GST Full Form – Goods and Services Tax Complete Guide 2025

Discover GST full form, meaning, types (CGST, SGST, IGST), current rates, registration process, and benefits. Complete guide to Goods and Services Tax in India with practical examples and expert insights.

GST

Goods and Services Tax

What is GST?

GST full form is Goods and Services Tax – a comprehensive indirect tax system that replaced multiple taxes in India. Implemented on July 1, 2017, GST is a single tax levied on the supply of goods and services from manufacturer to consumer, creating “One Nation, One Tax” system.

Types of GST – CGST, SGST, IGST Full Forms

CGST

CGST is collected by the Central Government on intra-state transactions. When goods or services are sold within the same state, both CGST and SGST are applicable. CGST rates range from 0% to 14% depending on the product category.

SGST

SGST is collected by the State Government on transactions within the state. It always accompanies CGST for intra-state sales. SGST rates are identical to CGST rates, ensuring revenue sharing between central and state governments.

IGST

IGST applies to inter-state transactions, imports, and exports. When goods cross state boundaries, IGST is levied instead of CGST+SGST. IGST rates equal the combined CGST and SGST rates for equivalent intra-state transactions.

UTGST

UTGST applies to transactions within Union Territories without legislature (like Chandigarh, Andaman & Nicobar Islands). It functions similarly to SGST but is administered by the Central Government for these specific territories.

Current GST Rates in India 2025

| GST Rate | Category | Common Items | CGST + SGST Split |

|---|---|---|---|

| 0% | Essential Items | Fresh fruits, vegetables, milk, eggs, bread, salt, jaggery | 0% + 0% |

| 5% | Daily Necessities | Packaged food, sugar, tea, coffee, medicines, coal, LPG | 2.5% + 2.5% |

| 12% | Standard Items | Computers, mobile phones, frozen vegetables, butter | 6% + 6% |

| 18% | Most Goods & Services | Electronics, IT services, restaurants, soaps, capital goods | 9% + 9% |

| 28% | Luxury Items | Cars, motorcycles, AC, refrigerator, tobacco, luxury goods | 14% + 14% |

*Rates are subject to change as per government notifications. Check the latest GST rates before transactions.

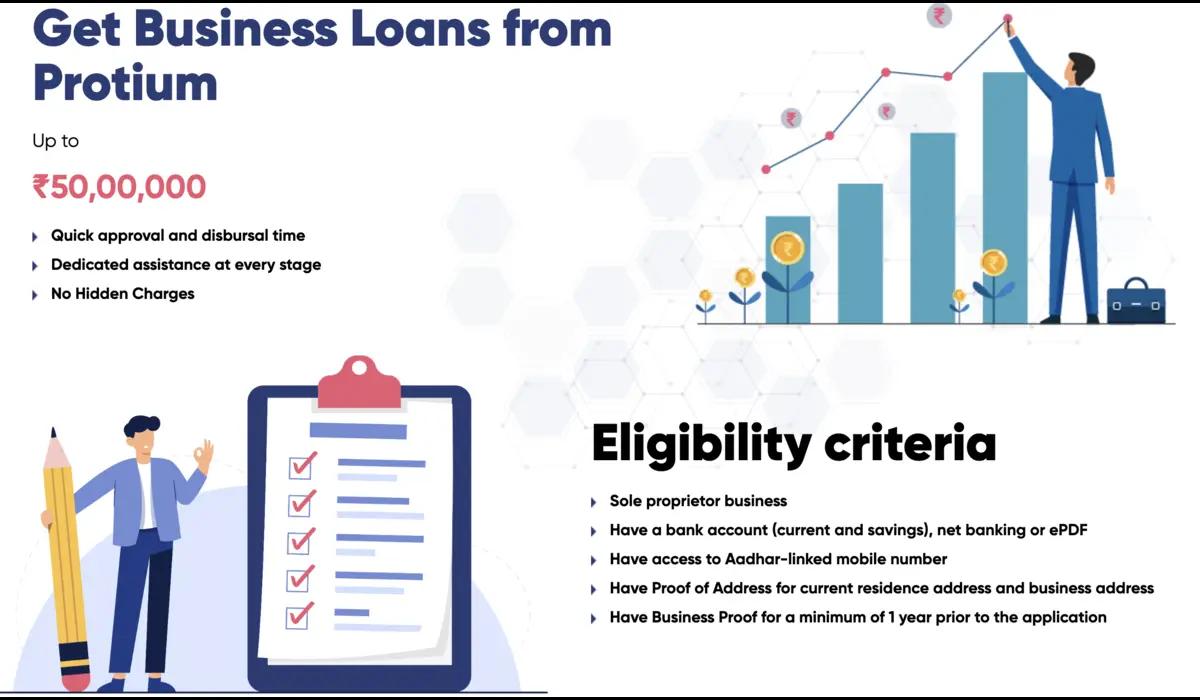

Need Business Funding or Property-Backed Loans?

Get instant business loans or leverage your property for financial growth with competitive rates and expert guidance

GST Full Form – Comprehensive guide to Goods and Services Tax in India

Benefits and Features of GST System

Understanding GST full form and benefits helps businesses and consumers appreciate this revolutionary tax system. Goods and Services Tax has simplified India’s taxation structure while promoting transparency and economic growth.

📋 Simplified Tax Structure

GST replaced multiple indirect taxes like VAT, excise duty, service tax, and octroi with a single comprehensive tax system, reducing compliance burden and simplifying business operations across India.

🔄 Input Tax Credit

Businesses can claim input tax credit for taxes paid on purchases, eliminating the cascading effect of taxes. This reduces the overall tax burden and makes Indian goods more competitive in global markets.

💻 Digital Platform

GST operates on a robust digital platform enabling online registration, return filing, and tax payment. The GSTN portal ensures transparency and reduces paperwork for businesses.

🌍 Common Market

GST creates a unified national market by removing interstate barriers and checkpoints. This facilitates free movement of goods and services, boosting trade and economic efficiency across states.

📈 Increased Tax Base

GST has significantly expanded the tax base by bringing more businesses under the formal economy. The system encourages voluntary compliance and reduces tax evasion through better monitoring.

✅ Transparency & Compliance

GST ensures complete transparency in tax administration with clear documentation requirements, standardized processes, and regular audit mechanisms for better compliance.

GST Registration & Compliance Requirements

GST Registration Threshold

Normal States: Annual turnover ₹40 lakhs

Special Category States: Annual turnover ₹20 lakhs

Service Providers: Annual turnover ₹20 lakhs (all states)

E-commerce: Mandatory registration regardless of turnover

Businesses exceeding these thresholds must obtain GST registration within 30 days.

GST Return Filing

GSTR-1: Monthly/Quarterly outward supplies

GSTR-3B: Monthly summary return

GSTR-9: Annual return

GSTR-4: Quarterly for composition scheme

Timely return filing is crucial to avoid penalties and maintain GST compliance status.

Required Documents

PAN Card: Primary identifier for GST registration

Aadhaar Card: For proprietorship businesses

Business Address Proof: Utility bills, rent agreement

Bank Account Details: Business bank statements

Ensure all documents are valid and updated before GST registration application.

Business Financial Services & Tools

GST Calculator

Calculate CGST, SGST, and IGST amounts instantly with our professional GST calculator

Calculate GST →Business Loans

Get business funding up to ₹50 lakhs for GST compliance and business expansion

Apply Now →Loan Against Property

Leverage your property for business expansion and GST-related financial needs

Explore Options →Frequently Asked Questions – GST Full Form

GST full form is “Goods and Services Tax.” It was implemented in India on July 1, 2017, replacing multiple indirect taxes like VAT, excise duty, service tax, and others. GST created a unified tax system across the country, establishing “One Nation, One Tax” policy for goods and services.

CGST full form is Central Goods and Services Tax (collected by central government), SGST is State Goods and Services Tax (collected by state government), and IGST is Integrated Goods and Services Tax (for inter-state transactions). CGST+SGST applies to intra-state sales, while IGST applies to inter-state sales and imports.

Current GST rates in India are: 0% for essential items (milk, fruits, vegetables), 5% for daily necessities (packaged foods, medicines), 12% for standard items (computers, mobiles), 18% for most goods and services (electronics, IT services), and 28% for luxury items (cars, ACs, tobacco). These rates are subject to government revisions.

GST registration is mandatory for businesses with annual turnover exceeding ₹40 lakhs in normal states and ₹20 lakhs in special category states (northeast states). For service providers, the threshold is ₹20 lakhs across all states. E-commerce operators must register regardless of turnover.

Input tax credit (ITC) allows businesses to reduce their GST liability by claiming credit for taxes paid on business purchases. This eliminates the cascading effect of taxes, where tax was levied on tax. ITC can be claimed only if the supplier has filed their returns and the goods/services are used for business purposes.

Key GST benefits include: simplified tax structure replacing multiple taxes, elimination of cascading tax effect through input tax credit, creation of unified national market, digital platform for easy compliance, transparent tax administration, reduced logistics costs, and competitive pricing for consumers due to lower tax burden on businesses.

Disclaimer:

This GST information is for educational purposes only and based on current regulations as of 2025. GST rates and rules are subject to change as per government notifications. For official GST information, consult the GST Portal or qualified tax professionals.

*Terms and conditions apply for all financial products and services offered by Protium Finance Ltd.