Understanding India’s Driving Force Behind Female Entrepreneurship Success

Synopsis: India’s fintech sector is witnessing a rise in female-led entrepreneurs, shattering stereotypes and empowering women entrepreneurs. This article explores the driving forces and impact of this phenomenon.

India is among the leading countries for fintech innovation and growth, with the sector estimated to reach INR 11.36 Trn by FY 2028. Interestingly, women represent around 35 per cent of fintech start-up founders. As per the Wiser’s report, the number of women-led startup unicorns have risen to 17% from 8% in the past five years. These successful women entrepreneurs have not only proven that gender is no obstacle, but they offer inspiration that can help India’s next generation of female founders aspire to new heights. But ever wondered what fostered them to be able to thrive in India as women entrepreneurs? Let’s try to understand.

Current Scenario of Women Entrepreneurship In India

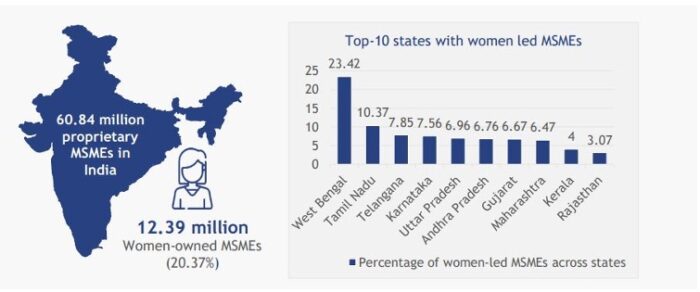

India is home to 63 million MSMEs with 20% of them owned by women entrepreneurs, creating 22-27 million jobs. Estimates suggest that with the way women entrepreneurship is scaling in India, the country may witness more than 30 million women-owned enterprises in the near future, which will produce 150 to 170 million jobs. These statistics underscore the significant contribution of women entrepreneurs towards national employment.

Alt Text: Share of wMSMEs and top-10 states

There are nearly 432 million working-age women in India. Out of them, less than 20% take part in any formal and paid work. It was also studied by GEM that women’s total early-stage entrepreneurial activity (TEA) rate in India is only 2.6%. Surprisingly, GEM reported that these female entrepreneurs are into business due to job scarcity in the market against the motivation of growing a business and earning profits.

Share of Women Entrepreneurs Towards Indian Economy

According to the annual report of the Ministry of MSME, rural areas have 22.24% of women-owned enterprises while urban areas have 18.42% women entrepreneurs, significantly contributing towards the national economy. Women entrepreneurs are strengthening 50% of India’s start-up ecosystem by fulfilling market needs and creating massive employment. As per the survey by Bain & Company, nearly 45% of rural Indian women started a business to fulfil unmet need and start-ups owned by women generate 35% higher ROI compared to men counterparts. The driving motivation for such success stems from their core responsibility to provide a better lifestyle to their family. Also, India ranks as one of the esteemed countries to foster up to 40% women entrepreneurs finishing in the area of science and technology.

But what makes women entrepreneurs start their business with ease in India?

Initiatives Promoting Easy Access to Loans for Women Entrepreneurs

The increased ease of accessing financial loans has had rippling effects across India by empowering women entrepreneurs. Financial accessibility has enabled many women to transform imaginative ideas into flourishing businesses, fueling a significant surge in the number of female entrepreneurs nationwide. Loans have also strengthened sectors traditionally dominated by women, such as handicrafts, textiles, and food processing, sustaining cultural legacies while promoting indigenous skills.

Let’s take a look at the great mediums that are acting as an early financial backbone for women entrepreneurs to scale their businesses from scratch.

Government Schemes:

Bridging financial gaps faced by female entrepreneurs, several initiatives from the government are creating a positive impact. The Micro Units Development and Refinance Agency (MUDRA) scheme particularly stands out, offering loans ranging from Rs. 50,000 to Rs. 10 lakh categorised as Shishu, Kishore, and Tarun based on the loan amount. Notably, these loans are provided without requiring collateral and women entrepreneurs can avail of subsidised interest rates.

Another pivotal program is Stand-Up India, which is uniquely designed to empower Scheduled Caste, Scheduled Tribe, and women entrepreneurs. This scheme facilitates bank loans of up to Rs. 1 crore to establish new ventures.

Public and Private Banks

Recognising the burgeoning potential of women-led businesses, banks are progressively offering customised loan products. For example, Indian Bank’s innovative “IND MSME SAKHI” provides loans at concessional rates for female entrepreneurs, coupled with mentoring programs to guide them through entrepreneurial challenges. Meanwhile, other private banks are also offering collateral-free commercial loans specifically targeting women in the manufacturing sector, enabling them to purchase equipment and expand operations.

Microfinance Institutions (MFIs):

Playing a critical role in rural regions, MFIs cater to women entrepreneurs who may lack access to conventional banking channels. These institutions offer microloans with flexible repayment schedules and frequently employ group lending models, fostering a sense of community and support among borrowers. Additionally, MFIs often provide financial literacy training, equipping women with the knowledge to effectively manage their finances.

Challenges and Areas for Improvement

While significant progress toward empowering female entrepreneurs through access to credit has without a doubt occurred, certain difficulties remain. Both lack of awareness regarding available loan options, especially in rural areas, and complex application procedures requiring onerous documentation stand as stumbling blocks preventing many women from obtaining these important resources.

However, access to capital alone does not solve all challenges facing women entrepreneurs. They must also overcome deep-rooted obstacles such as:

Unconscious gender bias: Preconceived gender-biassed notions and discriminatory practices can prevent women from matching shoulders with male entrepreneurs when seeking funds or loans from investors and financial institutions.

Work-life balance: Societal expectations frequently place disproportionate demands on women to devote time for childcare and home duties, constructing a maze difficult to navigate alongside managing a business venture.

Limited access to networks: Successful businesses are built on connections, yet women may find themselves shut out from male-dominated professional circles providing invaluable guidance, collaboration leads, and profitable opportunities.

To bridge these gaps, comprehensive solutions are the need of the hour to address such financial barriers and societal as well as cultural factors.

To fill this gap, concentrated efforts must be taken. Financial literacy initiatives and mentorship programs are absolutely vital. Also, advocacy efforts to combat unconscious bias and promote inclusive business practices are also necessary to equip women entrepreneurs with the knowledge and skills needed to navigate the loan application process and responsibly manage their finances in the long run. In addition, simplifying forms and streamlining requirements could make acquiring loans a much more surmountable task for more women. With continued efforts to enhance understanding of options and ease requirements, even greater numbers of female business owners may be empowered to achieve their entrepreneurial dreams.

End Thoughts

Women entrepreneurship is currently experiencing its golden age in India, and initiatives like our #TakeTheLeapBeTheLeap campaign are contributing to this positive trend. Beyond establishing their own ventures, women business owners are playing a crucial role in creating employment opportunities within their communities, addressing a significant need for jobs. This financial independence not only empowers women but also enhances their decision-making influence within households and society at large, leading to positive societal transformations. Moreover, as economies expand in female-led sectors and new opportunities emerge, initiatives promoting easier loan terms, such as our campaign, are effectively circulating wealth and uplifting entire populations.

Inspired by the success of barrier-breaking entrepreneurs? Rest assured that Protium is always there to help aspiring women entrepreneurs in India transform their dreams into reality through proprietary fintech solutions. Protium offers secured and unsecured loans to MSMEs anywhere in India to scale up or meet operational expenditure requirements with ease.