Compound Interest Calculator Online – Simple & Compound Interest Calculator

Professional compound interest calculator to calculate simple interest and compound interest instantly with detailed breakdowns. Advanced CI calculator with multiple compounding frequencies, investment planning, and comprehensive examples for smart financial decisions.

Interest Calculator – CI & SI Calculator

Interest Calculation Results

Compound Interest Calculator – Calculate CI and SI amounts for smart investment planning

Advanced Compound Interest Calculator & Investment Planning Tool

Our professional compound interest calculator provides instant and accurate CI calculations for smart investment planning. Calculate compound interest and simple interest with multiple compounding frequencies to maximize your investment returns and financial growth.

🧮 Professional CI Calculator

Advanced compound interest calculator with instant CI and SI calculations. Professional-grade accuracy for investment planning, savings analysis, and financial decision-making with real-time results.

📊 Multiple Compounding Frequencies

Calculate compound interest with various frequencies:

- Daily compounding (365 times per year)

- Monthly compounding (12 times per year)

- Quarterly compounding (4 times per year)

- Half-yearly compounding (2 times per year)

- Annual compounding (1 time per year)

- Continuous compounding for maximum growth

💼 Investment Planning Results

Professional compound interest calculator with detailed breakdowns perfect for investment analysis, portfolio planning, and wealth creation strategies. Compare different investment scenarios easily.

📱 Responsive CI Calculator

Access our compound interest calculator from any device – desktop, tablet, or mobile. Calculate CI and SI on-the-go with our responsive, user-friendly interface designed for modern investors.

🔄 Dual Calculator Modes

Advanced compound interest calculator supporting both CI and SI calculations. Switch between compound and simple interest modes instantly for comprehensive financial analysis and investment comparison.

✅ Precise & Reliable

Professional compound interest calculator with 100% accurate calculations. No registration required, unlimited calculations, and instant results for all your investment planning needs.

| Investment Period | Principal Amount | Interest Rate | Simple Interest | Compound Interest (Annual) | Difference |

|---|---|---|---|---|---|

| 5 Years | ₹1,00,000 | 10% p.a. | ₹50,000 | ₹61,051 | ₹11,051 |

| 10 Years | ₹1,00,000 | 10% p.a. | ₹1,00,000 | ₹1,59,374 | ₹59,374 |

| 15 Years | ₹1,00,000 | 10% p.a. | ₹1,50,000 | ₹3,17,217 | ₹1,67,217 |

| 20 Years | ₹1,00,000 | 10% p.a. | ₹2,00,000 | ₹5,72,750 | ₹3,72,750 |

Compound interest significantly outperforms simple interest over longer periods. Use our compound interest calculator to see the power of compounding in your investments.

Why Choose Our Compound Interest Calculator?

What is Compound Interest?

Compound interest is the interest calculated on the initial principal and the accumulated interest from previous periods. Our compound interest calculator uses the formula: A = P(1 + r/n)^(nt), where A is the final amount, P is principal, r is annual interest rate, n is compounding frequency, and t is time in years.

Simple Interest vs Compound Interest

Simple Interest (SI): Calculated only on the principal amount using SI = P × R × T / 100

Compound Interest (CI): Calculated on principal plus accumulated interest, leading to exponential growth

Our calculator shows both CI and SI to help you understand the power of compounding in wealth creation.

Benefits of Compound Interest Calculator

Our professional compound interest calculator provides instant, accurate calculations with detailed breakdowns. Essential for investors, financial planners, and individuals who need reliable CI computations for investment analysis, retirement planning, and wealth building strategies.

Explore Financial Tools & Investment Services

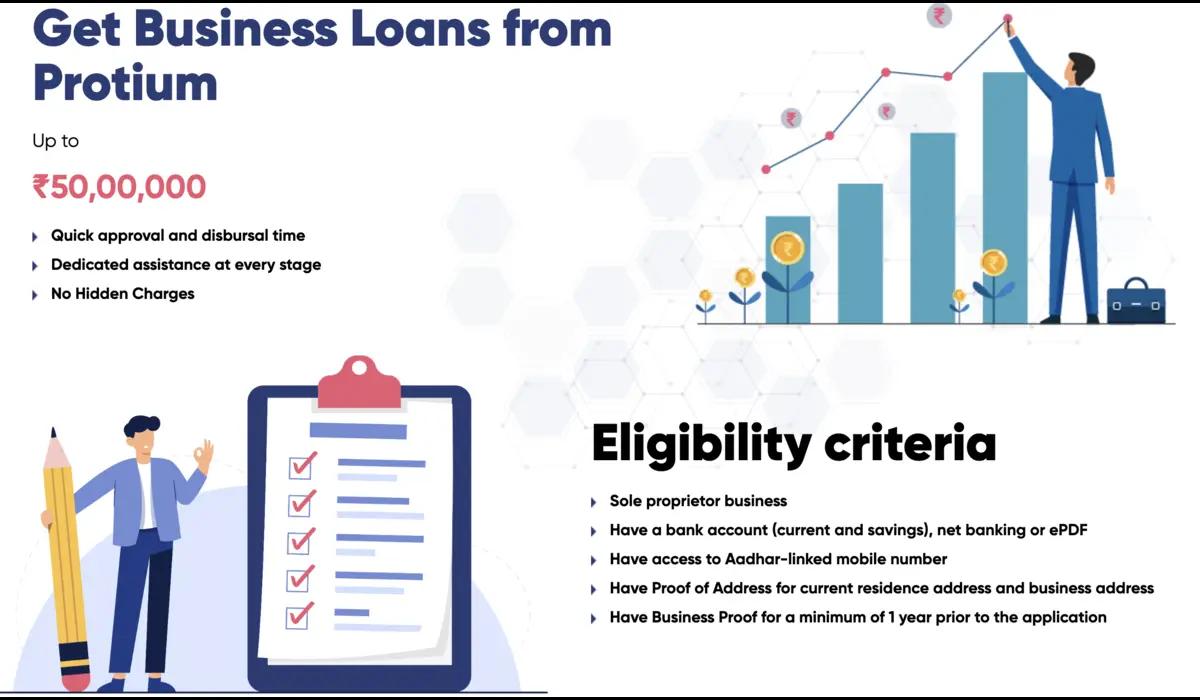

Business Loans

Get instant business funding for investment opportunities with competitive rates

Apply Now →Education Institutional Lending

We’re committed to elevating the quality of India’s education system so we can step into a better future together.

Get Consultation →Frequently Asked Questions – Compound Interest Calculator

Our compound interest calculator uses the standard formula A = P(1 + r/n)^(nt) to compute compound interest. You input the principal amount, annual interest rate, time period, and compounding frequency. The calculator instantly shows the final amount, interest earned, and detailed breakdown of how compound interest grows your investment over time.

Simple interest is calculated only on the principal amount using SI = P × R × T / 100. Compound interest is calculated on the principal plus accumulated interest from previous periods, leading to exponential growth. Our calculator shows both CI and SI calculations, demonstrating how compound interest significantly outperforms simple interest over longer periods.

Higher compounding frequencies generally yield higher returns. Daily compounding (365 times per year) gives better returns than monthly (12 times), quarterly (4 times), or annual (1 time) compounding. Continuous compounding provides the theoretical maximum return. Our calculator lets you compare different frequencies to see their impact on your investment growth.

Yes, our compound interest calculator is perfect for investment planning. You can analyze how your investments will grow over time, compare different investment scenarios, and understand the power of compounding in wealth creation. The calculator helps you make informed decisions about savings accounts, fixed deposits, mutual funds, and other compound interest investments.

Yes, our compound interest calculator is completely free and provides 100% accurate calculations based on standard financial formulas. No registration required, unlimited calculations, and instant results. The calculator is designed for professional use and is suitable for financial planning, investment analysis, and educational purposes.

The Rule of 72 is a quick way to estimate how long it takes for an investment to double at a given interest rate. Simply divide 72 by the annual interest rate. For example, at 10% interest, your money doubles in approximately 7.2 years (72 ÷ 10). Our compound interest calculator helps you verify these estimates with precise calculations.

Disclaimer:

This compound interest calculator is for informational and educational purposes only. Actual investment returns may vary based on market conditions, fees, and other factors. For professional financial advice and investment planning, please consult qualified financial advisors.

*Terms and conditions apply for all financial products and services offered by Protium Finance Ltd.