- India’s e-commerce market has crossed ₹10 lakh crore in size, is growing at a high double-digit rate, and is part of a global B2C market projected to reach US$8 trillion by 2030, creating sustained demand across retail and consumer segments.

- Growth is increasingly coming from Tier-2 and Tier-3 cities, allowing retail MSMEs to reach customers well beyond their immediate locations, but with higher expectations on service quality.

- Categories such as fashion and beauty are expanding faster online, offering strong opportunities for private labels, regional brands, and specialised products.

- Being present online is no longer enough; consistent fulfilment, inventory discipline, and customer experience now directly affect visibility and sales.

- Retail MSMEs that strengthen backend operations, build basic digital skills in their teams, and plan growth in phases will be better positioned to compete as the market matures.

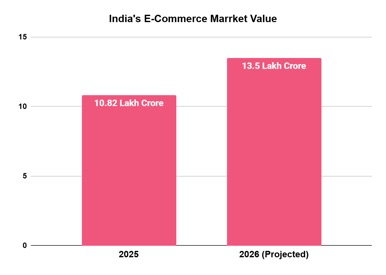

India’s e-commerce sector has recorded a gross merchandise value (GMV) of approximately ₹1.19 lakh crore, reflecting a 12% year-on-year growth. The market size has already reached ₹10.82 lakh crore and is projected to expand at a 27% CAGR, reaching ₹13.5 lakh crore by 2026[1]. This growth is supported by deeper digital adoption and changing consumer behaviour across income segments and geographies[2].

For MSMEs operating in retail and consumer services, this growth fundamentally changes the way they operate and scale. Demand is no longer confined to walk-in or local customers. Product discovery increasingly begins online, customer expectations are shaped by platform standards, and fulfilment performance directly affects brand credibility. Retail MSMEs are now participating in a national, and in some cases global, marketplace by default.

India’s Global E-Retail Position

India has surpassed the United States (290 million) to become the world’s second-largest e-retail market, with an estimated 342 million online shoppers in 2025. Globally, the country now ranks second, behind China (900 million)[3]. This scale of domestic consumption creates significant depth for retail categories while also building the foundation for outward expansion.

The country’s business-to-consumer e-commerce exports currently stand at around US$2 billion, while the global B2C e-commerce market is projected to reach US$8 trillion by 2030, indicating substantial potential for Indian sellers who can meet international standards of quality, compliance, and fulfilment.

Non-Metro India Driving the Next Wave of Growth

The momentum in India’s e-commerce expansion is increasingly coming from beyond major cities. Consumption patterns in Tier-2 and Tier-3 regions are rapidly converging with urban markets, driven by smartphone penetration, digital payments, and broader logistics coverage. During the 2025 summer sales period, Tier-3 cities recorded a 21% year-on-year increase and accounted for 38% of total order volumes, underscoring the shift in where online demand is emerging.

The growth in the online shopper base reflects this trend clearly. India’s online shoppers increased from around 14 crores in 2020 to nearly 26 crores in 2024. This base is projected to reach 30 crore by 2030 and could expand further to 70 crore by 2035, with a large proportion of new users coming from smaller towns and rural areas. By 2026, rural online shoppers are expected to grow at a CAGR of 22% to reach 8.8 crore, while urban online shoppers are expected to grow at 15% annually to reach 26.3 crore[4]. This shift enables retail MSMEs in smaller towns to access national demand but also raises expectations around service quality, delivery timelines, and customer communication.

Retail Opportunities Driven by Fashion & Beauty Categories

Among retail MSMEs, certain categories are expanding much faster. Trend-led fashion is projected to grow nearly four times to a market size of ₹68,456–₹85,570 crore by 2028[5], with more than half of category sales expected to come from online platforms, as digital channels have become central to fashion discovery, experimentation, and repeat purchasing.

Similarly, the beauty and personal care (BPC) segment is witnessing sustained momentum. The market is projected to reach a GMV of ₹2.3 lakh crore by 2028, with Tier-2 and Tier-3 cities such as Jaipur, Lucknow, and Surat leading the contribution[6]. This makes it one of the fastest-growing beauty and personal care markets globally. These categories favour private labels, regional brands, and specialised offerings, but they also demand strong branding, consistent quality, and clear digital communication.

The e-retail momentum will continue to grow, with GMV projected to reach more than 18% annually to reach ₹15.8 lakh crore by 2030[7]. This expansion is supported by continued growth in smartphone usage, digital payment adoption, logistics infrastructure, and higher disposable income.

As volumes rise, being listed online is only the starting point. As more sellers enter the same categories, visibility and sales are increasingly influenced by ratings, reviews, and repeat buying. Businesses that manage orders manually often struggle during sale periods, leading to stock mismatches, late shipments, and higher returns. In price-sensitive categories, even small inefficiencies can cut margins quickly, which makes backend control, including inventory discipline, packing accuracy, and faster issue resolution, critical for steady growth.

Manual inventory management and order handling create operational stress, especially during sales peaks. In price-sensitive segments, even small inefficiencies can erode margins quickly. This makes backend discipline as critical as front-end visibility. Artificial Intelligence (AI) is also emerging as a practical tool to manage this complexity.

AI as a Growth Enabler in E-Commerce Operations

Productivity improvements of 35–37% are expected in retail operations by 2030 through the adoption of generative AI. As many as 48% of Indian businesses have already initiated proof-of-concept (PoC) projects for generative AI solutions, and another 32% have allocated budgets or plan to invest in AI adoption[8].

For retail MSMEs, early adoption offers measurable advantages in efficiency, response time, and decision accuracy, particularly as competition increases. AI capabilities are increasingly embedded within platforms and software already used by MSMEs, lowering adoption barriers. Product listing optimisation improves search visibility and discovery, while demand forecasting helps reduce both stock-outs and excess inventory. Automated customer responses support order tracking and query resolution without increasing manpower, and pricing intelligence tools help protect margins in highly competitive environments.

These tools allow small retail businesses to operate with greater consistency and control, even as volumes rise.

Preparing Retail MSMEs for the Next Phase of Competition

As online sales rise, retail MSMEs will need to handle higher volumes without letting costs grow at the same pace. This is where artificial intelligence can support daily operations in a practical way, especially since many tools are already built into platforms and software MSMEs use. AI can help improve product listings, support demand planning, speed up customer responses, and make pricing decisions more data-based. At the same time, scaling will depend on strengthening backend processes first, building basic digital skills within small teams, and using structured financing for phased upgrades in inventory, technology, and fulfilment capacity.

- Easier Adoption Through Existing Platforms

AI tools are increasingly embedded within e-commerce platforms, accounting systems, and order management software already used by MSMEs. This allows small retail businesses to benefit from automation and insights without large upfront investments or technical expertise. - Better Product Listings and Online Visibility

AI helps improve product titles, descriptions, images, and keywords, which increases visibility in search results. Better visibility directly improves discovery and conversion, especially in crowded product categories. - Smarter Demand Forecasting

By analysing past sales patterns and seasonality, AI tools help MSMEs estimate future demand more accurately. This reduces the risk of stock-outs during peak periods and avoids excess inventory that ties up working capital. - Automated Customer Support

AI-powered responses can handle routine customer queries such as order status, delivery updates, and return requests. This improves response times and customer satisfaction while reducing pressure on small teams. - Pricing Intelligence for Margin Protection

AI tools track demand trends and competitive pricing to support more informed pricing decisions. This helps MSMEs remain competitive while protecting margins in price-sensitive online markets.

With GMV increasing, financial pressure also often rises. Higher sales do not automatically result in better cash flow, especially when inventory, logistics, and settlement cycles are misaligned. Retail MSMEs need to use data more actively to ensure that growth remains financially sustainable.

Managing Cash Flow and Scale With Data-Led Decisions

Here’s how small e-retail businesses can manage cash flow:

- Inventory Planning Based on Sales Data

Sales data helps MSMEs plan inventory purchases based on actual demand patterns rather than estimates, reducing overstocking and unnecessary cash blockage. - Early Identification of Cash Gaps

Tracking order volumes and payment cycles makes it easier to predict cash shortfalls during peak demand periods and prepare funding in advance. - Better Alignment of Payments and Repayments

Clear visibility into cash inflows allows businesses to align supplier payments, loan repayments, and marketplace settlements more effectively, reducing financial stress. - Improved Readiness for Formal Financing

Maintaining structured sales and financial records improves access to formal financing, enabling MSMEs to fund growth, technology upgrades, or operational improvements when needed.

As e-retail and consumer categories scale, access to timely and structured finance becomes a key enabler of growth. Retail MSMEs increasingly need capital to fund inventory expansion, upgrade fulfilment capabilities, and invest in digital tools without disrupting daily operations. RBI-regulated NBFC Protium’s financing solutions are designed to support this transition by aligning credit with business cash flows and growth stages. By enabling phased upgrades rather than one-time leaps, such financing helps e-retail and consumer MSMEs strengthen operations, absorb demand fluctuations, and scale sustainably in an increasingly competitive digital marketplace.

[1] IBEF, E-Commerce Industry in India

[2] IBEF, E-Commerce Industry in India

[3] Statista, 2025

[4] Brickwork Research, E-Commerce Market in India, October 2024

[5] Indian Retailer, December 2025

[6] Ken Research, ndia Beauty and Personal Care Market Outlook to 2030, March 2025

[7] Bain Report, May 2025

[8] EY India, The AIdea of India 2025 Report