Why should an MSME Formalize its Business?

- Over 3.9 crore MSMEs in India remain informal, missing out on formal credit, schemes, and growth opportunities.

- One way to formalize is by registering the business on Udyam, free, digital, and simple, making formalization easier than ever.

- Formal MSMEs gain access to finance, markets, government incentives, and structured compliance tools.

- Challenges like low awareness, tax fears, and digital gaps can be overcome through Common Service Centers (CSCs), financial institutions support, and government initiatives.

The Indian economy accommodates over 6.5 crore registered MSMEs. However, as of March 2024, approximately 3.9 crore MSMEs remained unregistered and operating informally.

This gap has long-term consequences. Informal businesses are often excluded from subsidies, financial assistance, and critical growth programs. They also struggle to scale due to a lack of access to structured financing, vendor networks, or quality certifications.

However, this scenario is beginning to shift. A series of digital reforms, simplified registration processes, and paperless systems have significantly lowered the barriers to formalization—especially for micro and small enterprises.

Why Formalization Matters More Than Ever for MSMEs

Many MSMEs continue to operate outside the formal ecosystem, often due to legacy practices or perceived risks. But doing so limits their potential. Formalization isn’t just a bureaucratic requirement—it’s a strategic decision that opens new doors.

- Improved Access to Finance

Registered MSMEs become eligible for a wide range of financial products. These include collateral-free loans under schemes like CGTMSE and MUDRA, along with working capital loans, term loans, equipment finance, and invoice-based lending. Having a Udyam Registration Certificate often acts as a first-level proof of business for lenders, enabling faster approval and better interest rates.

- Ease of Doing Business

With Udyam Registration, PAN, and GST in place, business owners can streamline accounting, taxation, and vendor transactions. Filing returns becomes easier, and digital systems ensure fewer errors and faster reconciliations. Integration across government portals also reduces repetitive data entry.

- Market Expansion Opportunities

Formalization helps MSMEs list on the Government e-Marketplace (GeM), participate in public procurement, and register for an Import Export Code (IEC). This allows them to move beyond local markets, tap into institutional buyers, and even explore exports.

- Eligibility for Government Schemes

Government programs such as the ZED Certification, Credit Linked Capital Subsidy Scheme (CLCSS), and PMEGP are available only to registered businesses. These schemes offer funding for machinery upgrades, skilling, sustainability practices, and market access—none of which informal units can access.

- Exports Schemes

Udyam-registered MSMEs in the export domain can avail of government support through the following schemes:

- Trade Infrastructure for Export Scheme (TIES) to fund the development of export-related infrastructure

- Market Access Initiatives (MAI) Scheme to assist businesses in participating in international exhibitions, trade delegations, and buyer-seller meets

- Export Promotion Capital Goods (EPCG) scheme enabling exporters to import capital goods at a concessional rate of customs duty for producing goods and services for export.

- Trade Connect e-Platform helps MSMEs access reliable information on international trade. The platform covers export procedures, market insights, and government schemes—making it easier for businesses to start or grow their export journey.

- Districts as Export Hubs initiative identifies high-potential products and services in each district. It supports local businesses by addressing challenges like logistics, approvals, and compliance, and helps them become ready to compete in global markets.

- Online Dispute Resolution (ODR)

With the new ODR portal launch on June 27, 2025, MSMEs gain access to a fast, digital mechanism for resolving payment disputes and contract issues—especially for those located in semi-urban and rural areas.

Despite the clear advantages, a significant portion of MSMEs continues to avoid formalization. The reasons are not always financial—they’re often psychological, logistical, or rooted in misinformation.

- Limited Awareness and Fear of Scrutiny

Many micro-enterprises are unaware that they must or can formalize their operations. They also mistakenly associate registration with burdensome tax obligations and government inspections. - Reluctance to Leave a Money Trail

Cash transactions remain the norm in many small businesses. Formalization requires transparency—bank accounts, digital payments, invoices—which some business owners view as a risk rather than an advantage. - Perceived Cost of Formalization

Even though Udyam Registration is completely free, some assume there are hidden costs—consultant fees, multiple licenses, or higher taxes. These misconceptions deter many from taking the first step. - Fear of Losing Competitive Edge

For very small players, entering the formal system is sometimes seen as a burden. They worry that larger, more structured competitors will overtake them once they’re in the same space. This is especially true for businesses operating with thin margins.

However, the government has acknowledged these challenges and introduced simplified, accessible processes. With the right guidance, formalization can now be achieved in just a few steps. For small businesses looking to formalize operations, the process is straightforward, mostly digital, and designed with ease in mind.

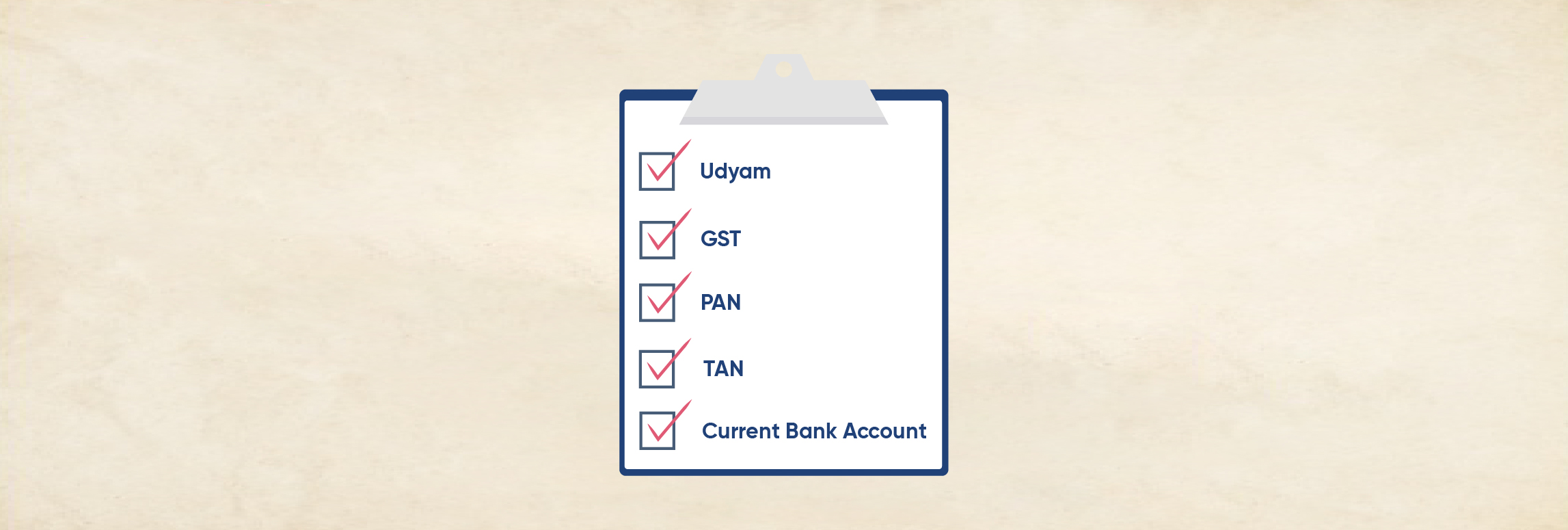

Step-by-Step Guide to MSME Formalization

While the government is doing their bit to encourage MSMEs to formally register themselves, financial institutions are also helping to narrow this gap. Here’s a step-wise process for formalisation.

Step 1: Registering on the Udyam Portal

The Udyam Registration Portal (https://udyamregistration.gov.in) is the official gateway for MSME recognition. It’s paperless, free of cost, and integrated with PAN and GST systems.

Documents/Details Required:

- Aadhaar Number of the proprietor, partner, or director

- PAN card and basic business details (type, activity, turnover)

- Mobile number linked to Aadhaar

Once submitted, the system automatically fetches data from income tax and GST databases. A business is issued a Udyam Registration Certificate with a unique Udyam number.

Step 2: Opening a Business Current Account

A business current account not only separates personal and professional finances but also signals operational credibility.

- Most banks now offer MSME-specific current accounts with zero or low balance requirements.

- The Udyam certificate often accelerates account opening.

- Having a current account helps build a financial history, which is necessary for future credit evaluation.

Step 3: Obtaining PAN and TAN for the Business

A Permanent Account Number (PAN) is mandatory for tax purposes, while a Tax Deduction and Collection Account Number (TAN) is needed if the business deducts TDS.

- Both can be applied for through NSDL or UTIITSL websites.

- Proprietorships can operate with the proprietor’s PAN, but separate PANs are recommended for partnerships or companies.

Step 4: GST Registration (If Applicable)

Businesses exceeding the turnover threshold—₹40 lakh for goods and ₹20 lakh for services—must register for GST.

Even below the threshold, many choose to register voluntarily due to advantages such as:

- Input Tax Credit (ITC) eligibility

- Enhanced vendor and buyer trust

- Access to e-commerce marketplaces

The GST portal (www.gst.gov.in) provides self-service registration. Integration with Udyam and PAN details ensures a smoother process.

Step 5: Enrolling in Other Relevant Registrations

Depending on the business type and location, some additional licenses may apply:

- Shop and Establishment License – Required for physical establishments in most states.

- FSSAI License – Mandatory for food processing, packaging, or sale.

- Trade License – Issued by local municipal bodies to ensure compliance with civic norms.

- Import Export Code (IEC) – Required for any business involved in cross-border trade.

These registrations often require minimal documentation and can be completed online in many states. The ease of these registrations is further enhanced by India’s digital public infrastructure that has made MSME onboarding faster and more transparent.

Digital Platforms That Make Formalization Easier

Here are the integrated platforms that supports a small business’s registration journey:

- Udyam Portal: For self-declaration-based MSME classification

- Udyam Assist Platform: Specially designed for informal micro-enterprises that lack PAN or GST

- GeM (Government e-Marketplace): Allows registered MSMEs to participate in government procurement

- DigiLocker & e-Sign: Enable paperless document verification and digital signatures

- GSTN and Income Tax Portals: Offer pre-filled forms, return filing support, and integrated compliance tracking

Despite these provisions and digitization, many micro-businesses need handholding through the process. The government and lending institutions have made conscious efforts to ease this transition.

How can MSMEs Overcome Common Challenges in Formalization

MSMEs may face unique challenges when it comes to formalization, but they can overcome these with the various

- Low Digital Literacy: Businesses struggling with online forms or verification can visit Common Service Centers (CSCs), which provide in-person support in rural and semi-urban areas.

- Fear of Compliance and Tax Burden: MSMEs can start with Udyam registration and gradually opt for GST or other registrations as the business grows. Formalization does not mean immediate taxation unless income thresholds are crossed.

- Lack of Awareness: Campaigns run by SIDBI, Ministry of MSME, conduct workshops, digital camps, and street-level outreach to inform and onboard small businesses.

- Multiple Registrations Confusion: Platforms like Udyam Assist and India Stack simplify the process by combining multiple verifications and documentation steps into one digital journey.

What MSMEs Must Keep in Mind Post-Formalization

Registration is only the first step. Sustaining formal status and leveraging it effectively requires discipline and planning.

- Maintain Records: MSMEs must Keep a track of revenue, expenses, and basic cash flow data. Even simple registers or Excel sheets help.

- File Returns: If GST-registered, file monthly/quarterly returns. File annual income tax returns based on profit or turnover.

- Update Udyam: If investment or turnover changes significantly, MSMEs must update their Udyam profile online.

- Tap Into Schemes: Monitor portals like myMSME and NSIC for new schemes on skilling, credit, marketing, and technology upgradation.

Real-Life Examples of MSMEs Scaling Up Thanks to Formalization

For MSMEs, formalization can be the first real step toward sustainable scale. By registering their business, MSMEs gain access to a structured financial system, and that’s where NBFC partners like Protium play a critical role.

As an RBI-regulated NBFC, Protium has helped MSMEs unlock the full potential of their formal status—through fast, flexible credit, deep business insights, and tailored support across sectors. Take the case of VSK Online Services, a growing tech-enabled platform that began its journey with a strong vision but limited resources. With Protium’s structured business loan, they overcame early-stage capital challenges, streamlined operations, and expanded outreach. Today, VSK serves over 50,000 customers across India, a transformation made possible through formalization backed by the right financial support.

Such stories reflect what’s possible when formalization is followed by access to the right capital, advisory, and ecosystem. As more MSMEs take that first step through platforms like Udyam, the support of institutions like Protium ensures that their journey doesn’t stop at registration—it accelerates toward scale, resilience, and long-term success.

1.Press Information Bureau, Government of India, Udyami Diwas – MSME 2025, June 2025

2.MSME Annual Report 2023–24