- India’s services sector is seeing strong growth, with the PMI indicating rising demand for service MSMEs.

- Growth in services brings immediate cost pressures and delayed cash inflows for many MSMEs. Asset-light service businesses face greater cash flow risk during expansion cycles.

- Structured financing can help these MSMEs overcome the challenges and support phased growth, operational stability, and long-term resilience.

- Financial planning can help in scaling without overextending operations or borrowing capacity.

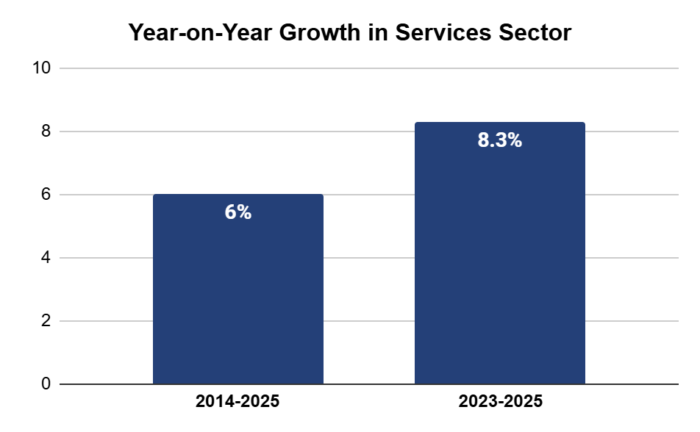

The services sector contributes 55.3% of India’s Gross Value Added (GVA) and forms the backbone of non-farm economic activity. The year-on-year growth in the sector has been above 6% between 2014 and 2025, with the average growth rising by 8.3% between FY23 and FY25. The sector’s importance is reflected in its strong performance in 2025, as the HSBC India Services Business Activity Index (PMI) stood at 60.5, indicating sustained expansion in business activity.

This growth becomes especially crucial because MSMEs account for a large share of this segment, operating across logistics, education, consulting, IT-enabled services, healthcare support, and professional services. However, demand growth does not automatically ensure business stability. Service MSMEs often operate with limited reserves, depend on timely client payments, and face fixed monthly expenses regardless of revenue realization. As a result, even businesses with strong order books can experience operational stress if growth is not supported by disciplined financial planning. Therefore, this growth phase requires more than aggressive expansion. It calls for balanced financial decision-making that allows MSMEs to scale without overstretching resources.

Why Financial Planning Is Central to Service MSME Stability

Service MSMEs differ fundamentally from manufacturing enterprises. They are typically light on assets and rely heavily on human capital, resulting in fixed monthly costs regardless of revenue timing. Salaries, office expenses, and technology subscriptions must be paid on schedule, even when collections are delayed.

During growth phases, these characteristics amplify financial risk. Higher volumes increase day-to-day operating pressure and make delayed payments or dependence on a few clients more risky. Financial planning helps MSMEs match growth decisions with actual cash flows. It supports clearer choices on when to borrow, how much to invest, and whether the business can expand without straining liquidity.

Here’s how a small business can inculcate structured financial planning:

- Assessing Demand Before Committing Capital

The first discipline in a growth cycle is demand clarity. Not all growth signals require immediate expansion or borrowing. MSMEs must distinguish between temporary demand spikes and sustained demand visibility.

For instance, a logistics service provider may see higher volumes during festive seasons or short-term contracts, while a consulting firm onboarding retainer-based clients may be entering a more predictable revenue phase. Treating both scenarios the same can lead to misaligned investments. Careful assessment of order pipelines, client concentration, and contract duration helps MSMEs size financial commitments realistically and avoid overextension.

- Financing Daily Operations Without Disruption

As demand rises, operating costs follow immediately. Service MSMEs must fund salaries, contractor payments, software tools, and delivery expenses well before revenues are collected. This phase is less about expansion and more about continuity.

When daily operations are not adequately financed, service quality suffers, staff turnover increases, and reputational risk builds. Financial planning ensures that short-term funding is aligned with operating cycles, allowing MSMEs to deliver consistently without relying on ad-hoc borrowing or delaying obligations.

- Build Capacity Without Creating Repayment Stress

Growth often necessitates capacity enhancement, but service MSMEs must approach this selectively. Capacity investments may involve hiring additional teams, upgrading technology platforms, or expanding classrooms, centres, or delivery locations.

An education MSME may need additional infrastructure to accommodate enrolment growth, while a technology services firm may require system upgrades to handle higher workloads. Planning ensures that such investments are phased, tenure-aligned, and supported by realistic revenue expectations, reducing long-term repayment pressure.

- Manage Cash Flow During Payment Delays

Delayed payments remain one of the most persistent challenges for service MSMEs. Payment cycles of 60 to 90 days are standard, particularly when dealing with larger clients. Without preparation, these delays can disrupt payroll, vendor payments, and loan servicing.

Financial planning allows MSMEs to forecast cash flows, build buffers, and maintain discipline during delayed collection periods. Instead of reacting to shortages, businesses that plan liquidity are better positioned to absorb timing mismatches without operational disruption.

- Plan for Strategic Expansion, Not just Growth

Once operational stability is established, MSMEs can move from reactive scaling to strategic expansion. This may involve entering new geographies, adding complementary service offerings, or upgrading service quality to move up the value chain. The critical distinction is readiness. Expansion driven by financial strength is more sustainable than expansion driven solely by market excitement. MSMEs that align expansion plans with repayment capacity and cash flow resilience are better equipped to navigate future cycles.

Financial planning through the above steps does not require complex forecasting models. A simple, repeatable structure can significantly improve decision-making. Understanding monthly operating costs, receivables timelines, funding needs by purpose, repayment capacity, and contingency buffers creates clarity.

How Structured Financing Helps

Structured financing plays a critical role when aligned with financial planning. Protium supports service MSMEs at each stage of this journey, from operational stability to capacity building and long-term expansion. Our Business Loans help MSMEs manage working capital and daily operating requirements as demand rises. Loan Against Property (LAP) supports long-term capacity creation and infrastructure expansion without placing immediate pressure on cash flows. Top-Up Loans provide incremental funding to existing borrowers to manage liquidity gaps or support phased growth. For education-focused service MSMEs, Educational Institution Loans enable classroom expansion, facility upgrades, and infrastructure development linked to enrolment growth.

By matching financing solutions to each stage of financial planning, MSMEs can convert a strong services cycle into stable operations, disciplined growth, and long-term sustainability.

Source: Economic Survey 2024-25