Udyam Registration Certificate – Complete Guide to Register Online 2025

Step-by-step guide to Udyam Registration for MSME businesses. Learn the complete online registration process, required documents, benefits, and download procedure with updated 2025 guidelines.

Start Your Udyam Registration Now

Register your MSME business directly on the official government portal

Register on Official Udyam Portal* Official Government Portal – No intermediary charges

Step-by-Step Udyam Registration Process

Visit Official Portal

Access the official Udyam Registration portal and click on “For New Entrepreneurs who are not Registered yet as EM-II or UAM” option.

- Go to udyamregistration.gov.in

- Select registration type

- Choose language preference

Enter Aadhaar & PAN

Provide your Aadhaar number and PAN details. The system will automatically validate and fetch your personal information.

- Enter 12-digit Aadhaar number

- Provide PAN card details

- Verify mobile number with OTP

Fill Business Details

Complete comprehensive business information including name, address, activity details, and investment particulars.

- Enterprise name and type

- Business address details

- Main activity and NIC code

- Investment and turnover data

Bank Account Details

Enter your business bank account information which will be verified through the account number and IFSC code.

- Bank account number

- IFSC code

- Bank name and branch

Upload Documents

Upload required supporting documents including business photos, proprietor photo, and signature in specified formats.

- Business/plant photographs

- Proprietor/owner photograph

- Digital signature

- Optional: Additional documents

Submit & Download

Review all information, submit the application, and immediately download your Udyam Registration Certificate.

- Review application details

- Submit the form

- Receive acknowledgment

- Download certificate instantly

Required Documents for Udyam Registration

Mandatory Documents

- Aadhaar Card (Proprietor/Partner/Director)

- PAN Card (Individual/Entity)

- Business Bank Account Details

- Business/Plant Photographs

- Proprietor/Owner Photograph

For Partnership Firms

- Partnership Deed

- All Partners’ Aadhaar Cards

- Firm’s PAN Card

- Bank Account Details

- Authorized Partner’s Photograph

For Private Limited Company

- Certificate of Incorporation

- Authorized Signatory’s Aadhaar

- Company PAN Card

- Board Resolution

- Director’s Photographs

Optional Documents

- Shop & Establishment License

- GST Registration Certificate

- Trade License

- Factory License (if applicable)

- Pollution Clearance Certificate

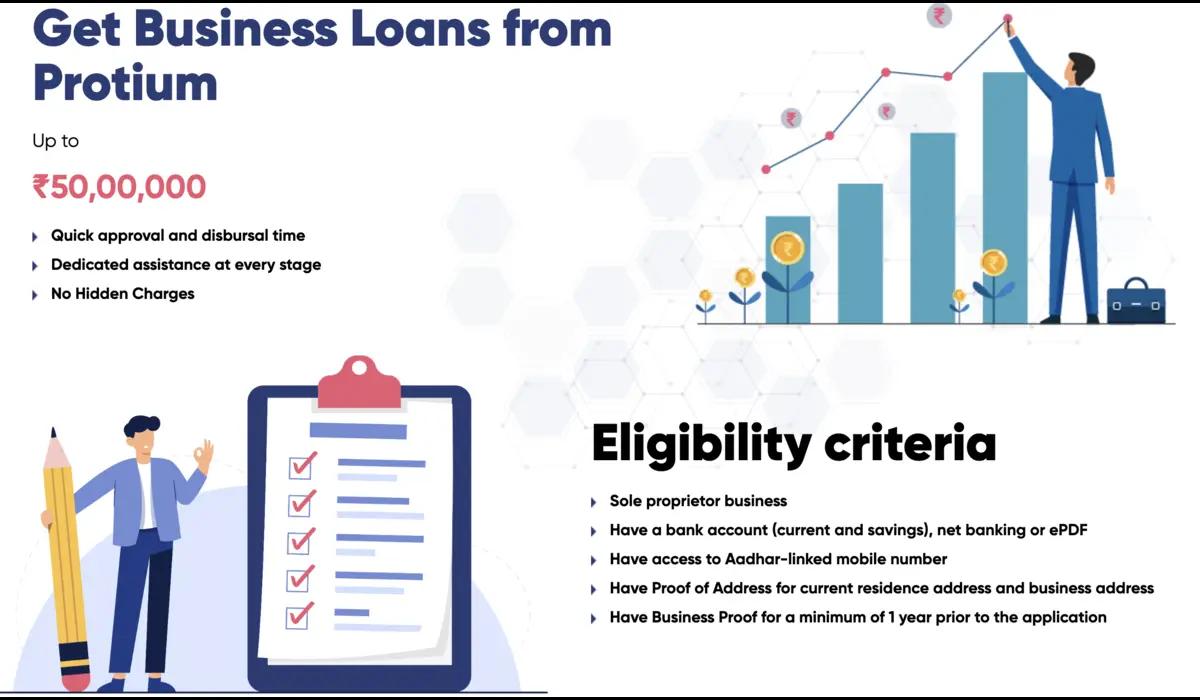

Need Financing for Your Registered MSME Business?

Leverage your Udyam Registration to access better loan terms and business funding opportunities

Complete Udyam Registration Guide – Step-by-step process for MSME businesses

Benefits of Udyam Registration Certificate

| Benefit Category | Specific Benefits | Impact |

|---|---|---|

| Financial Benefits | Easy loan access, lower interest rates, collateral-free loans up to ₹1 crore | Reduced financing costs by 2-3% |

| Government Subsidies | Credit guarantee schemes, interest subsidies, capital investment subsidies | Up to 35% capital subsidy |

| Tax Benefits | Reduced patent registration fees, lower compliance costs, tax exemptions | Save 50% on patent costs |

| Market Access | Government tender preferences, buyer-seller meets, trade fairs | Priority in government contracts |

| Technology Support | Technology upgradation schemes, R&D support, technical consultancy | Up to 75% technology cost coverage |

| Export Promotion | Export promotion schemes, international exhibition support | Reduced export compliance costs |

MSME Classification Under Udyam Registration

Micro Enterprises

Investment: Up to ₹1 crore

Turnover: Up to ₹5 crore

Examples: Small retail shops, individual service providers, home-based businesses, freelancers, cottage industries

Most suitable for individual entrepreneurs and small family businesses starting their journey.

Small Enterprises

Investment: Up to ₹10 crore

Turnover: Up to ₹50 crore

Examples: Manufacturing units, trading businesses, service companies, restaurants, IT services

Ideal for established businesses looking to scale and access better financing options.

Medium Enterprises

Investment: Up to ₹50 crore

Turnover: Up to ₹250 crore

Examples: Large manufacturing plants, established service companies, export-oriented units, technology companies

Perfect for mature businesses seeking expansion and international market access.

MSME Financial Services & Business Tools

MSME Business Loans

Special loan schemes for registered MSME businesses with competitive rates

Know More →Reverse GST Calculator

Calculate base price from GST inclusive amounts with GST 2.0 rates

Calculate Reverse GST →Loan Against Property

Use your property as collateral for business expansion funding

Explore Options →Frequently Asked Questions – Udyam Registration

Udyam Registration is the online registration process for Micro, Small, and Medium Enterprises (MSMEs) in India. It replaced the earlier Udyog Aadhaar registration. Any business engaged in manufacturing, production, or service activities that falls under MSME criteria needs Udyam Registration to avail government benefits and schemes.

Yes, Udyam Registration is completely free of cost when done through the official government portal (udyamregistration.gov.in). There are no government fees or charges. Beware of intermediaries or agents who may charge fees – you can complete the entire process yourself online for free.

Essential documents include: Aadhaar card of proprietor/authorized signatory, PAN card (individual or entity), business bank account details, business/plant photographs, and proprietor photograph. For partnerships and companies, additional documents like partnership deed, incorporation certificate, and board resolution may be required.

Udyam Registration certificate has lifetime validity. However, registered MSMEs must file annual returns and update their information periodically. Any changes in investment, turnover, or business activities should be updated in the registration to maintain compliance and continue availing benefits.

Yes, you can update your Udyam Registration details anytime through the official portal. Log in using your Udyam Registration Number and Aadhaar-linked mobile number to modify business information, investment details, turnover data, or other relevant information as your business grows.

Key benefits include: easier access to business loans with lower interest rates, collateral-free loans up to ₹1 crore, government subsidies and schemes, reduced compliance costs, priority in government tenders, patent registration fee reduction, export promotion support, and access to various MSME development programs and technology upgradation schemes.

Disclaimer:

This Udyam Registration guide is for informational purposes only and based on current government regulations as of 2025. Registration processes and requirements may change as per government notifications. For official information and registration, visit udyamregistration.gov.in.

*Terms and conditions apply for all financial products and services offered by Protium Finance Ltd.