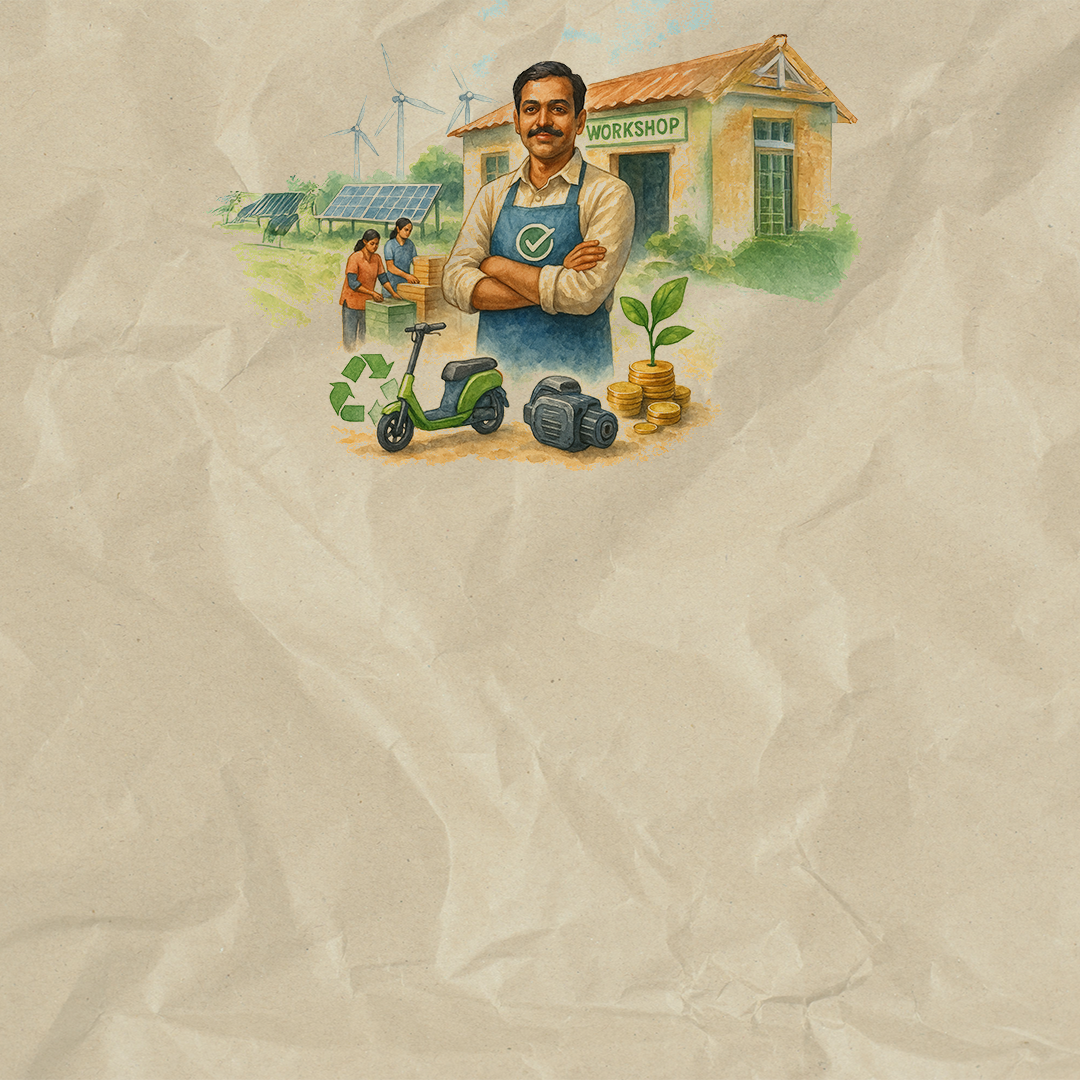

13% Indian MSMEs Go Green: Why Small Businesses Are Key to India’s Net-Zero Goals

India’s current climate policies are projected to reduce carbon dioxide emissions by around four billion tonnes between 2020 and 2030, and drive a 24% reduction in coal-based power generation. This is being supported by various measures being implemented by various... View Article