Government–Corporation Partnerships Creating a New E-Commerce Growth Path for Artisans & MSMEs

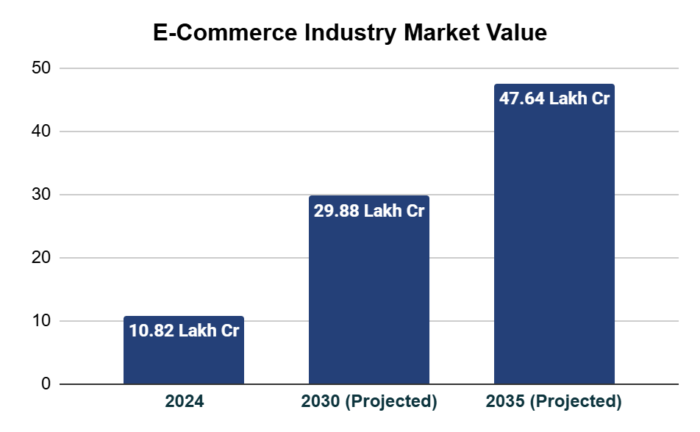

- With India’s e-commerce market valued at ₹10,82,875 crore in 2024 and handicrafts exports at ₹33,122.79 crore in FY 2024–25, the sector is creating a structural shift that allows artisans and MSMEs to move beyond seasonal local trade into sustained national and global markets.

- Government initiatives such as the PM Vishwakarma Scheme, Pehchan Artisan Identification Programme, National Handicrafts Development Programme (NHDP), Comprehensive Handicrafts Cluster Development Scheme (CHCDS), and Labour Codes are laying a strong institutional foundation by formalising artisans, improving skills, strengthening social security, and enabling enterprise-led growth.

- Government support is being amplified through collaboration with large corporations, which bring essential capabilities such as digital commerce infrastructure, demand aggregation, organised logistics, and operational training, helping convert policy intent into scalable and repeatable market outcomes.

- Programs including the Karigar Mission, Samarth Initiative, Startup Hub initiatives, and the Vriddhi Program are supporting artisans and MSMEs across growth stages, helping them progress from market entry to sustained scale through better formalisation, operational maturity, and readiness for larger and repeat orders.

- As artisans and MSMEs integrate into structured digital ecosystems, access to timely formal finance becomes critical to manage working capital needs, longer payment cycles, and capacity expansion, making financial readiness a key enabler of long-term, sustainable growth.

Valued at ₹10,82,875 crore in 2024, India’s e-commerce sector is in a decisive phase of expansion. The industry is projected to grow to ₹29,88,735 crore by 2030 and further to ₹47,64,650 crore by 20351. This growth is being driven by rising digital adoption, deeper internet penetration, and evolving consumer preferences across Tier-2 and Tier-3 cities. Artisans are among the segments benefiting from the expansion, driven by a structural shift in how traditional products reach consumers. Crafts that were earlier limited to local haats, exhibitions, or seasonal trade can now reach national and global markets that were previously inaccessible through physical channels alone. This is evident from handicrafts exports reaching ₹33,122.79 crore in FY 2024–252.

Recognising this opportunity, the Government of India has strengthened its focus on integrating traditional artisans into the formal and digital economy. While government schemes provide the framework, achieving scale requires complementary capabilities. Market access, logistics, digital infrastructure, and demand aggregation are areas where public systems alone cannot deliver at speed. This gap has led to structured collaboration between government institutions and large private ecosystems, creating a new growth pathway for artisan-led MSMEs.

Government’s Strategic Push to Empower Artisans

India’s artisan industry employs 64.66 lakh artisan workers3 across traditional trades such as pottery, weaving, metalwork, woodcraft, leatherwork, and sculpting. Many of these enterprises have historically operated informally, with limited access to credit, inconsistent demand, and heavy dependence on intermediaries.

To support the industry, the Government’s policy thinking has moved beyond preservation and welfare. The focus is on enterprise creation, income stability, and long-term sustainability through various initiatives, such as:

Pehchan Artisan Identification Programme: With over 32 lakh artisans across the country, Pehchan ID cards integrate artisans into the formal economy, enabling them to access benefits under various Government of India schemes. This, in turn, improves their working conditions, bargaining power, and economic security.

National Handicrafts Development Programme (NHDP): Focuses on strengthening artisan clusters through infrastructure support, design development, technology upgradation, and improved domestic and export market access for handicraft producers.

Comprehensive Handicrafts Cluster Development Scheme (CHCDS): Aims to develop integrated handicrafts clusters by providing common facility centres, raw material support, skill upgradation, and end-to-end value chain assistance to artisan groups.

Labour Codes (Labour Codes): consolidate multiple labour laws to extend formal employment benefits, social security coverage, wage protection, and safer working conditions to artisans and craft workers operating in the unorganised sector.

PM Vishwakarma Scheme: Launched on 17 September 2023, the scheme provides holistic, end-to-end support to artisans registered under the scheme. Its objective is to strengthen traditional skills while enabling artisans to operate as modern enterprises.

The scheme is designed to cover the full lifecycle of artisan enterprise development, including skill training, access to modern toolkits, market linkage support, and access to formal credit. A defining feature is its focus on improving product quality while preserving traditional skills, ensuring that cultural authenticity is retained even as artisans enter modern markets.

While these initiatives and schemes provide institutional structure and direction, government systems need to go beyond direct operational reach to drive large-scale market integration at speed. Structural gaps remain in areas such as demand aggregation, real-time consumer access, logistics coordination, and digital infrastructure management, which are critical for sustained commerce.

These gaps have made collaboration with large corporations operating national and global digital networks to augment government initiatives and translate policy intent into scalable outcomes.

Role of Large Corporations in Artisan and MSME Integration

In an evolving ecosystem, large corporations function not just as producers but also as enablers. They can play a pivotal role is connecting artisans and MSMEs with infrastructure and markets that would otherwise be inaccessible.

Key Areas of Contribution include:

- Digital commerce infrastructure

Private ecosystems provide the technological backbone that enables artisans to showcase products digitally, manage orders, and track performance.

- Product discovery and demand aggregation

By bringing multiple artisans onto organised platforms, these systems aggregate consumer demand and improve product visibility, reducing reliance on local footfall.

- Logistics and fulfilment systems

Organised pickup, warehousing, and delivery networks allow small producers to serve distant customers reliably.

- Training in digital selling and operations

Structured training helps artisans understand cataloguing, pricing, customer expectations, and delivery discipline.

Several large corporation initiatives are already underway to boost the industry’s growth and meet the demand for their products. These include:

Karigar Mission: Creating Market Access for Traditional Artisans

The Karigar Mission represents a structured government–corporatin partnership model focused on onboarding traditional artisans into organised digital marketplaces. The initiative is designed to integrate artisans registered under national schemes into formal selling environments with operational support.

Through guided digital onboarding, training in cataloguing and pricing, and access to organised logistics networks, the mission aims to improve income stability for artisans while preserving the authenticity of traditional crafts

Samarth Initiative: Supporting Women-Led MSMEs

The public–private partnership framework has also been extended to women entrepreneurs through initiatives such as the Samarth Initiative. It focuses on improving market access, providing mentorship, and encouraging formalisation among women-led enterprises, particularly in Tier-2 and Tier-3 regions. Such initiatives help reduce entry barriers and strengthen inclusive participation within the MSME ecosystem

Startup Hub Programs Under National Digital Missions

Early-stage enterprises are being supported through Startup Hub programs under national digital and technology missions. These programs focus on improving access to markets, digital infrastructure, and mentoring support.

For innovation-led MSMEs, this integration reduces early-stage market-entry risks and shortens the path to commercial viability

Vriddhi Program: Scaling Growth-Stage MSMEs

The Vriddhi Program targets MSMEs that have crossed the entry stage and are preparing to scale operations (Source: Ministry of MSME). The program focuses on advanced compliance readiness, digital operations, supply chain strengthening, export preparedness, and improved financial reporting.

This support enables MSMEs to transition from small enterprises into resilient, growth-oriented businesses capable of sustaining expansion.

As MSMEs move from early-stage participation to sustained scale under programs, the nature of support also evolves. What begins as market access and operational assistance gradually translates into deeper organisational maturity. Here’s how the partnership helps in this regard:

Formalisation as the Core Outcome of Digital Integration

One of the most significant outcomes of government-corporation initiatives is accelerated formalisation of artisan enterprises. Participation in organised marketplaces requires artisans to operate as registered entities, maintain transaction records, and follow basic compliance norms.

This transition enables access to institutional credit, eligibility for government incentives, participation in public procurement systems, and improved credibility with buyers, thereby transforming informal craft activity into structured enterprise growth.

Skill Development

Public–private initiatives increasingly recognise that market participation requires enterprise capabilities in addition to technical skill. Artisans are being trained in digital product listing, order management, quality consistency, packaging standards, and customer handling.

These capabilities help artisans move away from low-margin, price-driven selling toward value-added offerings that support repeat demand and long-term income resilience.

Supply Chain and Logistics Enablement

Logistics has historically been a major constraint for artisan MSMEs, particularly those operating from remote or cluster-based locations. Structured partnerships now aim to resolve this bottleneck by integrating artisans into organised pickup, warehousing, and delivery systems. Predictable shipping timelines, standardised packaging, and simplified reverse logistics reduce losses and improve customer trust, directly influencing profitability and repeat business.

As artisans and MSMEs integrate into structured ecosystems, their financial needs evolve, too. Irregular cash flows are replaced by larger, repeat orders that usually come with longer payment cycles. Managing this transition requires access to formal finance. Business Loans, Loan Against Property, and Top-Up Loans from RBI-regulated NBFC Protium can sustain participation and result in financial readiness to achieve long-term growth.