- Optimize resource allocation, ensuring that capital is directed toward the most profitable areas

- Avoid liquidity crises by anticipating revenue shortfalls and planning alternative financing solutions.

It’s crucial to note that the above-mentioned budgeting and forecasting efforts must align with business goals when the principles of Financial Planning & Analysis (FP&A) are in place.

Reasons Financial Planning & Analysis (FP&A) Matters

FP&A combines financial data, business trends, and forecasting models to create a realistic financial roadmap that helps businesses stay on track. FP&A serves as a financial guide, analyzes market conditions, sales performance, and cash flow trends, and offers structured insights to create more accurate financial projections.

Some of the key functions of FP&A in MSME financial planning include:

- Expense tracking and cost management – Ensuring businesses operate within their means

- Revenue forecasting – Predicting future earnings based on historical performance.

- Scenario planning – Helping businesses prepare for best-case and worst-case financial situations.

- Data-driven decision-making – Using insights to optimize pricing, inventory, and investment strategies.

Without FP&A, budgeting and forecasting remain incomplete, as businesses lack the analytical tools needed to connect financial data with strategic decision-making.

- Investment Planning: Aligning Funds with Growth Objectives

Once businesses work out their budget and have forecasting in place to make data-driven decisions, they need a sturdy investment plan that will align their funds with business goals. MSMEs must remember that growth is not just about increasing sales—it’s about investing strategically in areas that drive long-term success. Without a clear investment plan, businesses risk overspending in unproductive areas or missing out on critical opportunities. Strategic allocation of resources ensures that funds invested contribute to business expansion, improved efficiency, and sustainable profitability.

A well-structured investment plan focuses on four key areas:

- Technology Upgrades – Investing in automation, AI-driven financial tools, and digital payment solutions can reduce costs, improve efficiency, and enhance customer experience. Businesses that embrace digital transformation streamline operations, reduce manual errors, and optimize financial management.

- Infrastructure & Equipment – Expanding production capacity, upgrading machinery, or setting up new facilities enhances operational efficiency and helps businesses scale. Smart investments in infrastructure increase productivity and reduce long-term operational costs.

- Workforce Expansion & Skill Development – Hiring skilled professionals and upskilling existing employees ensures MSMEs remain competitive. Investing in workforce development improves productivity, innovation, and customer service, directly impacting revenue growth.

- Market Penetration & Business Expansion – Entering new markets, increasing distribution channels, or enhancing marketing efforts boosts visibility and revenue. Expanding into untapped customer segments creates new revenue streams and strengthens brand positioning.

3. Cash Flow Management: Ensuring Business Stability

For MSMEs, cash flow is the backbone of the business, as liquid cash covers daily expenses. Managing cash flow effectively ensures that businesses can pay suppliers, salaries, and other operational costs on time, avoiding disruptions and financial strain. Poor cash flow management, on the other hand, can lead to missed growth opportunities, delayed payments, and even business failure.

Cash flow management involves balancing money coming into the business (inflows) and money going out (outflows). This includes:

- Managing receivables – Ensuring customers pay invoices on time to maintain steady cash flow. Delayed payments can create financial bottlenecks, making it difficult to cover expenses.

- Tracking payables – Ensuring timely payments to suppliers while maintaining enough working capital for other business needs.

- Optimizing operational expenses – Reducing unnecessary costs, negotiating better terms with suppliers, and streamlining inventory management to avoid excessive cash tied up in stock.

By maintaining a clear cash flow projection, MSMEs can anticipate potential shortages and take proactive measures like adjusting payment cycles or securing credit. However, MSMEs require financial tools with greater efficiencies to achieve these effectively, for which they can leverage digital transformation.

4. Leveraging Digital Transformation for Strategic Financial Planning

For MSMEs to implement robust financial planning, manual processes alone are no longer sufficient. They must adopt AI-driven financial tools to manage, analyze, and forecast finances, which enables smarter decision-making, optimizes cash flow, and reduces financial risks.

A compelling reason to transition to digital transformation is that traditional financial management is often error-prone, time-consuming, and challenging to scale, while digitizing financial planning helps businesses:

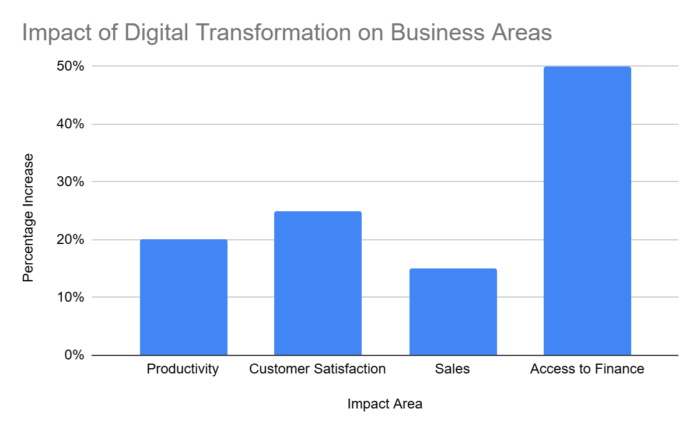

- Boost Productivity with Automation: By eliminating miscalculations and improving financial accuracy, automated budgeting helps streamline financial management. MSMEs that adopt digital technologies report up to a 20% increase in productivity1 since automation reduces redundant tasks, lowers operational costs, and improves workflow efficiency

- Real-Time Risk Management: Predict financial risks in real-time by identifying cash flow issues before they rise

- Seamless Compliance: Enhance compliance since digital accounting tools simplify GST filings, tax reporting, and audit processes

- Enhanced Financial Transparency: Improve financial transparency with cloud-based systems providing real-time visibility into cash flow, expenses, and profitability

- Transform Customer Engagement: Beyond internal efficiency, digital technologies revolutionize customer engagement, improving brand loyalty and satisfaction. For instance, MSMEs using social media for customer engagement witness a 25% boost in customer satisfaction2, as personalized communication, order tracking, and faster issue resolution become more seamless.

- Increase Sales: With online marketing tools and data-driven strategies, MSMEs can increase sales by up to 15%3. Targeted digital campaigns enable businesses to reach wider audiences, generate quality leads, and close deals more effectively.

Digital transformation can help streamline financial planning and improve decision-making, ensuring long-term financial health. For example, in the case of a retail MSME that uses AI-powered forecasting software to anticipate peak seasons, optimize inventory purchases, and allocate marketing budgets effectively or in the case of a manufacturer that can leverage AI-based risk management to receive automated alerts on delayed payments.

Besides, financial stability is another critical area where digital adoption drives significant benefits. Digital financial services, such as AI-based lending platforms and online credit assessment tools, enable MSMEs to secure funding more easily. MSMEs utilizing digital financial solutions increase their access to finance by 50%4, facilitating smoother cash flow management and better creditworthiness.

Role of Credit Lines & Funding Availability in Financial Planning

While budgeting, forecasting, and digitising help allocate existing resources effectively and enhances efficiencies, businesses require credit lines and funding for working capital, expansion, technology upgrades, and operational stability. Since MSMEs often lack immediate cash reserves, credit lines and external funding become essential for financing growth initiatives.

Credit plays a dual role in financial planning in the following manner:

- Supporting cash flow stability by bridging gaps between receivables and payables

- Enabling long-term investments in business expansion, ensuring MSMEs can scale without disrupting daily operations.

Furthermore, a well-structured financial plan ensures that credit is accessed strategically rather than as a reactive measure in times of crisis. Financial discipline is essential—businesses must secure funding at the right time and through channels, like regulated NBFCs such as Protium, to avoid excessive debt burdens.