India’s Social Security Expansion to 100 Crore Workers: 9 Ways MSMEs Can Prepare for the Transition

India is expanding the social security coverage to 100 crore workers from 90 crore by 2026. While this reflects a long-term push toward formalising the country’s workforce, for MSMEs, it’s a permanent change in how employment will be regulated and documented.

Because MSMEs employ a large share of informal, contractual, and gig workers, they are at the heart of this transition. The expansion is designed to integrate existing employment structures into formal systems, rather than dismantle flexible business models.

The use of digital registries and unified platforms will reduce paperwork and manual filings in the long run. MSMEs that build basic digital readiness early will face lower administrative friction as enforcement tightens.

Access to health, insurance, and retirement benefits improves worker confidence and loyalty. For MSMEs, this can translate into lower attrition, better attendance, and stronger ability to attract skilled and first-time workers in a more formal labour market.

Mapping workforce categories, strengthening payroll discipline, and budgeting for statutory contributions ahead of time allows MSMEs to absorb changes gradually. Businesses that prepare early are more likely to achieve smoother compliance and greater operational stability as 2026 approaches.

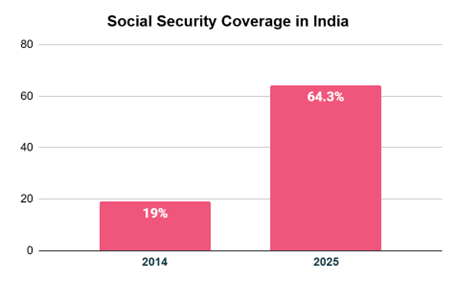

The government plans to expand social security coverage from 94 crore workers to 100 crore by March 2026, supported by worker-friendly provisions under the four Labour Codes rolled out in November 2025. This follows a sharp improvement over the last decade, with coverage rising from 19% in 2015 to 64.3% in 2025 (an increase of 45.3 percentage points), placing India behind only China, which covers 107 crore workers1.

The goal of expanding social security coverage signals deeper workforce inclusion and aims to bring uncovered workers into existing social security frameworks through simplified processes and digital systems. This approach seeks to balance worker protection with ease of doing business. Instead of creating parallel welfare structures, the government is strengthening the reach of current mechanisms.

For MSMEs, this policy means a structured transition toward formal workforce practices.

Social Security Expansion and Labour Reforms

The expansion of social security coverage is closely linked to India’s labour law reforms, particularly the consolidation of 29 laws into 4 codes. These reforms aim to reduce complexity, remove overlaps, and improve clarity of compliance. Because MSMEs often struggle with fragmented rules and unclear obligations, a unified framework makes it easier to understand responsibilities and plan compliance over time. The emphasis is on gradual adoption, allowing enterprises to align systems without disrupting day-to-day operations.

Digital Registries and Unified Frameworks Driving Coverage

A key enabler of this expansion is the use of digital registries and centralised databases. Worker identification and benefit mapping are increasingly being done through technology-driven platforms that allow portability across states and sectors.

For MSMEs, digital systems reduce paperwork and manual filings. At the same time, they improve visibility of workforce data, making it easier to manage employment records and statutory requirements. While this requires basic digital readiness, it also lowers long-term administrative friction.

Inclusion Over New Welfare Creation

The government’s approach prioritises inclusion rather than additional fiscal spending. The goal is to ensure that every worker has access to at least one form of social security—whether related to health, retirement, insurance, or income support.

For MSMEs, this distinction means that the expansion does not necessarily translate into sudden new costs, but rather structured participation in existing systems. Over time, this can help stabilise labour markets and reduce uncertainties for both employers and workers.

The Code on Social Security, 2020: What MSMEs Need to Understand

The Code on Social Security, 2020 plays a central role in this transition. It consolidated multiple social security laws under one framework, creating a more consistent approach to worker benefits.

One of the most significant changes introduced by the Code is the expanded definition of who qualifies as a worker. Beyond traditional full-time employees, the Code recognises unorganised, gig, and platform workers. This reflects the reality of modern employment, especially within MSMEs that rely on flexible staffing models.

Expanded Worker Definitions and Benefit Coverage

Under the Code, a wider range of workers becomes eligible for social security benefits. These include provident fund contributions, employee insurance, maternity benefits, and old-age security. The objective is to ensure basic protection across employment types.

Many small businesses operate in sectors such as manufacturing, services, logistics, retail, and construction. For such industries where contract labour, daily wage workers, and gig roles are common, this becomes relevant because the expanded coverage brings these workers into a formal safety net without fundamentally changing business models.

Why MSMEs Are at the Centre of This Expansion

MSMEs form the backbone of India’s employment ecosystem. Their dependence on informal and semi-formal labour has historically been driven by cost constraints, demand variability, and limited administrative capacity.

The policy intent is not to penalise this structure but to gradually integrate it into formal systems. Social security registration improves workforce visibility and creates employment records that support mobility, skilling, and long-term protection. For MSMEs, this represents a shift from informal hiring practices toward documented workforce management. Here’s how

Implications for Compliance and HR Planning

As coverage expands, MSMEs will need to place greater emphasis on basic documentation and record-keeping. This includes maintaining employee details, wage records, tenure information, and contribution tracking where applicable.

Digital compliance systems are expected to become the norm. While this requires some initial adjustment, it also simplifies reporting and reduces manual errors. Even small teams may need clearer role definitions and internal accountability to manage compliance efficiently.

Cost Management and Operational Adjustments

One of the primary concerns for MSMEs is the financial impact of recurring statutory contributions. Social security participation introduces predictable, ongoing expenses that must be planned for.

Integrating these costs into monthly operating budgets helps avoid cash flow stress. Phased compliance allows businesses to adjust gradually rather than absorbing sudden financial pressure. Predictable payroll cycles and disciplined financial planning become increasingly important as workforce formalisation progresses.

Workforce Stability and Retention Benefits

Beyond compliance, expanded social security coverage can deliver tangible workforce benefits. Access to health insurance, retirement savings, and income protection improves worker confidence and loyalty.

For MSMEs, this can reduce attrition and job-hopping, which are common challenges in labour-intensive sectors. Improved attendance and productivity often follow when workers feel financially and medically secure. Over time, this stability supports consistent output and operational continuity.

Hiring and Talent Access in a Formalising Labour Market

As the labour market becomes more structured, social security coverage increasingly acts as a trust signal for potential employees. Workers, particularly younger and first-time job seekers, are placing greater value on stability alongside wages.

MSMEs that adopt compliance early may find it easier to attract skilled and semi-skilled talent. Early alignment also creates a competitive advantage as enforcement tightens and informal practices become less sustainable.

Practical Steps Preparing MSMEs for the Transition

The period leading up to 2026 offers MSMEs a valuable window to prepare. Mapping workforce categories, identifying eligible workers, and updating records are practical first steps.

1. Map the Workforce Structure

Create a clear view of existing worker categories, including permanent, contractual, and gig roles. This helps businesses understand how different segments of the workforce may be impacted by expanded social security coverage.

2. Identify Eligible Workers Early

Assess which workers are likely to fall under the expanded social security framework and update employment records accordingly. Early identification reduces confusion as implementation timelines approach.

3. Update Workforce Details on Official Platforms

Registering and maintaining accurate worker data on relevant government platforms improves compliance readiness and limits operational disruption closer to enforcement deadlines.

4. Align Internal Processes and Payroll Systems

Review payroll, reporting, and internal workflows to ensure they are consistent with emerging compliance requirements. Early alignment allows smoother transitions and fewer last-minute adjustments.

5. Conduct a Workforce and Documentation Audit

Evaluate existing employment documents, wage records, and statutory filings to identify gaps. A structured audit helps prioritise corrective actions.

6. Formalise Basic Employment Terms

Where informal arrangements exist, introduce basic written terms to clarify roles, wages, and engagement conditions. This improves transparency for both employers and workers.

7. Strengthen Payroll and Accounting Discipline

Accurate payroll and disciplined accounting reduce compliance risks and support predictable cash flow management as statutory obligations expand.

8. Track Official Policy Updates Regularly

Monitor government notifications and implementation guidelines to stay aligned with regulatory developments and avoid surprises.

9. Budget for Compliance and Social Security Costs

Plan social security contributions and related expenses within annual and quarterly budgets to maintain financial stability during the transition to 2026.

Businesses that prepare early are likely to experience smoother compliance, stronger employee retention, and improved readiness for growth. As 2026 approaches, social security integration will increasingly become a marker of operational maturity for India’s MSME sector.