Farmer’s Day 2025: 5 Reasons Machinery & Equipment Loans Matter to Farming & Agri-MSMEs

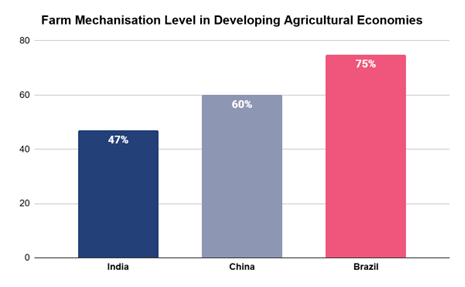

- Although the use of proper equipment can increase farm productivity by up to 30% and reduce costs by about 20%, India’s overall farm mechanisation level stands at around 47%.

- Access to machinery finance can enable farm mechanisation and lead to phased capacity expansion, allowing enterprises to start with essential equipment and gradually add attachments, post-harvest tools, or processing machinery as operations stabilise.

- High upfront equipment costs, seasonal cash flows, collateral and documentation barriers, and approval delays deter timely access to machinery. This forces many small enterprises to rely on rentals or outdated equipment, which raises costs and reduces operational reliability.

- Equipment loans support not only cultivation but also allied and downstream agri-MSMEs such as processors, aggregators, storage operators, and service providers, strengthening the entire agricultural value chain.

Farm mechanisation and the use of proper equipment can increase farm productivity by up to 30% and reduce costs by about 20%1. Despite these gains, India’s overall farm mechanisation level stands at around 47%, which is lower than other developing agricultural economies such as China (about 60%) and Brazil (about 75%)2. This gap is especially critical because small landholdings and farmers in rural India dominate Indian agriculture. Because small and marginal operational holdings account for about 86% of total holdings, the timely completion of activities (land preparation, sowing, weeding, harvesting, and threshing) becomes critical for produce and income stability. Thus, for agri-linked MSMEs, mechanisation not only leads to farm improvement but also ensures business reliability.

On Farmer’s Day today, we take a look at how farming is no longer defined only by land and labour. It is increasingly shaped by equipment, efficiency, and enterprise-level decision-making. With structured financing like Machinery & Equipment Loans, farmers and allied sectors can invest in equipment and capabilities to deliver consistent quality, avoid delays, reduce wastage, and run predictable operating cycles.

What Farm Mechanisation Means for Farmers and MSMEs

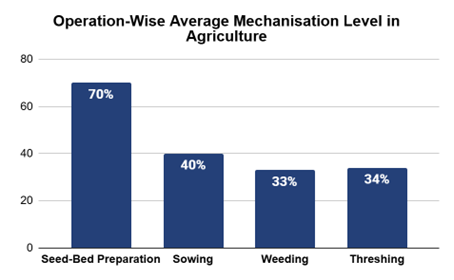

Agriculture in India is said to be ‘tractorised,’ as farm mechanisation is largely driven by tractors, which account for nearly 80% of all farm equipment usage in the country3. Their widespread adoption has transformed land preparation, making ploughing faster and less dependent on manual labor or animal power. However, tractor penetration has also created a visible gap: mechanisation is often high in seed-bed preparation at 70%, while adoption can be lower across sowing, planting, and transplanting (40%), weeding and inter-culture (33%), and harvesting and threshing activities (34%)4. This leaves farms and agri-linked enterprises exposed to delays, labour shortages, and higher variability in output quality.

To overcome this gap, mechanisation needs to move beyond tractor ownership alone. It needs to build complete equipment ecosystems, including primary machinery plus implements, attachments, and post-harvest tools, so that productivity improvements extend across the full farming cycle.

Equipment improves turnaround time. It makes output volumes more predictable. It reduces dependency on manual labour during peak seasons. These advantages are crucial not only for farming but also for the operating performance of agri-MSMEs, including dairy, fishing, food processing, local processors, and storage-linked businesses.

Mechanisation also supports operational discipline. When processes become faster and more repeatable, MSMEs can plan procurement schedules, manage inventory better, and reduce wastage.

Farm Machinery Commonly Utilised by Farms & Agri-MSMEs

Primary farm machinery forms the foundation of mechanised agriculture and is typically the first investment made by farmers and agri-linked enterprises. These include:

- Tractors: Serve as multi-purpose assets and support a wide range of activities through attachments.

- Power tillers: Widely used by small and marginal farmers, particularly in regions with fragmented landholdings where larger machinery is impractical.

- Cultivators and rotavators: Improve soil preparation by creating uniform tilth, supporting better root development and nutrient absorption.

- Seed-cum-fertiliser drills: Enable precise placement of seeds and fertilisers, improving input efficiency and reducing wastage.

While these machines collectively improve land preparation, sowing accuracy, and operational efficiency, forming the base layer of productivity-driven agriculture, productivity gains depend heavily on ancillary and attachment-based equipment that supports harvesting and post-harvest activities.

- Harvesters and reapers: Enable timely crop cutting and reduce losses caused by delayed harvesting and labour shortages.

- Threshers: Improve grain separation efficiency and quality, while balers support residue management and by-product utilisation.

- Power weeders: Help control weed growth with lower labour input, reducing dependence on manual weeding and excessive chemical use.

- Trailers and material handling attachments: Improve on-farm logistics, reducing time and effort involved in moving produce and inputs.

Together, these machines reduce post-harvest losses, lower manual labour dependency, and ensure that productivity gains achieved during cultivation are preserved through harvesting and handling.

Machinery Needs Across Allied and Food Processing MSMEs

Common machinery requirements across allied and food processing MSMEs include:

- Rice mills, flour mills, and oil expellers

These operations benefit when grains and oilseeds arrive in better condition, with lower moisture variation and reduced contamination—often linked to mechanised harvesting and threshing.

- Sorting, grading, and cleaning machines

These improve standardisation and consistency, helping small processors supply organised buyers.

- Cold storage and chilling units

These reduce spoilage and enable better price realisation by extending holding periods.

- Packaging and handling equipment

These improve hygiene, shelf life, and market readiness, especially for enterprises supplying formal retail or institutional buyers.

In short, mechanisation strengthens the entire agricultural value chain. It reduces variability at the farm level, improves consistency of raw material supply, and allows processing units to utilise capacity more effectively.

However, despite these clear advantages, access to machinery and equipment remains uneven, especially for small farmers and agri-MSMEs.

Challenges in Accessing Machinery & Equipment Loans

- High upfront costs

Farm and processing equipment require large ticket purchases that many small enterprises cannot fund internally.

- Seasonal and uneven cash flows

Agricultural revenues are uneven across months. Without structured repayment alignment, equipment purchases can create stress during lean periods.

- Collateral and documentation constraints

First-time borrowers and informal operators often struggle with collateral expectations and paperwork intensity.

- Approval delays

Time-sensitive seasons do not wait for long processing cycles. Delayed approvals can push purchases beyond the useful window.

- Dependence on rentals or outdated machinery

When finance is not accessible, many enterprises rely on rentals or older equipment, which can raise operating costs and reduce reliability.

Phased financing enables enterprises to upgrade equipment gradually, avoiding over-extension while building capacity. Such loans support both on-farm operations and allied MSMEs, enabling long-term productivity gains without compromising financial stability.

Why Structured Machinery & Equipment Loans Matter

Structured machinery and equipment loans address the above-mentioned challenges by aligning financing with agricultural realities.

- Aligning tenure with asset life

Farm machinery and equipment such as tractors, harvesters, processing units, and handling systems generate value over multiple years of use. Structuring loan tenures in line with the expected working life of these assets helps reduce short-term repayment pressure and allows enterprises to recover costs gradually through regular operations rather than upfront strain.

- Repayment aligned to crop and operating cycles

Agricultural and agri-linked businesses typically earn revenues in seasonal cycles rather than evenly through the year. When loan instalments are aligned with crop harvest periods and operating cash flows, enterprises are better positioned to meet repayments without disrupting working capital or facing sudden cash flow shocks during lean months.

- Phased upgrades instead of one-time overreach

Most agri-MSMEs do not need to invest in the full range of machinery at the start. Structured financing enables a step-by-step approach to capacity building—beginning with essential machinery, followed by attachments or implements, and eventually expanding into post-harvest handling or processing equipment as operations and revenues stabilise.

- Supporting both farm operations and allied MSMEs

Mechanisation is not limited to cultivation alone. Equipment financing also supports allied and downstream MSMEs such as aggregators, custom hiring operators, food processors, storage units, and logistics service providers. Access to machinery enables these enterprises to improve efficiency, scale operations, and deliver consistent output across the agricultural value chain.

- Higher Equipment Uptime

Financing newer or better-quality equipment allows enterprises to operate more consistently, reduce downtime-related disruptions, and maintain predictable service schedules during peak agricultural and processing periods.

This is where Machinery & Equipment Loan from an RBI-regulated NBFC such as Protium becomes a practical enabler for agri-MSMEs looking to build reliable capacity. Financing can support the purchase of primary machinery (tractors, power tillers), implements and attachments (rotavators, cultivators, seed drills), post-harvest equipment (reapers, threshers, balers), and ancillary logistics tools (trailers and material handling attachments). It can also support equipment for agri-allied and food processing enterprises, such as cleaning, grading, packaging, and small processing machinery—where assets directly improve throughput and quality.

The outcome is not only equipment ownership but also smoother operations, better planning discipline, and a stronger ability to serve customers consistently across the season. Farm machinery also aligns with domestic manufacturing momentum. Sector reports continue to position farm equipment as a space with strong potential for innovation and investment, supporting the broader Make in India direction.