EMI Calculator Online – Calculate Loan EMI Instantly

Professional EMI calculator updated with current market interest rates to calculate monthly loan installments instantly with precise breakdowns. Support for all loan types including home loans, personal loans, car loans and business loans with current RBI guidelines and flexible tenure options.

EMI Calculator – RBI Guidelines Compliant

Interest Rate Update – September 2025

This EMI calculator is updated with current market interest rates as per RBI guidelines and major banks’ lending rates effective from September 22, 2025.

EMI Calculation Results

EMI Calculator Online – Calculate monthly loan installments instantly with current market interest rates

Advanced EMI Calculator with Current Interest Rates

Our professional EMI calculator is updated with current market interest rates as per RBI guidelines to provide instant and accurate monthly installment calculations. Calculate monthly EMI, total interest, and repayment amount with precision using our advanced loan calculation system supporting current market rates and flexible tenure options.

🏠 Home Loan EMI Calculator

Calculate home loan EMI with current interest rates from 8.5% to 12% as per major banks. Perfect for property buyers planning their monthly budget with accurate mortgage calculations and repayment schedules.

🚗 Car Loan EMI Calculator

Instant car loan EMI calculations with current market rates from 9% to 15%. Plan your vehicle purchase with precise monthly installment calculations for new and used car financing options from authorized lenders.

💼 Personal Loan EMI Calculator

Calculate personal loan EMI with competitive rates from 10% to 24% as per RBI guidelines. Perfect for instant loan planning for medical emergencies, education, or personal expenses with transparent calculations.

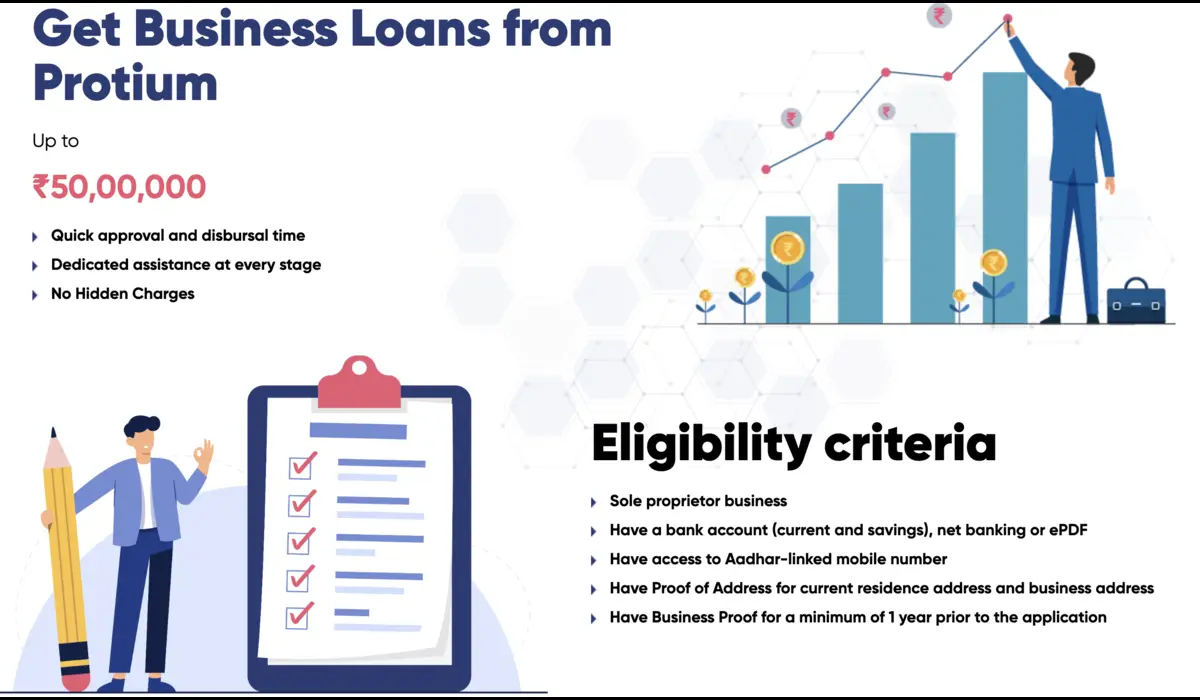

🏢 Business Loan EMI Calculator

Professional business loan EMI calculations with rates from 11% to 18% as per MSME guidelines. Essential for entrepreneurs planning business expansion, working capital, or equipment financing with accurate cost projections.

📱 Mobile-Responsive Calculator

Access our EMI calculator from any device – desktop, tablet, or mobile. Calculate loan EMI on-the-go with our responsive, user-friendly interface designed for modern borrowers with instant results.

⚡ RBI Guidelines Compliant

Professional EMI calculator with 100% accurate calculations using standard EMI formula as per RBI guidelines. No registration required, unlimited calculations, and instant results for all your loan planning needs.

| Loan Type | Interest Rate Range | Typical Tenure | Key Features |

|---|---|---|---|

| Home Loan | 8.5% – 12% p.a. | 15-30 years | Lowest interest rates, tax benefits, long tenure |

| Car Loan | 9% – 15% p.a. | 3-7 years | Quick approval, asset-backed security |

| Personal Loan | 10% – 24% p.a. | 1-5 years | Unsecured, quick disbursal, flexible usage |

| Business Loan | 11% – 18% p.a. | 1-10 years | Working capital, expansion, equipment finance |

| Education Loan | 8.5% – 15% p.a. | 5-15 years | Moratorium period, government subsidies available |

| Loan Against Property | 9% – 16% p.a. | 5-20 years | High loan amount, property as collateral |

Interest rates are subject to change as per RBI policy and market conditions. For latest rates, visit Reserve Bank of India or consult with authorized lenders.

Understanding EMI Calculations & Market Rates

What is EMI Calculator?

An EMI calculator is a financial tool that helps calculate monthly loan installments using the standard formula: EMI = [P x R x (1+R)^N] / [(1+R)^N-1]. Our EMI calculator provides precise calculations for all loan types with current market interest rates as per RBI guidelines. For official banking regulations, visit the Reserve Bank of India.

Current Interest Rate Scenario

Repo Rate: Current RBI repo rate affects all lending rates

Base Rate: Minimum lending rate as per RBI guidelines

MCLR: Marginal Cost of funds based Lending Rate

Our EMI calculator automatically applies current market rates and provides instant calculations with detailed breakdowns. Learn more about banking regulations on the Indian Banks Association website.

Benefits of Professional EMI Calculator

Our professional EMI calculator provides instant, accurate calculations with current market rates for better financial planning. Essential for borrowers comparing loan options, planning monthly budgets, and understanding total cost of borrowing with precise interest and principal breakdowns as per industry standards.

Explore Financial Tools & Loan Services

Equipment & Machinery Finance

We help you secure the machinery you need while preserving working capital for smooth daily operations.

Know More →Reverse GST Calculator

Calculate base price from GST inclusive amounts with GST 2.0 rates

Calculate Reverse GST →Frequently Asked Questions – EMI Calculator

Our EMI calculator uses the standard EMI formula: EMI = [P x R x (1+R)^N] / [(1+R)^N-1] where P is principal, R is monthly interest rate, and N is tenure in months. It works with current market interest rates as per RBI guidelines for all loan types including home loans (8.5%-12%), car loans (9%-15%), personal loans (10%-24%), and business loans (11%-18%).

Our EMI calculator supports interest rates from 1% to 50% per annum to accommodate all loan types with current market rates. As per September 2025 market conditions: Home loans (8.5%-12%), Car loans (9%-15%), Personal loans (10%-24%), Business loans (11%-18%), and Education loans (8.5%-15%). The calculator automatically computes monthly EMI based on your selected rate with detailed repayment breakdowns.

RBI policy changes, especially repo rate modifications, directly impact lending rates across all banks and financial institutions. When RBI increases repo rates, loan interest rates typically rise, resulting in higher EMIs. Conversely, rate cuts lead to lower EMIs. Our calculator reflects current market rates, and borrowers should monitor RBI announcements for potential EMI changes on floating rate loans.

Fixed rate EMIs remain constant throughout the loan tenure as the interest rate doesn’t change, providing payment predictability. Floating rate EMIs fluctuate based on market conditions and RBI policy changes. Our EMI calculator can compute both scenarios – use a fixed rate for consistent EMI calculations or adjust rates periodically for floating rate scenarios to understand potential EMI variations.

Absolutely! Our EMI calculator is perfect for comparing loan offers from different banks and NBFCs. Input various interest rates, processing fees, and tenure options from different lenders to compare total cost of borrowing. This helps you choose the most cost-effective loan option that fits your budget while considering all associated costs beyond just the EMI amount.

Our EMI calculator provides 100% accurate calculations using the standard EMI formula recognized by all financial institutions and RBI guidelines. However, actual EMI may vary slightly due to processing fees, insurance charges, and other applicable costs. The calculator gives you precise principal and interest calculations that form the base EMI amount used by all authorized lenders.

While our EMI calculator provides standard monthly installment calculations, prepayments can significantly reduce total interest and tenure. For prepayment calculations, you can use our results as a base and calculate savings manually or consult with your lender for precise prepayment schedules. Most lenders allow partial prepayments without penalties as per RBI guidelines.

Besides EMI affordability, consider processing fees (typically 0.5%-2% of loan amount), prepayment charges, insurance requirements, documentation charges, and credit score impact. Also evaluate lender reputation, customer service quality, digital banking facilities, and loan approval timelines. Our EMI calculator helps with the basic calculation, but comprehensive evaluation ensures you choose the right lender and loan product.

Disclaimer:

This EMI calculator is updated with current market interest rates for informational and educational purposes only. Actual EMI amounts may vary based on lender policies, processing fees, and other charges. For official interest rates and loan terms, please refer to the Reserve Bank of India, Indian Banks Association, and NABARD.

*Terms and conditions apply for all financial products and services offered by Protium Finance Ltd.