- Over 18 lakh Indian students were studying abroad as of 2025, with outbound education spending projected to reach $70 billion. A growing share of these students now comes from Tier-2 and Tier-3 cities.

- GCCs increased their share in Tier-2 and Tier-3 cities from 5 percent in FY2019 to 7 percent in FY2024. However, many continue to struggle with the availability of globally prepared talent.

- Education consulting MSMEs act as the first structured interface between students and global education systems, helping build early global exposure aligned with future workforce needs.

- Seasonality, uneven cash flows, high upfront costs, delayed revenues, and compliance risks constrain sustainable growth despite strong demand.

- Formal finance helps education MSMEs manage working capital, invest in capacity and systems, and transition from informal operations to scalable institutions.

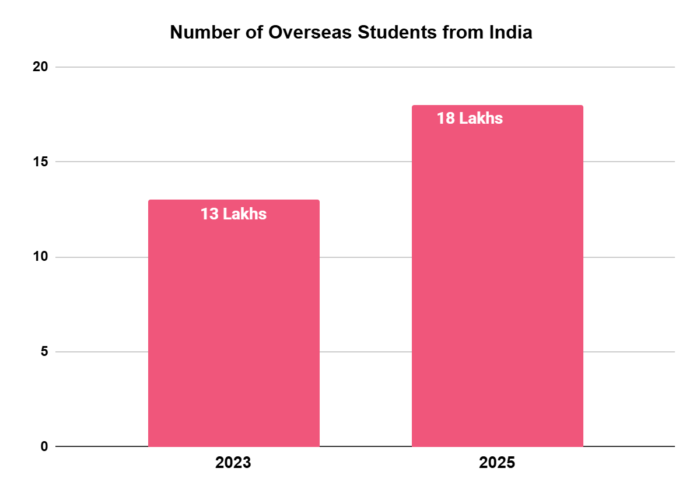

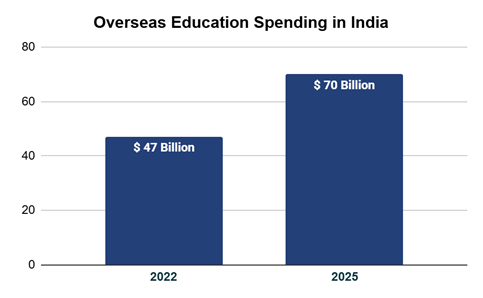

With more than 18 lakh Indian students studying abroad as of 2025, up from 13 lakhs in 20231, India remains one of the largest source countries for international education globally. The student outflows continue at record levels, with outbound spending reaching ~$47 billion in 2022 and estimated at $70 billion by 20252.

A significant share of this demand is now coming from Tier-2 and Tier-3 cities, reflecting a deeper structural shift in international education aspirations. This growing participation from non-metro regions is driven by rising aspirations for global careers, greater digital exposure, and awareness of international universities, their outcomes, and employment prospects, including at Global Capability Centres (GCCs) in Tier-2 and Tier-3 cities.

GCCs have increased their share from 5% in FY2019 to 7% in FY2024, with nearly 3,000 operating across India and more than 220 in smaller cities3. Despite this expansion, many of these in smaller regions continue to face a readiness gap due to the availability of talent with global exposure, international academic training, and familiarity with cross-border work environments. This highlights that workforce readiness begins during the formative academic years through awareness, exposure, and educational choices.

As more students from smaller cities pursue overseas education, they develop capabilities that closely align with GCC requirements. Educational consultants, by enabling these pathways early, play an indirect but critical role in shaping the future talent pool for globally integrated roles emerging beyond metro markets.

The Role of Educational Consultants

For many years, international education was largely concentrated in metro cities, where exposure, institutional awareness, and access to guidance were more readily available. That pattern has changed steadily over the past decade. Students from Tier-2 and Tier-3 cities are now actively exploring overseas education, supported by improving schooling outcomes, better access to standardised test preparation, and stronger family balance sheets.

Educational consultants in Tier-2 and Tier-3 cities form a foundational layer of India’s future workforce infrastructure by enabling access to global education pathways. These MSMEs usually offer a range of services that span the entire student journey, including test preparation for exams such as IELTS, TOEFL, or GRE, admissions counselling and university shortlisting, documentation and visa guidance, language training, interview preparation, and pre-departure support. In many cases, consultants also assist with accommodation planning and post-arrival coordination through partner networks.

For students and parents in smaller towns, this bundled support reduces uncertainty and risk. For international universities, these consultants act as localised distribution and screening partners. In effect, education consulting MSMEs become the first structured interface between Indian students and global education systems.

However, these students often lack direct access to structured counselling, alumni networks, or institutional representatives. This gap creates a strong dependence on local education consultants, who become the primary source of information, evaluation, and guidance. In smaller cities, the consultant is not just an application processor but also a trusted advisor for families navigating an unfamiliar, high-stakes decision.

Business Realities and Challenges

Despite strong and growing demand, overseas education consultants face several structural constraints that undermine stability and growth.

- Seasonal Demand Cycles

Admissions, test preparation, and visa-related activity are tightly linked to exam schedules and international intake windows. This creates sharp peaks and troughs in workloads for which additional employees could be hired on contractual work. This temporary hiring could disrupt the cash flows.

- High Upfront Operating Costs

Consultants must invest continuously in qualified faculty, trained counsellors, classroom infrastructure, and basic technology tools. These costs are largely fixed, regardless of intake cycles or student volumes.

- Delayed Revenue Realisation

A significant portion of income is linked to commissions from international institutions, which are often received months after student enrollment. This delay puts pressure on working capital, especially for smaller firms.

- Credibility and Compliance Risks

In Tier-2 and Tier-3 markets, reputation is built slowly but can be damaged quickly. Visa rejections, documentation errors, or compliance lapses can affect long-term trust. Maintaining accuracy and process discipline is critical, even with limited teams.

- Limited Access to Formal Capital

For many education MSMEs, growth is constrained not by demand but by the lack of structured financing. Without access to formal credit, it becomes difficult to smooth cash flows, invest in capacity, or scale operations sustainably.

As education consulting businesses mature, operational complexity increases alongside demand. Expanding physical capacity, maintaining service quality, and managing uneven cash flows require more than informal arrangements or ad-hoc funding.

Why Structured Financing is Critical for Education MSMEs

For education MSMEs in Tier-2 and Tier-3 cities, access to structured finance from RBI-regulated NBFC such as Protium becomes a practical necessity rather than just a growth accelerator. Formal financing supports stability, professionalism, and the ability to deliver consistent outcomes across admission cycles.

- Supporting Expansion of Centres and Services

Structured financing enables consultants to expand centres, classrooms, and counselling capacity in line with rising student demand. It enables investment in language labs, interview preparation facilities, and dedicated counselling spaces, thereby improving the overall quality of services offered.

- Enabling Hiring and Skill Development

Access to formal credit helps consultants hire trained counsellors and faculty and invest in continuous skill development. In smaller cities, this is critical for building dependable teams and reducing over-reliance on a few individuals.

- Improving Operational Efficiency Through Technology

Financing supports the adoption of basic technology platforms for lead management, application tracking, and student engagement. These tools help streamline processes, reduce manual errors, and improve consistency across admission cycles.

- Managing Working Capital During Off-Peak Periods

Education consulting is often seasonal. Working capital finance helps cover operating expenses during lean periods, reducing the need for informal borrowing or disruptive cost cuts.

- Building Scalable and Institutional Business Models

Over time, formal finance enables education MSMEs to move beyond founder-driven operations. It supports better governance, predictable cash flows, and the transition to more structured and scalable institutions.

As a large share of outbound students originates from Tier-2 and Tier-3 cities, education consulting MSMEs play a growing role in shaping future workforce quality. By enabling global education exposure, these businesses contribute indirectly to closing the readiness gap faced by employers in smaller cities.